FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Printing Supply of Baltimore has applied for a loan. Its bank has requested a budgeted income statement for

April

2024

and budgeted

April

30,

2024.

The

March

31,

2024,

balance sheet follows:

As

Tune

Printing Supply's controller, you have assembled the following additional information:

|

a.

|

April

dividends of

$6,000

were declared and paid. |

|

b.

|

April

capital expenditures of

$16,200

budgeted for cash purchase of equipment. |

|

c.

|

April

depreciation expense,

$500.

|

|

d.

|

Cost of goods sold,

45%

of sales. |

|

e.

|

Desired ending inventory for

April

is

$22,800.

|

|

f.

|

April

selling and administrative expenses include salaries of

$32,000,

30%

of which will be paid in cash and the remainder paid next month. |

|

g.

|

Additional

April

selling and administrative expenses also include miscellaneous expenses of

15%

of sales, all paid in

April.

|

|

h.

|

April

budgeted sales,

$86,000,

50%

collected in

April

and

50%

in

May.

|

|

i.

|

April

cash payments of

March

31

liabilities incurred for

March

purchases of inventory,

$8,100.

|

|

j.

|

April

purchases of inventory,

$12,300

for cash and

$37,500

on account. Half the credit purchases will be paid in

April

and half in

May.

|

I'VE ASKED THIS QUESTION A FEW TIMES BUT ONLY GET PART ANSWERS. CAN YOU PLEASE HELP ME WITH REST OF PART 8?

|

1.

|

Prepare the sales budget for

April.

|

|

2.

|

Prepare the inventory, purchases, and cost of goods sold budget for

April.

|

|

3.

|

Prepare the selling and administrative expense budget for

April.

|

|

4.

|

Prepare the schedule of cash receipts from customers for

April.

|

|

5.

|

Prepare the schedule of cash payments for selling and administrative expenses for

April.

|

|

6.

|

Prepare the

April.

Assume the company does not use short-term financing to maintain a minimum cash balance. |

|

7.

|

Prepare the budgeted income statement for

April.

|

|

8.

|

Prepare the budgeted balance sheet at

April

30,

2024.

|

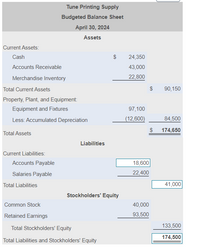

Transcribed Image Text:**Tune Printing Supply: Budgeted Balance Sheet**

**Date:** April 30, 2024

---

### Assets

**Current Assets:**

- **Cash:** $24,350

- **Accounts Receivable:** $43,000

- **Merchandise Inventory:** $22,800

**Total Current Assets:** $90,150

**Property, Plant, and Equipment:**

- **Equipment and Fixtures:** $97,100

- **Less: Accumulated Depreciation:** $(12,600)

**Net Property, Plant, and Equipment:** $84,500

**Total Assets:** $174,650

---

### Liabilities

**Current Liabilities:**

- **Accounts Payable:** $18,600

- **Salaries Payable:** $22,400

**Total Liabilities:** $41,000

---

### Stockholders' Equity

- **Common Stock:** $40,000

- **Retained Earnings:** $93,500

**Total Stockholders' Equity:** $133,500

**Total Liabilities and Stockholders' Equity:** $174,500

This balance sheet provides a snapshot of Tune Printing Supply's financial position as of April 30, 2024. It details the company's assets, liabilities, and stockholders' equity, emphasizing the balanced nature of financial statements where total assets equal the sum of liabilities and equity.

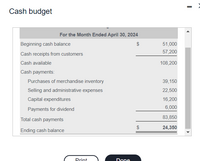

Transcribed Image Text:**Cash Budget**

**For the Month Ended April 30, 2024**

- **Beginning cash balance:** $51,000

- **Cash receipts from customers:** $57,200

**Cash available:** $108,200

**Cash payments:**

- Purchases of merchandise inventory: $39,150

- Selling and administrative expenses: $22,500

- Capital expenditures: $16,200

- Payments for dividend: $6,000

**Total cash payments:** $83,850

**Ending cash balance:** $24,350

**Explanation:**

The cash budget details the financial transactions expected within a specific timeframe, here for the month ending April 30, 2024. The beginning cash balance is the initial funds available at the start of the period, followed by cash inflows, such as customer receipts, resulting in total cash available. Cash outflows include various payments, leading to the total cash payments. The ending cash balance reflects the remaining funds after considering all inflows and outflows.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 8 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required information [The following information applies to the questions displayed below.] Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year. The company's balance sheet as of June 30th is shown in the picture provided: Beech's managers have made the following additional assumptions and estimates: Estimated sales for July, August, September, and October will be $360,000, $380,000, $370,000, and $390,000, respectively. All sales are on credit and all credit sales are collected. Each month's credit sales are collected 35% in the month of sale and 65% in the month following the sale. All of the accounts receivable at June 30 will be collected in July. Each month's ending inventory must equal 25% of the cost of next month's sales. The cost of goods sold is 60% of sales. The company pays for 40% of its merchandise purchases in the month of the purchase and the remaining 60% in the month following the purchase. All of…arrow_forwardQuestion 6. Please answer in same format as question so it's easy to transfer overarrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

