FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

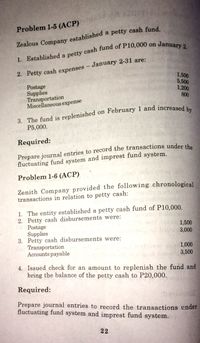

Transcribed Image Text:Problem 1-5 (ACP)

1. Established a petty cash fund of P10,000 on

2. Petty cash expenses – January 2-31 are:

Postage

Supplies

Transportation

Miscellaneous expense

1,500

5,500

1,200

800

3. The fund is replenished on February 1 and increased

P5,000.

Required:

Prepare journal entries to record the transactions under the

fluctuating fund system and imprest fund system.

Problem 1-6 (ACP)

Zenith Company provided the following chronological

transactions in relation to petty cash:

1. The entity established a petty cash fund of P10,000.

2. Petty cash disbursements were:

Postage

Supplies

3. Petty cash disbursements were:

Transportation

Accounts payable

1,500

3,000

1,000

3,500

4. Issued check for an amount to replenish the fund and

bring the balance of the petty cash to P20,000.

Required:

Prepare journal entries to record the transactions under

fluctuating fund system and imprest fund system.

22

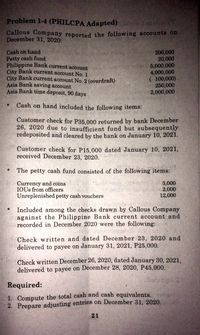

Transcribed Image Text:Problem 1-4 (PHILCPA Adapted)

Callous Company reported the following accounts on

December 31, 2020:

Cash on hand

Petty cash fund

Philippine Bank current account

City Bank current account No. 1

City Bank current account No. 2 (overdraft)

Asia Bank saving account

Asia Bank time deposit, 90 days

200,000

20,000

5,000,000

4,000,000

( 100,000)

250,000

2,000,000

Cash on hand included the following items:

Customer check for P35.000 returned by bank December

26, 2020 due to insufficient fund but subsequently

redeposited and cleared by the bank on January 10, 2021.

Customer check for P15,000 dated January 10, 2021,

received December 23, 2020.

The petty cash fund consisted of the following items:

Currency and coins

IQUS from officers

Unreplenished petty cash vouchers

5,000

2,000

12,000

Included among the checks drawn by Callous Company

against the Philippine Bank current account and

recorded in December 2020 were the following:

*

Check written and dated December 23, 2020 and

0 delivered to payee on January 31, 2021, P25,000.

Check written December 26, 2020, dated January 30, 2021,

delivered to payee on December 28, 2020, P45,000.

henito

Required:

1. Compute the total cash and cash equivalents.

2. Prepare adjusting entries on December 31, 2020.

21

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- urrent Attempt in Progress Nancy's Cabinet Design established a petty cash fund on April 1, 2024, to facilitate the payment of small items. The following petty cash transactions were noted by the petty cash custodian during the month of April 2024: Apr. 1 10 15 Received cash of $205 to establish the petty cash fund. The petty cash fund was replenished when there was $80 on hand and the following receipts: a) $32 for supplies b) $52 for freight in charges c) $27 for postage The petty cash fund was increased to $246arrow_forwardHt.11.arrow_forwardRequired information Problem 6-24A (Algo) Petty cash fund LO 6-4 [The following information applies to the questions displayed below.) Austin Company established a petty cash fund by issuing a check for $286 and appointing Steve Mack as petty cash custodian. Mack had vouchers for the following petty cash payments during the month. Stamps Miscellaneous items Employee supper money Taxi fare Window-washing service $50 24 65 45 81 There was $20 of currency in the petty cash box at the time it was replenished. The four distinct accounting events affecting the petty cash fund for the period were (1) establishment of the fund, (2) reimbursements made to employees, (3) recognition of expenses, and (4) replenishment of the fund. Assume the company uses a traditional approach to petty cash expense recognition and replenishment.arrow_forward

- View Policies Current Attempt in Progress Blue Spruce Company established a $110 petty cash fund on August 1. On August 31, the fund had $9 cash remaining and petty cash receipts for postage $41, office supplies $24, and miscellaneous expense $34. Prepare journal entries to establish the fund on August 1 and replenish the fund on August 31. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Date Account Titles and Explanation e Textbook and Media Debit Creditarrow_forwardPetty Cash PolekMart established a $1,050 petty cash fund on May 2. On May 30, the fund shows $326 in cash along with receipts for the following expenditures: transportation-in, $120; postage expenses, $369, and miscellaneous expenses, $240. The company uses the perpetual system in accounting for merchandise inventory. Prepare the entries to (1) establish the fund, (2) reimburse the fund, and (3) increase the fund to $1,200.arrow_forwardRecord entry for recognition of expenses and replenishment of the fund, record entry for reimbursements made by employee, record entry for petty cash found.arrow_forward

- Kk.435.arrow_forwardowe subject-Accountingarrow_forwardExercise 6-10 (Algo) Petty cash fund accounting LO P2 Palmona Company establishes a $160 petty cash fund on January 1. On January 8, the fund shows $71 in cash along with receipts for the following expenditures: postage, $36; transportation-in, $13; delivery expenses, $15; and miscellaneous expenses, $25. Palmona uses the perpetual system in accounting for merchandise inventory. 1. Prepare the entry to establish the fund on January 1. 2. Prepare the entry to reimburse the fund on January 8 under two separate situations: a. To reimburse the fund. b. To reimburse the fund and increase it to $210. Hint. Make two entries.arrow_forward

- answer in text form please (without image), Note: .Every entry should have narration pleasearrow_forwardDon't give answer in image formatarrow_forward000 Debit Cash $250; credit Accounts Payable $250. Havermill Co. establishes a $250 petty cash fund on September 1. On September 30, the fund is replenished. The accumulated receipts on that date represent $73 for Office Supplies, $137 for merchandise inventory, and $22 for miscellaneous expenses. The fund has a balance of $18. On October 1, the accountant determines that the fund should be increased by $50. The journal entry to record the establishment of the fund on September 1 is: Debit Petty Cash $250; credit Cash $250. Debit Petty Cash $250; credit Accounts Payable $250. Debit Cash $250; credit Petty Cash $250. Debit Miscellaneous Expense $250; credit Cash $250.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education