FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:<

eBook

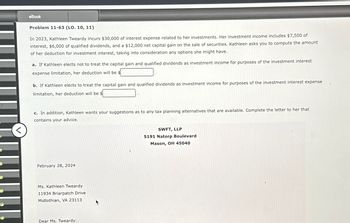

Problem 11-63 (LO. 10, 11)

In 2023, Kathleen Tweardy incurs $30,000 of interest expense related to her investments. Her investment income includes $7,500 of

interest, $6,000 of qualified dividends, and a $12,000 net capital gain on the sale of securities. Kathleen asks you to compute the amount

of her deduction for investment interest, taking into consideration any options she might have.

a. If Kathleen elects not to treat the capital gain and qualified dividends as investment income for purposes of the investment interest

expense limitation, her deduction will be $

b. If Kathleen elects to treat the capital gain and qualified dividends as investment income for purposes of the investment interest expense

limitation, her deduction will be $

c. In addition, Kathleen wants your suggestions as to any tax planning alternatives that are available. Complete the letter to her that

contains your advice.

February 28, 2024

Ms. Kathleen Tweardy

11934 Briarpatch Drive

Midlothian, VA 23113

Dear Ms. Tweardy:

SWFT, LLP

5191 Natorp Boulevard

Mason, OH 45040

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- In 2019, Mrs. Ulm paid $80,000 for a corporate bond with a $100,000 stated redemption value. Based on the bond's yield to maturity, amortization of the $20,000 discount was $1,512 in 2019, $1,480 in 2020, and $295 in 2021. Mrs. Ulm sold the bond for $84,180 in March 2021. Assume the taxable year is 2021. Required: a. What are her tax consequences in each year assuming that she bought the newly issued bond from the corporation? b. What are her tax consequences in each year assuming that she bought the bond in the public market through her broker? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Required A Required B What are her tax consequences in each year assuming that she bought the bond in the public market through her broker? 2020 Ordinary Income Amount $ 0 2021 Ordinary Income $ 893 2021 Long-term capital gain $ 893 2019 Ordinary Income $ 0arrow_forwardLou had the following transactions for 2020: Salary $ 80,000 Alimony paid (divorce final in 2016) (4,000) Recovery from car accident— Personal injury damages $40,000 Punitive damages 70,000 110,000 Gift from parents 20,000 Property sales— Loss on sale of boat (used for pleasure and owned 4 years) ($4,000) Gain on sale of GE stock (held for 10 months as an investment) 4,000 (–0–) What is Maya’s AGI for 2020?arrow_forwardPlease answer.upvote confirmarrow_forward

- Complete Problem above before completing below Problem Richard and Christine McCarthy have a 19-year-old son Jack, (born 10/2/2001; Social Security number 555-55-1212), who is a full-time student at the University of Key West. Years ago, the McCarthys shifted a significant amount of investments into Jack’s name. In 2020, Jack received Forms 1099-INT and 1099-DIV that reported the following: Tandy Corporation Bonds interest $11,300 Tandy Corporation ordinary dividends 3,400 The dividends are not qualified dividends. In addition, Jack works part-time as a waiter in an upscale seafood restaurant in Miami, FL. His 2020 Form W-2 reported: Wages $12,800 Federal withholding 1,080 In spite of his fairly large income, the McCarthys provide over 50 percent of his support and claim Jack as a dependent in 2020. Jack’s mailing address is 100 Duval Street, Apt. #B12, Key West, FL 33040. Use the parent’s information from Problem 1A, Form 1040, Schedule B, and…arrow_forwardItem 5 Xavier bought furniture and fixtures (7-year property) on September 15, 2023, for $1,185,000. He elects to expense as much as possible under Section 179 but does not elect the 100% bonus. Xavier's earned income for the year is $1,200,000. What is the maximum deduction Xavier can take in 2023 for the equipment?arrow_forwardAnswer the following a. If Kathleen receives a $17,000 distribution from her traditional 401(k) account, how much will she be able to keep after paying taxes and penalties, if any, on the distribution? b. If Kathleen receives a $17,000 distribution from her Roth 401(k) account, how much will she be able to keep after paying taxes and penalties, if any, on the distribution? c. If Kathleen retires from MH and then receives a $17,000 distribution from her traditional 401(k), how much will she be able to keep after paying taxes and penalties, if any, on the distribution?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education