ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

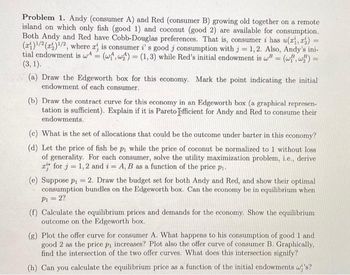

Transcribed Image Text:Problem 1. Andy (consumer A) and Red (consumer B) growing old together on a remote

island on which only fish (good 1) and coconut (good 2) are available for consumption.

Both Andy and Red have Cobb-Douglas preferences. That is, consumer i has u(xi, z) =

(a)¹/2 (1)¹/2, where x is consumer i' s good j consumption with j = 1, 2. Also, Andy's ini-

tial endowment is w (w, w) (1,3) while Red's initial endowment is w = (wi, wz) =

=

=

=

(3, 1).

(a) Draw the Edgeworth box for this economy. Mark the point indicating the initial

endowment of each consumer.

(b) Draw the contract curve for this economy in an Edgeworth box (a graphical represen-

tation is sufficient). Explain if it is Pareto efficient for Andy and Red to consume their

endowments.

(c) What is the set of allocations that could be the outcome under barter in this economy?

(d) Let the price of fish be p₁ while the price of coconut be normalized to 1 without loss

of generality. For each consumer, solve the utility maximization problem, i.e., derive

z for j= 1, 2 and i = A, B as a function of the price p₁.

(e) Suppose p₁2. Draw the budget set for both Andy and Red, and show their optimal

consumption bundles on the Edgeworth box. Can the economy be in equilibrium when

P₁ = 2?

(f) Calculate the equilibrium prices and demands for the economy. Show the equilibrium

outcome on the Edgeworth box.

(g) Plot the offer curve for consumer A. What happens to his consumption of good 1 and

good 2 as the price p₁ increases? Plot also the offer curve of consumer B. Graphically,

find the intersection of the two offer curves. What does this intersection signify?

(h) Can you calculate the equilibrium price as a function of the initial endowments w's?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Tom, Dick, and Harry live in the same apartment building in downtown Los Angeles. Tom and Dick work at local auto parts stores, and each of them has an income of y dollars per week. Harry is less fortunate. He used to have a good job at the LAPD, but his penchant for firing large caliber weapons in crowded public places led to his dismissal. He currently has no income. Tom and Dick (who are originally from Texas) firmly believe in a man’s right to draw his gun in the defence of just about anything, and are happy to financially support Harry. Tom gives Harry zT dollars each week, and Dick gives Harry zD dollars each week Tom’s utility UT depends upon the dollar value of his own weekly consumption, cT , and of Harry’s weekly consumption, cH : Likewise, Dick’s utility UD depends upon the dollar value of his own weekly consumption, cD, and of Harry’s weekly consumption: Harry spends all of the money that he receives from Tom and Dick. Tom and Dick spend…arrow_forwardThe utility possibility frontier is defined as the set of maximum utility levels for all consumers that is feasible in the economy, given resource constraints and preferences. For a two-consumer economy, it is defined formally as the solution to: u (ūB) = max u A (xA) subject to ug(xB) > ūg and (xA, XB)feasible. For each of the economies above, find an equation for the utility possibilities frontier, and graph it.arrow_forwardTwo individuals (A and B) live on an island where they consume coconuts (good x) and bananas (good y) for survival. A owns the coconut producing part of the island and B owns the banana part. Their utility functions and endowments are given by UA (TA,YA) = A+YA +min {A, YA}, UB (TB, YB) = TB +YB + min {ïß, YB}, (ww) = (0, 12) B B Assume that the price of coconuts is p and that of bananas is 1, so relative prices are denoted by p. (ww) = (10,0) A 1. What are their respective budget constraints? 2. What are their individual demand functions? (Hint: you have to consider multiple cases for the value of p) 3. The individuals trade their endowments with each other. What is the competitive equilibrium price in the market? What are their respective utilities at equilibrium?arrow_forward

