FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

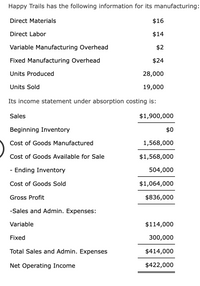

Transcribed Image Text:Happy Trails has the following information for its manufacturing:

Direct Materials

$16

Direct Labor

$14

Variable Manufacturing Overhead

$2

Fixed Manufacturing Overhead

$24

Units Produced

28,000

Units Sold

19,000

Its income statement under absorption costing is:

Sales

$1,900,000

Beginning Inventory

$0

Cost of Goods Manufactured

1,568,000

Cost of Goods Available for Sale

$1,568,000

- Ending Inventory

504,000

Cost of Goods Sold

$1,064,000

Gross Profit

$836,000

-Sales and Admin. Expenses:

Variable

$114,000

Fixed

300,000

Total Sales and Admin. Expenses

$414,000

Net Operating Income

$422,000

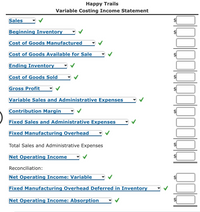

Transcribed Image Text:Happy Trails

Variable Costing Income Statement

Sales

Beginning Inventory

Cost of Goods Manufactured

Cost of Goods Available for Sale

Ending Inventory

Cost of Goods Sold

Gross Profit

Variable Sales and Administrative Expenses

Contribution Margin

Fixed Sales and Administrative Expenses

Fixed Manufacturing Overhead

Total Sales and Administrative Expenses

$

Net Operating Income

Reconciliation:

Net Operating Income: Variable

Fixed Manufacturing Overhead Deferred in Inventory

Net Operating Income: Absorption

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Trio Company reports the following information for its first year of operations. Direct materials $ 18 per unit Direct labor $ 19 per unit Variable overhead $ 7 per unit Fixed overhead $ 221,650 per year Units produced 20,150 units Units sold 15,500 units Ending finished goods inventory 4,650 units Assume instead that Trio Company uses variable costing.1. Compute the product cost per unit using variable costing.2. Determine the cost of ending finished goods inventory using variable costing.3. Determine the cost of goods sold using variable costing.arrow_forwardData concerning Dakota Enterprises' operations last year appear below: Units in the Beginning Inventory -0- Units Units Produced 4,000 Units Units Sold 3,900 Units Selling Price Per Unit $140 Variable Costs Per Unit: Direct Material $41 Direct Labor 43 Manufacturing Overhead 6 Sellling and Administrative Costs 4 Fixed Costs in Total: Manufacturing Overhead $84,000 Selling and Administrative Costs 39,000 Match each of the following items with the proper amount. Unit Product Cost , Using Absorption Costing Unit Gross Margin…arrow_forwardMy company’s relevant range of production is 27,000 to 29,000 units. When it produces and sells 28,000 units, its average costs per unit are as follows: Average Cost per Unit Direct materials $ 8.70 Direct labor $ 5.70 Variable manufacturing overhead $ 3.20 Fixed manufacturing overhead $ 6.70 Fixed selling expense $ 5.20 Fixed administrative expense $ 4.20 Sales commissions $ 2.70 Variable administrative expense $ 2.20 For financial accounting purposes, what is the total product cost incurred to make 29,000 units? For financial accounting purposes, what is the total period cost incurred to sell 27,000 units?arrow_forward

- ed Dowell Company produces a single product. Its income statements under absorption costing for its first two years of operation follow. Income Statements (Absorption Costing) Sales ($60 per unit) Year 1 $ Year 2 $ 1,920,000 3,960,000 Cost of goods sold ($45 per unit) 1,440,000 2,970,000 Gross profit 480,000 990,000 Selling and administrative expenses ok Income t 338,000 474,000 $ 142,000 $ 516,000 Additional Information a. Sales and production data for these first two years follow. Year 1 Year 2 nces Units Units produced 49,000 49,000 Units sold 32,000 66,000 b. Variable costs per unit and fixed costs per year are unchanged during these years. The company's $45 per unit product cost using absorption costing consists of the following. Direct materials Direct labor $ 12 19 Variable overhead Fixed overhead ($539,000/49,000 units) 3 11 Total product cost per unit $ 45 c. Selling and administrative expenses consist of the following. Selling and Administrative Expenses Variable selling and…arrow_forwardMagpie Corporation uses the total cost method of product pricing. Below is cost information for the production and sale of 64,400 units of its sole product. Magpie desires a profit equal to a 19% return on invested assets of $619,000. Fixed factory overhead cost $36,000 Fixed selling and administrative costs 7,500 Variable direct materials cost per unit 4.72 Variable direct labor cost per unit 1.88 Variable factory overhead cost per unit 1.13 Variable selling and administrative cost per unit 4.50 The cost per unit for the production and sale of Magpie's product isarrow_forwardThe following information is available for Barnes Company for the fiscal year ended December 31: Beginning finished goods inventory in units 0 Units produced 4,800 Units sold 4,000 Sales $ 400,000 Materials cost $ 96,000 Variable conversion cost used $ 48,000 Fixed manufacturing cost $ 72,000 Indirect operating costs (fixed) $ 80,000 Cost of goods sold using variable costing is: $120,000 $40,000 $144,000 $110,000arrow_forward

- Yancey, Inc reports the following information Units produced Units sold Sales poce Direct materials Direct labor 520 units 520 units $150 per unit $40 per unit $30 per unit Variable manufacturing overhead Fixed manufacturing overhead $20 per unit $24,000 per year $15 per unit Variable selling and administrative costs Fixed selling and administrative costs $25,000 per year What is the amount of unit product cost that will be considered for external reporting purposes? (Round any intermediate calculations and your final answer to the nearest cent) OA. $76 15 OB 5136 15 OC. $116 15 OD $80.00arrow_forwardHappy Trails has the following information for its manufacturing: Direct Materials $16 Direct Labor $16 Variable Manufacturing Overhead $3 Fixed Manufacturing Overhead $25 Units Produced 27,000 Units Sold 18,000 Its income statement under absorption costing is: Sales $1,901,000 Beginning Inventory $0 Cost of Goods Manufactured 1,620,000 Cost of Goods Available for Sale $1,620,000 - Ending Inventory 540,000 Cost of Goods Sold $1,080,000 Gross Profit $821,000 -Sales and Admin. Expenses: Variable $108,000 Fixed 200,000 Total Sales and Admin. Expenses $308,000 Net Operating Income $513,000 Prepare an income statement with variable costing and a reconciliation statement between both methods. If an amount box does not require an entry, leave it blank.arrow_forwardHi-Tek Manufacturing, Inc., makes two types of industrial component parts—the B300 and the T500. An absorption costing income statement for the most recent period is shown: Hi-Tek Manufacturing Inc.Income Statement Sales $ 1,712,000 Cost of goods sold 1,244,712 Gross margin 467,288 Selling and administrative expenses 620,000 Net operating loss $ (152,712 ) Hi-Tek produced and sold 60,200 units of B300 at a price of $20 per unit and 12,700 units of T500 at a price of $40 per unit. The company’s traditional cost system allocates manufacturing overhead to products using a plantwide overhead rate and direct labor dollars as the allocation base. Additional information relating to the company’s two product lines is shown below: B300 T500 Total Direct materials $ 400,700 $ 162,100 $ 562,800 Direct labor $ 120,500 $ 42,700 163,200 Manufacturing overhead 518,712 Cost of goods sold $ 1,244,712 The company has created an…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education