ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

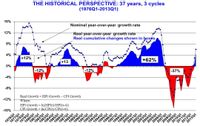

Problem 1: The following two figures illustrate historical home price trend and interest rate for the 30-years fixed rate mortgage in the United States. Based on the information, please answer the following questions if today were in 2013.

- Assuming that history will repeat itself, what do you think of the U.S. housing market for the next 10 years? How about mortgage rate for the next 10 years?

- Based on your prediction, answer the two questions below:

a)If you have money, should you invest in the housing market?

b)If your answer in a) is “Yes”, and one lender allows you to borrow money, should you borrow money to buy the property? Why?

Transcribed Image Text:THE HISTORICAL PERSPECTIVE: 37 years, 3 cycles

16%

12%

8%

(1976Q1-2013Q1)

4%

Nominal year-over-year growth rate

+12%

Real year-over-year growth rate

Real cumulative changes shown in boxes

0%

-4%

-12%

-8%

+13

-12%

Real Growth =HPI Growth - CPI Growth

Where:

-16%

-12%

HPI Growth = In(HPI(t)/HPI(t-4))

CPI Growth = In(CPI(t)/CPI(t-4))

1976Q1

1977Q1

1978Q1

1979Q1

1980Q1

+62%

1981Q1

1983Q1

1984Q1

1985Q1

1986Q1

1987Q1

1988Q1

-37%

1990Q1

1992Q1

1993Q1

1994Q1

1995Q1

1996Q1

1997Q1

1998Q1

1999Q1

2000Q1

2001Q1

2002Q1

2004Q1

2005Q1

2006Q1

2007Q1

2003Q1

2008Q1

2009Q1

2010Q1

2011Q1

2012Q1

2013Q1

1982Q1

1989Q1

1991Q1

Transcribed Image Text:30-year Fixed Morgate Rate: 1971-2013

18%

16%

14%

12%

Historical average: 8.6%

10%

8%

6%

4%

2%

0%

2013Q3

2012Q3

2011Q3

2010Q3

2009Q3

2008Q3

2007Q3

2006Q3

2005Q3

2004Q3

2003Q3

2002Q3

2001Q3

2000Q3

1999Q3

1998Q3

1997Q3

1996Q3

1995Q3

1994Q3

1993Q3

1992Q3

1991Q3

1990Q3

1989Q3

1988Q3

1987Q3

1986Q3

1985Q3

1984Q3

1983Q3

1982Q3

1981Q3

1980Q3

1979Q3

1978Q3

1977Q3

1976Q3

1975Q3

1974Q3

1973Q3

1972Q3

1971Q3

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- You will submit a Word document that is in proper APA formatting. Your Word document should be properly submitted with citations/references to support your work. Please answer the following questions: Suppose you are an advisor to the Business Cycle Dating Committee. You are asked to look at macroeconomic data to evaluate whether the economy has entered a recession this year. Which data do you look at? How does the economy behave at the onset of a recession? Explain how unemployment changes over the business cycle. Why do these changes occur? Make sure that it is 2 to 3 word pages please!arrow_forwardMary has income of $2000 today and $1000 tomorrow. She can lend and borrow at an interest rate of 20%. There is 10% inflation. Her preferences for intertemporal consumption are represented by the following utility function u(c, c) = min{c1, 2c2} (a) What is her optimal consumption bundle?arrow_forwardI need clarification on what a "numerical solution" should be in the context of my economic question. Is it simply a number or numerical value, or is it a formula? I'm not looking for the answer to this problem. I am just making sure i understand the question. See attached.arrow_forward

- The lower the interest rate: the greater the level of inflation the smaller the present value of a future amount the greater the present value of a future amount None of the statements associated with this question are correct.arrow_forward8, Q2) Hey, need help with the following multi-part macroeconomics problem. Thank you in Advance! Many kinds of loans, like student loans and mortgages, can be taken out at either a fixed or variable rate. A fixed rate loan allows the borrower to pay the same nominal interest rate for the entire lifetime of the loan, while a variable rate loan may experience changes in in the nominal interest rate as the rate that banks charge each other for overnight loans changes. For this problem, assume that this variable nominal interest rate adjusts such that the associated real interest rate remains constant over time. In the first year, inflation is 2.75 percent and the nominal interest rate for both the fixed and variable rate loans is 5 percent. What is the real interest rate for the fixed rate loan? What about for the variable rate loan? In the second year, inflation rises to 3 percent. Calculate the nominal and real interest rates for the fixed rate and the variable rate loans…arrow_forwardQuestion [4]: Please explain why there is a concern in the Thai financial market about rising inflation in the US using theories in macroeconomics. Your score bases on how you apply theories. Please clearly refer to theories accordingly.arrow_forward

- Answer your friend who claims that a) (1) housing boom in Japan is unbelievable due to its declining population (Table 3). b) (2) The condominium prices are determined by the building costs by the construction companies rather than financial condition of buyers. The condominium prices (3) are similar to those in other property types (Table 1) and (4) do not change largely regionally across Japan (Table 2). c) (5) population changes do have similar effects on house prices in large cities and rural areas in Jарan. 2012 2016 Table 3: Table 1: Japan: Residential 2012 2015 2018 Table 2: 1997 2005 2013 Condo. Changes in Prices Rate of Property Price Index (2010=100) Net Migration (2010=100) Residential 100 100 101 Osaka 130 174 Fukuoka 0.6 0.3 Land with suburbs 104 Hokkaido Tokyo Area Residential 100 110 115 154 0.8 0.7 0.6 Property Condominiums 104 120 140 100 0.2 -0.2 Jарan Average 124 Osaka 0.6 Area Nagoya 0.5 0.4 Area Rest of -0.3 -0.5 Jарanarrow_forwardPhilippine Economics History Which periods of Philippine economic history have seen significant jumps in inflation? What are the various hypotheses for the high inflation rates and what have been the results of such high inflation for the economy and the average Filipino?arrow_forwardQuestion 22: UK unemployment flat as wage growth drives inflation worries The U.K. unemployment rate remained flat at 4.1% in the last quarter of 2021 and likely declined in January, data by the Office for National Statistics showed. The information also confirmed that fewer Britons are working than before the pandemic. Although the number of employees on payrolls rose in January and now tops pre-pandemic levels, "the number of people in employment overall is well below where it was before COVID-19 hit," said ONS head of economic statistics, Sam Beckett. "This is because there are now far fewer self- employed people." Around 400,000 people, mostly over the age of 50, "have disengaged from the world of work altogether and are neither working nor looking for a job," he said, with the data pointing to an increase in long-term illness, among other factors. Source: Politico.eu (adapted extract) - February 2022 (a) Explain the term unemployment. (b) Explain using a diagram the likely effects…arrow_forward

- Dear tutor, I would be glad if you solve this question with its detailed explanation. Thank you so much!!arrow_forwardPlease draw and explain the life cycle path of hours worked for a person who, at age 40, suddenly wins 5,000,000 RMB in the lottery. What would be that life cycle path of hours worked if he always knew that he would win the lottery?arrow_forwardPlease only solve parts a, b, and c of this introductory economics question!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education