FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

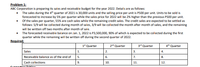

Transcribed Image Text:Problem 1:

ABC Corporation is preparing its sales and receivable budget for the year 2022. Details are as follows:

• The sales during the 4th quarter of 2021 is 30,000 units and the selling price per unit is P500 per unit. Units to be sold is

forecasted to increase by 5% per quarter while the sales price for 2022 will be 2% higher than the previous P500 per unit.

• Of the sales per quarter, 55% are cash sales while the remaining credit sales. The credit sales are expected to be settled as

follows: 5/9 will be collected during month of sales, 3/9 will be collected the month after month of sales, and the remaining

will be written off two months after month of sale.

The forecasted receivable balance on Jan. 1, 2022 is P3,500,000, 90% of which is expected to be collected during the first

quarter while the remaining will be written off during the second quarter of 2022.

Required:

1' Quarter

2nd Quarter

3rd Quarter

4th Quarter

Sales

1.

2.

3.

4.

Receivable balance as of the end of

5.

6.

7.

8.

Cash collections

9.

10.

11.

12.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The Company produces widgets. The sales forecast for 2022 is as follows: 2022 Quarter 1 3,000 Units 2022 Quarter 2 8,000 Units 2022 Quarter 3 5,000 Units 2022 Quarter 4 6,000 Units 2023 Quarter 1 5,000 Units The beginning of the year inventory of widgets was 900 units. Management desires and ending inventory each quarter of 30% of the following quarter's sales units. Prepare the quarterly production budget for each quarter of 2022 (No need to indicate the total for the year).arrow_forwardPlease answer the question thanks.arrow_forwardHere are some important figures from the budget of Nashville Nougats, Incorporated, for the second quarter of 2022: April May June $399,000$ 348,000 $436,000 176,000 164,000 197,000 Credit sales Credit purchases Cash disbursements Wages, taxes, and expenses Interest Equipment purchases Beginning cash balance Cash receipts The company predicts that 5 percent of its credit sales will never be collected, 30 percent of its sales will be collected in the month of the sale, and the remaining 65 percent will be collected in the following month. Credit purchases will be paid in the month following the purchase. In March 2022, credit sales were $326,000. Cash collections from credit sales Total cash available Cash disbursements Using this information, complete the following cash budget. Note: Do not round intermediate calculations and round your answers to the nearest whole number, e.g., 32. Purchases Wages, taxes, and expenses Interest Equipment purchases 79,400 9,100 31,500 Total cash…arrow_forward

- jarrow_forwardMultiple cash budgets-Scenario analysis Brownstein, Inc., expects sales of $96,000 during each of the next 3 months. It will make monthly purchases of $58,000 during this time. Wages and salaries are $12,000 per month plus 6% of sales. Brownstein expects to make a tax payment of $17,000 in the next month and a $20,000 purchase of fixed assets in the second month and to receive $8,000 in cash from the sale of an asset in the third month. All sales and purchases are for cash. Beginning cash and the minimum cash balance are assumed to be zero. a. Construct a cash budget for the next 3 months. b. Brownstein is unsure of the sales levels, but all other figures are certain. If the most pessimistic sales figure is $77,000 per month and the most optimistic is $124,000 per month, what are the monthly minimum and maximum ending cash balances that the firm can expect for each of the 1-month periods? c. Briefly discuss how the financial manager can use the data in parts a. and b. to plan for…arrow_forward3arrow_forward

- on 4 obinson Corp., which operates on a calendar year, expects to sell 1380 units in October, and expects sales to increase 130 units each month thereafter. Sales price expected to stay constant at $7 per unit. What are budgeted sales revenue for the fourth quarter? << < Question 4 of 5arrow_forwardSubject: accountingarrow_forwardMooney Equipment is putting together its cash budget for the following year and has forecasted expected cash collections over the next five quarters (one year plus the first quarter of the next year). The cash collection estimates are based on sales projections and expected collection of receivables. The sales and cash collection estimates are shown in the following table (in millions of dollars): Q1 Q2 Q3 Q4 Q5 Sales $1,100 $1,400 $1,450 $1,250 $1,500 Total cash collections $1,100 $1,150 $1,200 $1,200 You also have the following information about Mooney Equipment: • In any given period, Mooney’s purchases from suppliers generally account for 72% of the expected sales in the next period, and wages, supplies, and taxes are expected to be 15% of next period’s sales. • In the third quarter, Mooney expects to expand one of its plants, which will require an additional $1,072 million investment. • Every quarter, Mooney pays $60 million in interest and…arrow_forward

- Blue Company’s budgeted sales and budgeted cost of goods sold for the coming year are $144,440,000 and $90,720,000, respectively. Short-term interest rates are expected to average 10%. If Blue can increase inventory turnover from its present level of 9 times a year to a level of 10 times per year.Compute its expected cost savings for the coming year. Expected Cost Savingsarrow_forwardBuffalo Company’s budgeted sales and budgeted cost of goods sold for the coming year are $149,520,000 and $103,320,000, respectively. Short-term interest rates are expected to average 10%. If Buffalo can increase inventory turnover from its present level of 9 times a year to a level of 12 times per year.Compute its expected cost savings for the coming year.arrow_forwardThe following are the total sales of Top Class Ltd for the past three months of 2021Month April May JuneTotal Sales R900 000 R700 000 R500 000The budgeted sales figures for the next three months are expected as followsMonth July August SeptemberTotal Sales R825 000 R760 000 R920 000Additional information1) 40% of all sales are made in cash.2) Credit sales for October 2021 are expected to be R450 000.3) Debtors are collected as follows.• 15% of outstanding amounts are collected during the month following the month of sale(i.e.: 30 days). A discount of 4,5% is offered for early settlement of accounts.• 60% is collected in the subsequent month (i.e.: 60 days).• 20% is collected in the subsequent month (i.e.: 90 days).• The balance is irrecoverable and needs to be written off.REQUIRED:Prepare a schedule of forecasted receipts from customers (cash and credit) for the period 1 July 2021to 31 October 2021.Show all workingsRound to the nearest Randarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education