Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

Transcribed Image Text:on National Bank. The fund contained:

Dec. 1 Established an imprest petty cash fund of P10,000 by

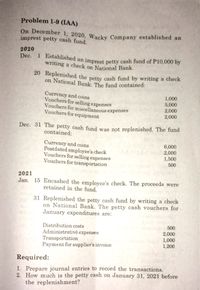

Problem 1-9 (IAA)

On December 1, 2020, Wwacky Company established an

imprest petty cash fund.

2020

1 Established an imprest petty cash fund of P10,000 by

writing a check on National Bank.

20 Replenished the petty cash fund by writing a check

Currency and coins

Vouchers for selling expenses

Vouchers for miscellaneous expenses

Vouchers for equipment

1,000

5,000

2,000

2,000

Dec. 31 The petty cash fund was not replenished. The fund

contained:

Currency and coins

Postdated employee's check

Vouchers for selling expenses

Vouchers for transportation

6,000

2,000

1,500

500

AAD

2021

Jan. 15 Encashed the employee's check. The proceeds were

retained in the fund.

31 Replenished the petty cash fund by writing a check

on National Bank. The petty cash vouchers for

January expenditures are:

000

500

Distribution costs

Administrativě expenses

Transportation

Payment for supplier's invoice

2,000

1,000

1,200

Required:

1. Prepare journal entries to record the transactions.

2. How much is the petty cash on January 31, 2021 before

the replenishment?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Record the following transactions: A. Started a petty cash fund in the amount of $500. B. Replenished petty cash fund using the following expenses: Auto $24, Office Expenses $43, Postage Expense $19, Miscellaneous Expenses $25. Cash on hand is $389. C. The company has decided to reduce the petty cash fund to $300.arrow_forwardThe bank reconciliation shows the following adjustments: Deposits in transit: $1,234 Outstanding checks: $558 Bank service charges: $50 NSF checks: $250 Prepare the correcting journal entry.arrow_forwardRecord the following transactions: A. Started a petty cash fund in the amount of $200. B. Replenished petty cash fund using the following expenses: Auto $15, Office Expenses $20, Postage Expense $81, Miscellaneous Expenses $66. Cash on hand is $10. C. Increased petty cash by $75.arrow_forward

- The bank reconciliation shows the following adjustments: Deposits in transit: $852 Notes receivable collected by bank: $1,000; interest: $20 Outstanding checks: $569 Error by bank: $300 Bank charges: $30 Prepare the correcting journal entry.arrow_forwardOn June 1 French company has decided to initiate a petty cash fund in the amount of $800. Prepare journal entries for the following transactions: A. On June 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $37, Supplies $124, Postage Expense $270, Repairs and Maintenance Expense $168, Miscellaneous Expense $149. The cash on hand at this time was $48. B. On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $18, Supplies $175, Postage Expense $50, Repairs and Maintenance Expense $269, Miscellaneous Expense $59. The cash on hand at this time was $220. C. On June 23, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $251, Supplies $88, Postage Expense $63, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $20. D. On June 29, the company determined that the petty cash fund needed to be increased to $1,000. E. On June 30, the petty cash fund needed replenishment, as it was month end. The following are the receipts: Auto Expense $18, Supplies $175, Postage Expense $50, Repairs and Maintenance Expense $269, Miscellaneous Expense $59. The cash on hand at this time was $437.arrow_forwardUsing the following information, prepare a bank reconciliation. Bank balance: $7,651 Book balance: $10,595 Deposits in transit: $2,588 Outstanding checks: $489 Interest income: $121 NSF check: $966arrow_forward

- Using the following information, prepare a bank reconciliation. Bank balance: $3,678 Book balance: $2,547 Deposits in transit: $321 Outstanding checks: $108 and $334 Bank charges: $25 Notes receivable: $1,000; interest: $35arrow_forwardWhat is the journal entry to record an NSF check, from J. Smith for 250, that is returned with the bank statement? a. Cash 250 DR; NSF Check 250 CR b. Accounts Receivable 250 DR; Cash 250 CR c. NSF Check 250 DR; Accounts Receivable 250 CR d. Cash 250 DR; Accounts Receivable 250 CR e. Cash 250 DR; Miscellaneous Expense 250 DRarrow_forwardOn July 2 Kellie Company has decided to initiate a petty cash fund in the amount of $1,200. Prepare journal entries for the following transactions: A. On July 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $125, Supplies $368, Postage Expense $325, Repairs and Maintenance Expense $99, Miscellaneous Expense $259. The cash on hand at this time was $38. B. On June 14, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $425, Supplies $95, Postage Expense $240, Repairs and Maintenance Expense $299, Miscellaneous Expense $77. The cash on hand at this time was $110. C. On June 23, the petty cash fund needed replenishment and the following are the receipts: Auto Expense $251, Supplies $188, Postage Expense $263, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $93. D. On June 29, the company determined that the petty cash fund needed to be decreased to $1,000. E. On June 30, the petty cash fund needed replenishment, as it was month end. The following are the receipts: Auto Expense $14, Supplies $75, Postage Expense $150, Repairs and Maintenance Expense $121, Miscellaneous Expense $39. The cash on hand at this time was $603.arrow_forward

- On September 1, French company has decided to initiate a petty cash fund in the amount of $800. Prepare journal entries for the following transactions: A. On September 5, the petty cash fund needed replenishment, and the following are the receipts: Auto Expense $37, Supplies $124, Postage Expense $270, Repairs and Maintenance Expense $168, Miscellaneous Expense $149. The cash on hand at this time was $48. B. On September 14, the petty cash fund needed replenishment and the following are the receipts: Auto Expense $18, Supplies $175, Postage Expense $50, Repairs and Maintenance Expense $269, Miscellaneous Expense $59. The cash on hand at this time was $210. C. On September 23, the petty cash fund needed replenishment and the following are the receipts: Auto Expense $251, Supplies $88, Postage Expense $63, Repairs and Maintenance Expense $182, Miscellaneous Expense $203. The cash on hand at this time was $20. D. On September 29, the company determined that the petty cash fund needed to be increased to $1,000. E. On September 30, the petty cash fund needed replenishment as it was month end. The following are the receipts: Auto Expense $18, Supplies $15, Postage Expense $57, Repairs and Maintenance Expense $49, Miscellaneous Expense $29. The cash on hand at this time was $837.arrow_forwardThe bank reconciliation shows the following adjustments. Deposits in transit: $526 Outstanding checks: $328 Bank charges: $55 NSF checks: $69 Prepare the correcting journal entry.arrow_forwardUsing the following information, prepare a bank reconciliation. Bank balance: $12,565. Book balance: $13,744. Deposits in transit: $2,509. Outstanding checks: $1,777. Bank charges: $125. Bank incorrectly charged the account for $412. The bank will correct the error next month. Check number 1879 correctly cleared the bank in the amount of $562 but posted in the accounting records as $652. This check was expensed to Utilities Expense.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub