Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

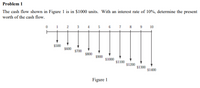

Transcribed Image Text:Problem 1

The cash flow shown in Figure 1 is in $1000 units. With an interest rate of 10%, determine the present

worth of the cash flow.

1 2 3

4 5

7 8 9 10

6

$500

$600

$700

$800

$900

$1000

$1100

$1200

$1300

$1400

Figure 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Consider the following cash flow diagram. What value of C makes the inflow series equivalent to the outflow series at an interest rate of 10% compounded annually?arrow_forwardThe total amount of present worth for the cash flow diagram below is : $1000 Select one: 2 $500 3 4 a. $305 at interest rate 10% b. Zero at interest rate 10% C. Zero at interest rate 15% d. $305 at interest rate 15% $1500 5arrow_forwardFor the cash flow diagram given below, compute the rate of return. $300 $250 $250 $200 $200 $150 $150 $100 $50 1 2 3 4 5 6 7 8 9 10 P = 1000arrow_forward

- Show manual calculationsarrow_forwardQuestion content area top Part 1 (Present value of complex cash flows) How much do you have to deposit today so that beginning 11 years from now you can withdraw $ 8,000 a year for the next 5 years (periods 11 through 15) plus an additional amount of $ 16,000 in the last year (period 15)? Assume an interest rate of 5 percent. Question content area bottom Part 1 The amount of money you have to deposit today is $ enter your response here . (Round to the nearest cent.)arrow_forward1 Required information As indicated, some of the cash flows are expressed in future (then-current) dollars and others in current-value (today's) dollars. Use a real interest rate of 10% per year and an inflation rate of 6% per year. Year 10 3 4 7 Cash Flow, $ 19,000 38,500 22,000 28,500 Expressed As Today's Then-current Then-current Today's NOTE: This is a multi-part question. Once an answer is submitted, you will be unable to return to this part. Find the present worth of the estimated cash flows. The present worth of the estimated cash flows is $91451.92arrow_forward

- QUESTION 1 For the below Cash Flow, find the total PW value using 10% interest rate years 0 1 2 3 4 5 6 cost $ 2,719 1,000.00 3,010 4,000.00 1,000.00arrow_forwardSolve Problem 20.17 using Excel.arrow_forward► CRC Inc. is buying new equipment that has the following cash flows: Year Cash Flow O-$17.7 What is the NPV if the interest rate is $6%? O $482.24 D -$537.78 0 -$500 O $22.44 1 $100 2 $200 3 $250arrow_forward

- Question 6 Consider a series of cash flows as follows: £750 received one year from now, £1,200 received three years from now, and £1,250 received six years from now. If the discount rate is 6%, to the nearest £0.01 what is the (i) present value of the cash flows and (ii) the future value in ten years of the cash flows? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a (i) £2,596.29 and (ii) £4,386.38 b (i) £2,395.41 and (ii) £4,289.41 (i) £2,596.29 and (ii) £4,649.56 None of the above (1) £2,395.41 and (ii) £4,046.99arrow_forwardP7arrow_forwardUneven Cash Flow Stream Year Cash Stream A Cash Stream B 1 $100 $300 2 400 400 3 400 400 4 400 400 5 300 100 What is the value of each cash flow stream at a 0% interest rate? Round your answers to the nearest cent.Stream A $ _______Stream B $ _______arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education