Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

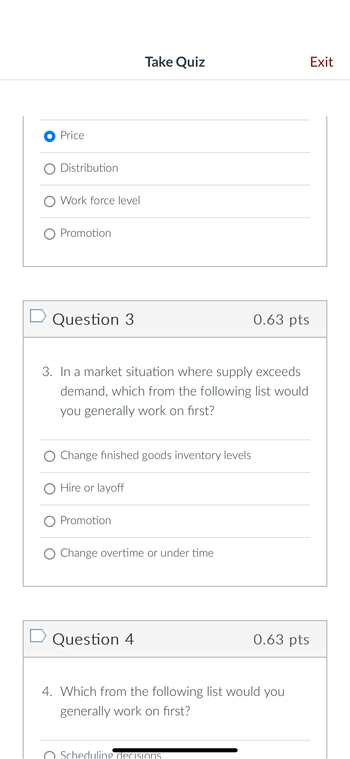

Transcribed Image Text:● Price

O Distribution

O Work force level

○ Promotion

☐ Question 3

Take Quiz

Exit

0.63 pts

3. In a market situation where supply exceeds

demand, which from the following list would

you generally work on first?

Change finished goods inventory levels

O Hire or layoff

Promotion

O Change overtime or under time

☐ Question 4

0.63 pts

4. Which from the following list would you

generally work on first?

Scheduling decisions.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Helparrow_forwardConvert Insert MANAGEMENT SCIENCE ASSESSMENT TASKS PROBLEM 1. For each of the following costs, indicate whether the cost would be an out-of-pocket carrying cost (C), or a cost of placing an order (P). If the item does not qualify for either of these categories, note that it as none of the above (N) Assume that wages vary with the level of work while salaries are fixed for a monthly or longer time period. 1. Hourly fee for inventory audit. 2 Salary of purchasing supervisor. 3. Costs to audit purchase orders and invoices, on a per-order basis. 4. Taxes on inventory. 5. Stockout costs. 6. Storage costs charged per unit in inventory. 7. Fire insurance on inventory. 8. Fire insurance on warehouse. 9. Obsolescence costs on inventory. | 10. Shipping costs per shipment. PROBLEM 2 The Strawberry Bread Company buys and then sells (as bread) 2.6 million bushels of wheat annually. The wheat must be purchased in multiples of 2,000 bushels. Ordering costs, which include grain elevator removal…arrow_forwardProduct costs under variable costing are typically: Question 1 options: lower than under absorption costing higher than under absorption costing the same as with absorption costing higher than absorption costing when inventory increasesarrow_forward

- Relevant of differential cost analysis takes all variable and fixed costs into account to analyze decision alternatives considers only variable costs as they change with each decision alternative considers the change in reported net income for each alternative to arrive at the optimum decision for the company considers all variable and fixed costs as they change with each decision alternatives The term that refers to costs incurred in the past that are not relevant to a future decision is full absorption cost sunk cost incurred marginal cost under allocated indirect costarrow_forwarda. Prepare an income statement based on full absorption costing. Only use a negative sign with your answer for net income (loss), if the answer represents a net loss. Otherwise, do not use negative signs with any answers. Round answers to the nearest whole number, when applicable. Sales Absorption Costing Income Statement Cost of Goods Sold: $ 100,000 Beginning Inventory Direct labor 47,000 ✔ Manufacturing overhead いく 21,000✓ Less: Ending Inventory Cost of Goods Sold Gross profit 0 x 80,000 * Operating expenses ÷ Net Income (Loss) $ 32,000 x 11,400 xarrow_forwardIh order to attract investors and borrow on attractive terms, a company would use in times when inventory costs are rising. A) average costing B) specific-identification costing C) FIFO O D) LIFOarrow_forward

- Please do not give solution in image format thankuarrow_forwardTime left 1:46 Which of the following statements about CVP analysis is false? O a. Unit selling price, unit variable costs, and total fixed costs are known and remain constant. Ob. All of the given answers are true. Oc. Managers use (CVP) analysis to study the behavior of and relationship among the elements such as total revenues, total costs, and income O d. Total revenues and total costs are linear in relation to output units. O e. Operating income calculations in CVP analysis are based on contribution margin not gross margin. 14:13 A O A d0 ENG 15-04-2021 re to search hp end brt sc delete home & num 23 + backspace 24 4. lock 8. 3. 6 7 V 8 A home enter 5 0 D F G J K L. pause 51 B ↑ shift 11 2 N M end alt ctrl insarrow_forward3arrow_forward

- Discuss the two (2) components of every Sales dollar, and defend the choice of a business to utilize the LIFO inventory costing system, in a period of rising prices.arrow_forwardPLEASE USE THIS TIME TO ANSWER THIS. AYAW NA PAGHULAT UG DEADLINE, TOMORROW IS ANOTHER DAY. PLEASE DEFINE AND GIVE THE FORMULA OF THE FOLLOWING (IF THERE IS ANY): PLEASE ANSWER HERE DIRECTLY 1. absorption costing 2. activity bases (drivers) 3. break-even polnt 4. contributlon margin 5. contributlon margin ratlo 6. cost behavlor 7. cost-volume-profit analysls 8. cost-volume-profit chartarrow_forward(a) What is the gross margin now? (b) What is the net operating income now? (c) What is the contribution margin now?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education