Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Question a

.

Full explain this question and text typing work only

We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this line

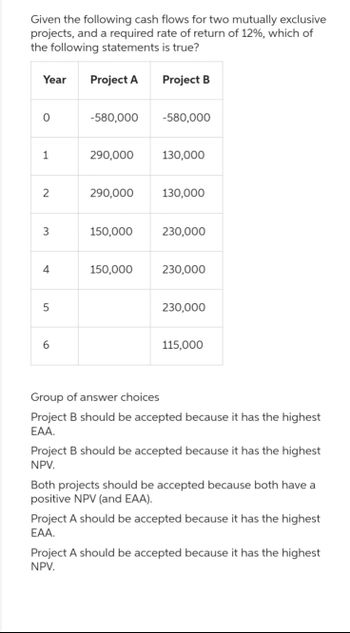

Transcribed Image Text:Given the following cash flows for two mutually exclusive

projects, and a required rate of return of 12%, which of

the following statements is true?

Year Project A

O

1

2

3

4

5

6

-580,000

290,000

290,000

150,000

150,000

Project B

-580,000

130,000

130,000

230,000

230,000

230,000

115,000

Group of answer choices

Project B should be accepted because it has the highest

EAA.

Project B should be accepted because it has the highest

NPV.

Both projects should be accepted because both have a

positive NPV (and EAA).

Project A should be accepted because it has the highest

EAA.

Project A should be accepted because it has the highest

NPV.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forward- Main View | Course X * CengageNOWV2| Online teachin X University of Sioux Falls, South D x - genow.com/ilrn/takeAssignment/takeAssignmentMain.do?invoker=&takeAssignmentSessionLocator%3D&inpro... eBook Average Rate of Return-Cost Savings Maui Fabricators Inc. is considering an investment in equipment that will replace direct labor. The equipment has a cost of $90,000 with a $8,000 residual value and a ten-year life. The equipment will replace one employee who has an average wage of $15,980 per year. In addition, the equipment will have operating and energy costs of $4,350 per year. Determine the average rate of return on the equipment, giving effect to straight-line depreciation on the investment. If required, round to the nearest whole percent. ICarrow_forwardQuestion 2 Suppose Cyberdyne Systems creates a Professional version of its machine learning software. By disabling some of the features in the Professional version it can create a Home version. Both versions have zero marginal cost. Cyberdyne Systems faces two customer segments each interested in buying at most one version. The RPs of each segments for each version are displayed below. Professional Version Home Version Segment Size Business Home Buyers $100 $20 $ 0 $5 20 80 Each customer will choose the software that gives her the highest surplus. 1. If Cyberdyne Systems offers only the Professional version, what price should it charge in order to maximize revenue? 2. If it offers both versions, what prices should it set to maximize revenue. 3. Now suppose that instead of valuing the Home version at $0, each Business buyer values the Home version at $80. Keep all other RPs the same as before. Show that at the prices you chose in (2), Business buyers would actually prefer to buy the…arrow_forward

- need help for all with full working thanksarrow_forwardI am struggling with the question listed below.arrow_forwardER ES Study Question 6 In applying the high-low method, what is the fixed cost? Month Miles January 76000 February 52000 March 66000 April 84000 O$12000 $40000 O$45000 $32000 Total Cost $122000 110000 n the web and Windows 118000 150000 Click if you would like to Show Work for this question: Open Show Workarrow_forward

- Question Z Short Answer (2 sentences or less) What are 3 benefits of reducing a client’s AGI? I. II. III. Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this linearrow_forwardHow to solve this?arrow_forwardQuestion Z Full explain this question and text typing work only We should answer our question within 2 hours takes more time then we will reduce Rating Dont ignore this linearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education