ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

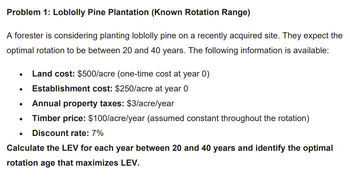

Transcribed Image Text:Problem 1: Loblolly Pine Plantation (Known Rotation Range)

A forester is considering planting loblolly pine on a recently acquired site. They expect the

optimal rotation to be between 20 and 40 years. The following information is available:

•

•

•

•

Land cost: $500/acre (one-time cost at year 0)

Establishment cost: $250/acre at year 0

Annual property taxes: $3/acre/year

Timber price: $100/acre/year (assumed constant throughout the rotation)

Discount rate: 7%

Calculate the LEV for each year between 20 and 40 years and identify the optimal

rotation age that maximizes LEV.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Required information PEMEX, Mexico's petroleum corporation, has an estimated budget for oil and gas exploration that includes equipment for three offshore platforms as shown. Use PW analysis to select the best alternative at a MARR of 16% per year. Platform First cost, $ million Y Z -300 -450 -510 M&O, $ million per year -320 -290 -230 Salvage value, $ million 75 50 90 Estimated life, years 20 20 20 Select platform X, Y, or Z using tabulated factors. The present worth of platform X is $- 2298.4 worth of platform Z is $- 1944.14 million, the present worth of platform Y is $- 2262.15 million, and the present million. The platform selected based on the present worth is platform Zarrow_forwardShow your complete solution.arrow_forward12.9 A three-year maintenance contract for a local computer network costs $4000. The network is expected to be needed for fifteen years and the maintenance contract will be purchased for the same price at the beginning of every three year period. If the interest rate is 6%, the present equivalent cost of the maintenance contract is nearest: (A) $12,950 (B) $14,500 (C) $15,400 (D) $16,000arrow_forward

- The General Hospital is evaluating new office equipment offered by three companies. Cost Annual benefit End of useful life salvage value Useful life (yrs) Select one: 9.5% 8.5% 7.5% Company A $500 $130 $0 10.5% 5 The incremental rate of return between Company B and Company C is close to Company B $600 $115 $250 5 Company C $700 $100 $180 10arrow_forwardplease answer in text form and in proper format answer with must explanation , calculation for each part and steps clearlyarrow_forward1. The first cost of a component is $ 50,000. It will have an annual operating cost of $20,000 and $5,000 salvage value after its 5-year life. At an interest rate of 10% per year, what is the capitalized cost?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education