FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

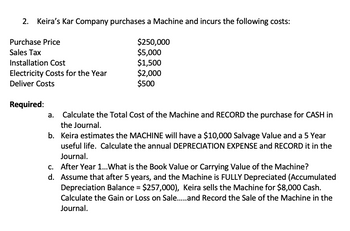

Transcribed Image Text:2. Keira's Kar Company purchases a Machine and incurs the following costs:

$250,000

$5,000

$1,500

$2,000

$500

Purchase Price

Sales Tax

Installation Cost

Electricity Costs for the Year

Deliver Costs

Required:

Calculate the Total Cost of the Machine and RECORD the purchase for CASH in

the Journal.

b. Keira estimates the MACHINE will have a $10,000 Salvage Value and a 5 Year

useful life. Calculate the annual DEPRECIATION EXPENSE and RECORD it in the

Journal.

d.

c. After Year 1... What is the Book Value or Carrying Value of the Machine?

Assume that after 5 years, and the Machine is FULLY Depreciated (Accumulated

Depreciation Balance = $257,000), Keira sells the Machine for $8,000 Cash.

Calculate the Gain or Loss on Sale......and Record the Sale of the Machine in the

Journal.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 5 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Linda’s Luxury Travel (LLT) is considering the purchase of two Hummer limousines. Various information about the proposed investment follows: Initial investment (2 limos) $ 1,080,000 Useful life 10 years Salvage value $ 120,000 Annual net income generated 95,040 LLT’s cost of capital 15 % Assume straight line depreciation method is used. Required:Help LLT evaluate this project by calculating each of the following: 1. Accounting rate of return. (Round your percentage answer to 1 decimal place.) 2. Payback period. (Round your answer to 2 decimal places.) 3. Net present value. (Future Value of $1, Present Value of $1, Future Value Annuity of $1, Present Value Annuity of $1.) (Use appropriate factor(s) from the tables provided. Do not round intermediate calculations. Cash Outflows and negative amounts should be indicated by a minus sign. Round your "Present Values" to the nearest whole dollar amount.)arrow_forwardUramilabenarrow_forwardAgranary purchases a conveyor used in the manufacture of grain for transporting, filling. or emptying. It is purchased and installed for $80,000 with a market value for salvage purposes that decreases at arate of 20% per year with a minimum of value $1.750, Operation and maintenance is expected to cost $15.000 in the first year, increasing $1.060 per year thereafter. The granary uses a MARR of 15%. What is the optimum replacement interval for the conveyor? years, Click here to access the TVM Factor Table Calculator For calculation purposes, use 5 decimal places as displayed in the factor table provided.arrow_forward

- The information below relates to the purchase of equipment: investment in the project: $10,000 Net annual cash inflows: 2,400 Working capital required: 5,000 Salvage value of the equipment: 1,000 Life of the project: 8 years At the completion of the project, the working capital will be released for use elsewhere. Compute the net present value of the project, using a discount rate of 10% $606 $8,271 ($1,729) $1,729arrow_forwardHeidi Company is considering the acquisition of a machine that costs $453,000. The machine is expected to have a useful life of 6 years, a negligible residual value, an annual net cash inflow of $119,000, and annual operating income of $80,621. The estimated cash payback period for the machine is (round to one decimal point)? Oa. 18 years Ob. 5.6 years Oc. 50 years Od. 65 yearsarrow_forwardQ1) A catering company buys a delivery truck for $34000 for its everyday business. The lifetime of the truck is estimated Five years and the production life in Kilometers is 200 000 KM. The residual value at the end of its lifetime is $4000. The truck has the following production in five years. Year 1 30 000 KM Year 2 40 000 KM Year 3 50 000 KM Year 4 70 000 KM Year 5 10 000 KM Requirements: Compute the Depreciation Expense under the following methods. Double Declining Balance Method. Sum-of-year-digit Methodarrow_forward

- A wedding maching custs $250,000. A facility purchases one and plans to use it for 10 years, at 'which point it will have a value of 35,000. calculate the depreciation allowance and book value after 5 yrak of use using Straight line depreciation balance depreciation (a) (b) using deckning () Uring MACKS 7-year property with 50% bonus depreciation (d) using MACKS 7- year property with 50% bonus depreciation of the machine is sold if in year s?arrow_forward1. A machine is purchased for $50,000. Its annual maintenance costs are $1000. Every 4 years the machine requires a complete overhaul at a cost of $4,000. The machine has a lifespan of 20 years with a salvage value at that time of $10,000. a) Create a cash flow diagram for the machine lifespan costs. b) What additional information might be useful in determining if the should purchase this machine? c) Of the factors you have identified as important (part (b)) what are the most critical (top two perhaps) that should be further investigated/resolved? companyarrow_forwardAn energy production company has the following information regarding the acquisition of new gas turbine equipment. Purchase price = $780,000 Trans-oceanic shipping and delivery cost $4300 Installation cost (1 technician at $1600 per day for 4 days) = $6400 Tax recovery period = 15 years Book depreciation recovery period = 10 years Salvage value = 10% of purchase price Operating cost (with technician) = $185,000 per year The manager of the department asked your friend in Accounting to enter the appropriate data into the tax-accounting program. What are the values of B, n, and S in depreciating the asset for tax purposes that he should enter?arrow_forward

- Henrie's Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $151,640, including freight and installation. Henrie's estimated the new machine would increase the company's cash inflows, net of expenses, by $40,000 per year. The machine would have a five-year useful life and no salvage value. Click here to view Exhibit 148-1 and Exhibit 14B-2, to determine the appropriate discount factor(s) using table. Required: 1. What is the machine's internal rate of return? Note: Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as 12%. 2. Using a discount rate of 10%, what is the machine's net present value? Interpret your results. 3. Suppose the new machine would increase the company's annual cash inflows, net of expenses, by only $35,030 per year. Under these conditions, what is the internal rate of return? Note: Round your answer to the nearest whole percentage, i.e. 0.123 should be considered as…arrow_forwardWizard Company has an old machine that is fully depreciated but has a current salvage value of $10,000. The company wants to purchase a new machine that would cost $60,000 and have a five-year useful life and zero salvage value. Expected changes in annual revenues and expenses if the new machine is purchased are: Increased revenues $10,000 $120,000 Increased expenses 14,000 Salary of additional operator Supplies Depreciation 12,000 Maintenance Increased net income 8.000 20.000 $30,000 (ignore income taxes in this problem.) Required: 1. What is the payback period on the new equipment? 2. What is the simple rate of return on the new equipment?arrow_forwardCrane Corp. is considering purchasing one of two new processing machines. Either machine would make it possible for the company to produce its products more efficiently than it is currently equipped to do. Estimates regarding each machine are provided below: Machine A Machine B Original cost $113,900 $278,300 Estimated life 10 years 10 years Salvage value -0- -0- Estimated annual cash inflows $29,700 $60,100 Estimated annual cash outflows $7,600 $14,800 Calculate the net present value and profitability index of each machine. Assume an 8% discount rate. Machine A Machine B Net present value top row, profitability index bottom row Which machine should be purchased? Crane Corp. should purchase select a machine .arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education