- You have preferences u(x,y) = xy over games (X) and videos (Y) you can buy on a platform and a $360 budget, with prices px = 9 and py = 6. How much would you be willing to pay (at most) as a subscription fee for each of the following plans (you can buy any amount of Y in each plan at the original price, unless otherwise stated): (a) Plan A : You can buy (any amount of) X at a discounted price px = 4(b) Plan B : You are given 40 units of X for free, but you cannot buy any more of X. (surely can buy any amount of Y)(c) Plan C : You are given 30 units of X for free, but you cannot buy any more of X; you also have a discounted price for good Y; py = 4.arrow_forwardA gambling game requires people to place bets on either "Big" or "Small" or "Seven" designating the result of two dice throws. Big represents a sum of 8 to 12, while small is from 2 to 6. The special space "seven" is reserved for, of course, 7. Betting on "Big" provides a 1:1 betting win ratio amount. (Ex: Any bet amount of X, will net the winner another amount X, and still get his bet amount X back. ) Betting on "Small" also provides a 1:1 betting win ratio. The space "Seven" gives a 1:5 win ratio amount: Betting 100 money units on "Seven" and having a result of 7 nets the bettor 500 money units, and still have his 100 money units returned to him. If your bet does not appear, then the player loses his/her bet. What is the net Expected value of the strategy of betting 100 money units on "Big" ? Give your answer to two decimal places.arrow_forwardFinn is in charge of decorations for an upcoming festival, and he is planning to decorate withclovers (C) and flags (F). Suppose his preferences over decorations can be represented by theutility function U(C, F) = C^(3/4)F^(1/4) For this problem, assume C and F are infinitely divisible so you don’t need to worry aboutrestricting to whole-number answers.(a) Write Finn’s budget constraint as a function of the prices PC, PF , and his budget I.(b) Write Finn’s constrained optimization problem in Lagrangian form and derive the threefirst order conditions.(c) Use two of the first order conditions to show that Finn’s marginal rate of substitution(MRS) equals the marginal rate of transformation (MRT) at the optimum. (Note: Youdo not need to solve the constrained optimization any more than this.)arrow_forward

- Bleecker Street runs from A to B, as shown in the diagram. The lone convenience store currently in operation along this street is at A. An entrepreneur who wants to open another store in the neighborhood is weighing a choice between the only two available locations, C and D. If customers, who are uniformly distributed along Bleecker Street, always shop at the store nearest to where they live, which of the locations C or D would be optimal from the perspective of customers and why? A C D B O Location D because that would minimize the average travel time for customers. O Location D because that would mean each store would get an equal share of the market. O Location C because that would give the new entrepreneur higher profits. O Locations C and D would be equally attractive because consumers have no reason to care about the relative profitability of different entrepreneurs.arrow_forwardVan has plans to go to an opera and already has a $100 nonrefundable, nonexchangeable, and nontransferable ticket. Now Amy, whom Van has wanted to date for a long time, asks him to a party. Van would prefer to go to the party with Amy and forgo the opera, but he doesn't want to waste the $100 he spent on the opera ticket. From the perspective of an economist, if Van decides to go to the party with Amy, what has he just done? 1. Incorrectly allowed a sunk cost to influence his decision 2. Made a choice that was not optimal 3 Correctly ignored a sunk cost Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardSuppose you find that MU1(X1Xx2)=2x2 and MU₂(x1+x₂)=2x1. What is the rate at which the consumer is willing to trade good 2 for good 1 at bundle (2,4)? (Note: enter a positive number, i.e. enter the quantity of good 2 that the consumer is willing to give up for an additional-marginal-unit of good 1.) Question 20 Suppose you find that the expressions of the marginal utilities for a consumer are given by MU1 (1,2)= 2 and MU₂ (1,2)= 7. Then you can conclude that: This consumer has Cobb-Douglas tastes For this consumer good 1 and good 2 are perfect complements For this consumer good 1 and good 2 are perfect substitutes None of the above Question 21 Suppose a consumer is always willing to give up 5 units of good 2 for an additional unit of good 1. For this consumer: Good 1 and good 2 are perfect complements Good 1 and good 2 are perfect substitutes Good 1 and good 2 are both essential goods None of the abovearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education