FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

Transcribed Image Text:aldo

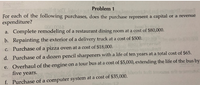

Problem 1

tod

For each of the following purchases, does the purchase represent a capital or a revenue

expenditure?

00000

a. Complete remodeling of a restaurant dining room at a cost of $80,000.

b. Repainting the exterior of a delivery truck at a cost of $500.

c. Purchase of a pizza oven at a cost of $18,000.

d. Purchase of a dozen pencil sharpeners with a life of ten years at a total cost of $65.

e. Overhaul of the engine on a tour bus at a cost of $5,000, extending the life of the bus by

five years.

illind bluoda te inuome srl

f. Purchase of a computer system at a cost of $35,000.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following annual costs are associated with three new extruder machines being considered for use in a Styrofoam cup plant: Data Useful Life, Years First Cost Salvage Value Annual Benefit M&O M&O Gradient X 17 $2,090,000 $87,000 $396,000 $56,000 $9,000 X-TRUD 13 $2,610,000 $93,000 $534,000 $60,000 $11,000 SUPR-X 11 $2,430,000 $119,000 $638,000 $53,000 $13,000 The company's interest rate (MARR) is 21%. Which extruder should the Styrofoam company choose? Use Annual Cash Flow Analysis and provide the right reason. Choosing SUPR-X is best because it has the lowest M&O cost in yr1 Choosing SUPR-X is best because it has the highest Annual Benefit Choosing SUPR-X will maximize the EUAB-EAUC; its value is $-127,486 higher than X and $15,650 higher than X-TRUD. Choosing SUPR-X will maximize the EUAB-EAUC; its value is $117,514 higher than X and $126,650 higher than X-TRUD.arrow_forwardPLEASE PROVIDE THE NEEDED ANSWER AND SOLUTION ASAP PLEASE THANKYOU A company purchased an air conditioner at SY Appliance Center for Php 45,000 and paid an installation fee of Php 6,000 with a delivery charge of Php 1,000. The air conditioner has an estimated life span of 5 years with a residual value of Php 15,000 a. What is the depreciable cost of the air conditioner? b. How much is the annual depreciation?arrow_forwardA machine’s first cost is $60,000 with salvage values over the next 5 years of are $50K, $40K, $32K, $25K, and $12K. The annual operating and maintenance costs are the same every year. Determine the machine total cost.arrow_forward

- On 1 May 2020, Ron Trading purchased a new machine. The following paymentsrelate to the machine.List price $21,500Purchase discount $2,000Transportation cost $300Repair of damage parts incurred in transporting the machine $1,000Fees paid to test the machine before use $500Fees paid to the installer to install the machine $800Machine operator’s salary for the first month of operation $3,000Maintenance costs for the first month of operation $300(i) Identify and compute the cost of the machine to be recognised. Explainyour reasoning.(ii) Journalise the transactions. Assume the above payments are paid in cash.arrow_forwardManjiarrow_forwardInformation for two alternative projects involving machinery investments follows. Project 1 requires an initial investment of $229,500. Project 2 requires an initial investment of $156,000. Annual Amounts Project 1 Project 2 Sales of new product $ 148,000 $ 128,000 Expenses Materials, labor, and overhead (except depreciation) 77,000 44,000 Depreciation—Machinery 32,000 30,000 Selling, general, and administrative expenses 20,000 32,000 Income $ 19,000 $ 22,000 (a) Compute each project’s annual net cash flow.(b) Compute payback period for each investment.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education