ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

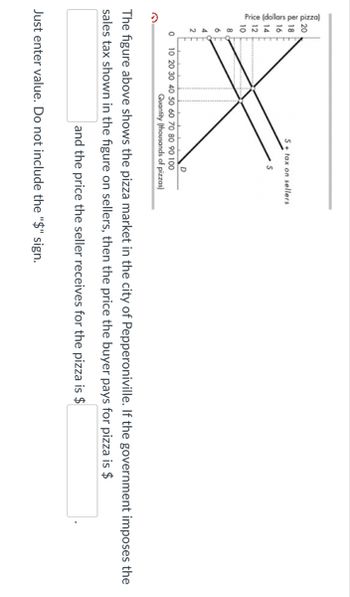

Transcribed Image Text:Price (dollars per pizza)

18

8

6

A

2

S+ tax on sellers

S

D

0 10 20 30 40 50 60 70 80 90 100

Quantity (thousands of pizzas)

The figure above shows the pizza market in the city of Pepperoniville. If the government imposes the

sales tax shown in the figure on sellers, then the price the buyer pays for pizza is $

and the price the seller receives for the pizza is $

Just enter value. Do not include the "$" sign.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Table 1: Market for Skis P 0 20 40 60 80 100 Qd a. 25 20 15 10 Qs 0 0 4 8 12 5 16 20 Part 1: Consider the market for skis. What is the equilibrium price and quantity? What is the equilibrium price sellers receive, equilibrium price buyers pay, and equilibrium quantity if there is a $20 tax on buyers?arrow_forward7. Effect of a tax on buyers and sellers Part 2 The following graph shows the daily market for wine. Suppose the government institutes a tax of $10.15 per bottle. This places a wedge between the price buyers pay and the price sellers receive.arrow_forwardMacmillan Learning (Figure and Table: The Market for Lyft Rides) The market for Lyft rides is shown below. If the government imposes an excise tax of $1 per ride on producers, then people who ride Lyft will pay S of each $1 tax Price (per ride) Quantity Demanded (millions of rides per year) Quantity Supplied (millions of rides per year) $7.00 14 13 12 11 6.50 6.00 5.50 5.00 4.50 4.00 3.50 3.00 0¹ 00 0.50 0.25 00.00 6 7 8 9 10 11 12 13 14 10 9 18 7 6arrow_forward

- Table: The market for taxi rides Fare (per ride) $7.50 7.00 6.50 6.00 5.50 5.00 4.50 4.00 3.50 3.00 2.50 2.00 5 6 7 89 10 11 12 13 14 15 Quantity of rides (millions per year) Look at the table "The Market for Taxi Rides". If a tax of $2.00 per taxi ride is implemented in this market, how much will consumers pay for a taxi ride? O $6.00 O $4.00 O $7.00 O $5.00arrow_forwardq6-arrow_forwardQUESTION 19 The original equilibrium of a market is at price $20 and quantity 20. If a tax of $10 is imposed and producers receive a net price of $18, how much (in dollars) is the tax burden on producers? 2arrow_forward

- If the price of a product rises by an amount less than the established tax, 1. Suppliers bear the tax 2. sellers bear the tax 3. buyers and sellers share the burden of tax 4. Buyers bear the taxarrow_forward6. The diagram below shows the market for chromebooks in the town of Smallville, U.S.A. Policy mak- ers want to collect money for more paper books in school and place a tax of 100 $ on chromebooks. Describe the impact of the tax on the market below. Price 500 450 400 350 300 250 200 150 100 50 100 200 300- Chromebooks 800 900 1,000 7. After the tax, 8. After the tax, consumers pay a price of . 9. After the tax, producers receive a price of 10. What amount of tax revenues are collected when the tax is instituted?. chromebooks are exchanged in the market.arrow_forwardPrice $3.50 3 2.50 Supply Demand Demand + $1 tax 1,200 1,500 Quantity The graph above illustrates a market for gasoline with a $1 tax imposed on the buyers. What is the buyer's tax incidence?arrow_forward

- Suppose the market for cigarette is competitive. An economist estimates the price elasticity of demand and supply for cigarette are -0.8 and 0.7 respectively. Suppose the government imposes a per-unit tax of $45 on the cigarette sellers. By how much would buyers share the tax burden respectively? Show your calculation.arrow_forwardPrice Tax Amount of the tax C. Quantity Click to view larger image. Look at the provided figure. What area(s) represent the deadweight loss after the tax? O A + B B + C O E+ F B.arrow_forwardPrice $3.50 3 2.50 $0.25 $1.00 1,200 1,500 $0.50 Supply The figure above illustrates a market for gasoline with a $1 tax imposed on the buyers. What is the seller's tax incidence? Between $0.00 and $1.00 depending on elasticity of supply. Demand Demand + $1 tax Quantityarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education