Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

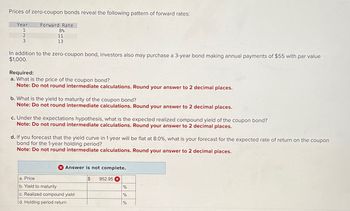

Transcribed Image Text:Prices of zero-coupon bonds reveal the following pattern of forward rates:

Year

1

2

3

Forward Rate

8%

11

13

In addition to the zero-coupon bond, investors also may purchase a 3-year bond making annual payments of $55 with par value

$1,000.

Required:

a. What is the price of the coupon bond?

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

b. What is the yield to maturity of the coupon bond?

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

c. Under the expectations hypothesis, what is the expected realized compound yield of the coupon bond?

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

d. If you forecast that the yield curve in 1 year will be flat at 8.0%, what is your forecast for the expected rate of return on the coupon

bond for the 1-year holding period?

Note: Do not round intermediate calculations. Round your answer to 2 decimal places.

Answer is not complete.

$ 952.95 x

a. Price

b. Yield to maturity

c. Realized compound yield

d. Holding period return

%

%

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Zero-Coupon Bonds (ZCBS) with maturity in 1 and 5 years are available on the market. Their redemption value is £100, and they sell for £90 (1-year ZCB) and £84 (5-year ZCB). Find the spot rates corresponding to the ZCBs' prices 数字 i1 = % i5 数字 Enter a percentage correct to 2 decimal places % Calculate the forward rate 1,5 i1,5 数字 Enter a percentage correct to 2 decimal places %arrow_forwardAn investor wants to find the duration of a(n) 15-year, 6% semiannual pay, noncallable bond that's currently priced in the market at $587.05, to yield 12%. Using a 150 basis point change in yield, find the effective duration of this bond (Hint: use Equation 11.11). Question content area bottom Part 1 The new price of the bond if the market interest rate decreases by 150 basis points (or 1.5%) is $enter your response here. (Round to the nearest cent.)arrow_forwardK Assume that a bond will make payments every six months as shown on the following timeline (using six-month periods): Period 0 2 Cash Flows $19.12 $19.12 a. What is the maturity of the bond (in years)? b. What is the coupon rate (as a percentage)? c. What is the face value? a. What is the maturity of the bond (in years)? The maturity is years. (Round to the nearest integer.) 39 $19.12arrow_forward

- Related to Checkpoint 9.2) (Yield to maturity) The market price is $850 for a 12-year bond ($1,000 par value) that pays 11 percent annual interest, but makes interest payments on a semiannual basis (5.5 percent semiannually). What is the bond's yield to maturity? Question content area bottom Part 1 The bond's yield to maturity is enter your response here%. (Round to two decimal places.)arrow_forwardWhat are the Modified Duration and Macaulay Duration of the following bond? Coupon Rate = 8% (Semi-annually paid) YTM = 9% Maturity = 2 Years Par Value = 1,000 (Hint: this question is similar to Example 1 and Example 2 on slides) ModD = 1.886 and MacD = 1.805 ModD = 1.784 and MacD = 1.954 ModD = 1.954 and MacD = 1.784 ModD = 1.805 and MacD = 1.886arrow_forwardYou are given the following information with respect to a non-callable bond: par amount: 1,000 • term to maturity: 4 years annual coupon rate: 8% payable annually. Time 0 1 2 3 1-Year Annual Forward Interest Rates Scenario X Scenario Y 7% 7% 8% 10% 7% 6% 7% 5% Each interest rate scenario has an equal probability of occurring. Calculate the value of the bond (i.e. the expected present value of the bond payments). A 1,000.00 B 1,018.40 C 1,022.80 D 1,030.39 E 1,031.07arrow_forward

- Suppose 1-year Treasury bonds yield 4.40% while 2-year T-bonds yield 5.70%. Assuming the pure expectations theory is correct, and thus the maturity risk premium for T-bonds is zero, what is the yield on a 1-year T-bond expected to be one year from now? Do not round your intermediate calculations. Round your final answer to 2 decimal places. a. 7.02% b. 5.66% c. 5.05% Od. 4.92% e. 7.32%arrow_forwardYou are given the following prices of zero coupon bonds per $1.00 of maturity value: Term in years 1 2 3 4 Zero-coupon bond prices 0.9852 0.9701 0.9546 0.9388 Determine the one-year forward rate for year 4 (ie, the one-year forward rate deferred for 3 years. a) 1.629% b) 1.526% c) 1.572% d) 1.729% e) 1.683%arrow_forwardQuestion Given the following information about a bond, calculate the modified duration of the bond. i) The term-to-maturity is two years. ii) Coupons are payable annually at 5%. iii) The bond is trading at par. Possible Answers A B D 1.859 с 1.928 E 1.881 1.952 Cannot be determined since the yield rate i is not provided.arrow_forward

- Please show working Please answer ALL OF QUESTIONS 1 AND 2 1. A 7% semiannual coupon bond matures in 6 years. The bond has a face value of $1,000 and a current yield of 7.5219%.a. What is the bond's price? Do not round intermediate calculations. Round your answer to the nearest cent.b. What is the bond's YTM? (Hint: Refer to Footnote 6 for the definition of the current yield and to Table 7.1) Do not round intermediate calculations. Round your answers to two decimal places. 2. Nesmith Corporation's outstanding bonds have a $1,000 par value, a 7% semiannual coupon, 18 years to maturity, and a 9% YTM. What is the bond's price? Round your answer to the nearest cent.arrow_forwardNeed help with C Approximate yield to maturity An investor must choose between two bonds: Bond A pays $90 annual interest and has a market value of $815. It has 15 years to maturity. Bond B pays $81 annual interest and has a market value of $700. It has eight years to maturity. Assume the par value of the bonds is $1,000. a. Compute the current yield on both bonds. (Do not round intermediate calculations. Input your answers as a percent rounded to 2 decimal places.) Current Yield Bond A11.04% Bond B11.57% c. A drawback of current yield is that it does not consider the total life of the bond. For example, the approximate yield to maturity on Bond A is 11.51 percent. What is the approximate yield to maturity on Bond B? The exact yield to maturity? (Use the approximation formula to compute the approximate yield to maturity and use the calculator method to compute the exact yield to maturity. Do not round intermediate calculations. Input your answers as a percent rounded to 2…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education