- The president of the retailer Prime Products has just approached the company's bank with a request for a $57,000, 90-day loan. The purpose of the loan is to assist the company in acquiring inventories. Because the company has had some difficulty in paying off its loans in the past, the loan officer has asked for a cash budget to help determine whether the loan should be made. The following data are available for the months April through June, during which the loan will be used: On April 1, the start of the loan period, the cash balance will be $30,800. Accounts receivable on April 1 will total $159,600, of which $136,800 will be collected during April and $18,240 will be collected during May. The remainder will be uncollectible. Past experience shows that 30% of a month’s sales are collected in the month of sale, 60% in the month following sale, and 8% in the second month following sale. The other 2% is bad debts that are never collected. Budgeted sales and expenses for the…arrow_forwardThe president of the retailer Prime Products has just approached the company’s bank with a request for a $30,000, 90-day loan. The purpose of the loan is to assist the company in acquiring inventories. Because the company has had some difficulty in paying off its loans in the past, the loan officer has asked for a cash budget to help determine whether the loan should be made. The following data are available for the months April through June, during which the loan will be used: On April 1, the start of the loan period, the cash balance will be $24,000. Accounts receivable on April 1 will total $140,000, of which $120,000 will be collected during April and $16,000 will be collected during May. The remainder will be uncollectible. Past experience shows that30% of a month’s sales are collected in the month of sale, 60% in the month followingsale, and 8% in the second month following sale. The other 2% represents bad debts that are never collected. Budgeted sales and expenses for the…arrow_forwardRequired information [The following information applies to the questions displayed below.] Beech Corporation is a merchandising company that is preparing a master budget for the third quarter of the calendar year. The company's balance sheet as of June 30th is shown below: Beech Corporation Balance Sheet June 30 Assets Cash Accounts receivable Inventory Plant and equipment, net of depreciation Total assets Liabilities and Stockholders' Equity Accounts payable Common stock Retained earnings Total liabilities and stockholders' equity $ 94,000 145,000 59,400 222,000 $520,400 $ 83,000 331,000 106,400 $ 520,400 Beech's managers have made the following additional assumptions and estimates: 1. Estimated sales for July, August, September, and October will be $330,000 $350,000, $340,000, and $360,000, respectively. 2. All sales are on credit and all credit sales are collected. Each month's credit sales are collected 35% in the month of sale and 65% in the month following the sale. All of the…arrow_forward

- A company has completed the operating budget and the cash budget. It is now preparing the budgeted balance sheet. Please use the below image as your guide for the next 5 questions. )dentify the document that contains accounts receivable A B C D Earrow_forwardFrom the above information, can you produce the budgeted statement of financial position and a brief analysis report?arrow_forwardThe controller of Ultramint Company wishes to improve the company's control system by preparing a monthly cash budget. The following information relates to the month ending July 31, 2008. June 30, 2008 cash balance ... Dividends to be declared on July 15* Cash expenditures to be paid in July for operating expenses Amortization expense.... Cash collections to be received ... $ 90,000 24,000 73,600 9,000 178,000 112,400 41,000 50,000 Merchandise purchases to be paid in cash Equipment to be purchased for cash. …….. Ulramint Company wishes to maintain a minimum cash balance of .... *Dividends are payable to shareholders of record on declaration date, 30 days after declaration. Required: Prepare a cash budget for the month ended July 31, 2008, indicating how much, if anything, Ultramint will need to borrow to meet its minimum cash requirement.arrow_forward

- 3. The Uthred Company, a merchandising firm, has planned the following sales for the next four months: March $50,000 Аpril $70,000 Мay $90,000 June July $90,000 Total budgeted Sales $60,000 Sales are made 60% on account and 40% cash. From experience, the company has learned that a month's sales on account are collected according to the following pattern: Month of sale 60% • First month following month of sale . • Second month following month of sale • Uncollectible 28% 10% 2% Uthred has a building that is not used in the business operation; they rented it out and receive $10,080 rent every month. The company requires a minimum cash balance of $14,000 to start a month.arrow_forwardPlease do not give solution in image format ? And Fast Answering Please And Explain Proper Step by Step.arrow_forwardplease answer within the format by providing formula the detailed workingPlease provide answer in text (Without image)Please provide answer in text (Without image)Please provide answer in text (Without image)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education