FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

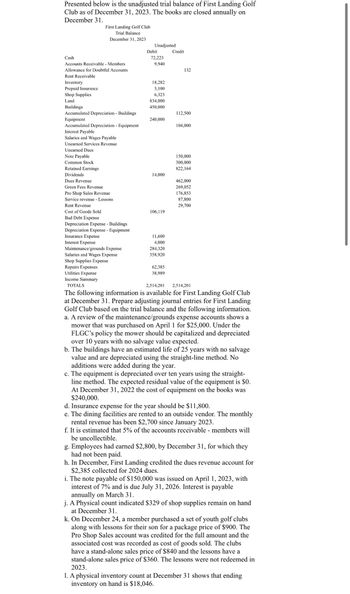

Transcribed Image Text:Presented below is the unadjusted trial balance of First Landing Golf

Club as of December 31, 2023. The books are closed annually on

December 31.

First Landing Golf Club

Trial Balance

December 31, 2023

Unadjusted

Debit

Credit

Cash

72,223

Accounts Receivable - Members

9,940

132

Allowance for Doubtful Accounts

Rent Receivable

Inventory

18,282

Prepaid Insurance

3,100

Shop Supplies

6,323

Land

834,000

Buildings

450,000

Accumulated Depreciation - Buildings

112,500

Equipment

240,000

Accumulated Depreciation Equipment

104,000

Interest Payable

Salaries and Wages Payable

Unearned Services Revenue

Unearned Dues

Note Payable

Common Stock

Retained Earnings

Dividends

Dues Revenue

Green Fees Revenue

Pro Shop Sales Revenue

Service revenue - Lessons

Rent Revenue

150,000

300,000

822,164

14,000

462,000

269,052

176,853

87,800

29,700

Cost of Goods Sold

106,119

Bad Debt Expense

Depreciation Expense - Buildings

Depreciation Expense - Equipment

Insurance Expense

11,600

Interest Expense

4,000

Maintenance/grounds Expense

284,320

Salaries and Wages Expense

358,920

Shop Supplies Expense

Repairs Expenses

62,385

38,989

2,514,201 2,514,201

Utilities Expense

Income Summary

TOTALS

The following information is available for First Landing Golf Club

at December 31. Prepare adjusting journal entries for First Landing

Golf Club based on the trial balance and the following information.

a. A review of the maintenance/grounds expense accounts shows a

mower that was purchased on April 1 for $25,000. Under the

FLGC's policy the mower should be capitalized and depreciated

over 10 years with no salvage value expected.

b. The buildings have an estimated life of 25 years with no salvage

value and are depreciated using the straight-line method. No

additions were added during the year.

c. The equipment is depreciated over ten years using the straight-

line method. The expected residual value of the equipment is $0.

At December 31, 2022 the cost of equipment on the books was

$240,000.

d. Insurance expense for the year should be $11,800.

e. The dining facilities are rented to an outside vendor. The monthly

rental revenue has been $2,700 since January 2023.

f. It is estimated that 5% of the accounts receivable - members will

be uncollectible.

g. Employees had earned $2,800, by December 31, for which they

had not been paid.

h. In December, First Landing credited the dues revenue account for

$2,385 collected for 2024 dues.

i. The note payable of $150,000 was issued on April 1, 2023, with

interest of 7% and is due July 31, 2026. Interest is payable

annually on March 31.

j. A Physical count indicated $329 of shop supplies remain on hand

at December 31.

k. On December 24, a member purchased a set of youth golf clubs

along with lessons for their son for a package price of $900. The

Pro Shop Sales account was credited for the full amount and the

associated cost was recorded as cost of goods sold. The clubs

have a stand-alone sales price of $840 and the lessons have a

stand-alone sales price of $360. The lessons were not redeemed in

2023.

1. A physical inventory count at December 31 shows that ending

inventory on hand is $18,046.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardGive me correct answer with explanationarrow_forwardRequired information [The following information applies to the questions displayed below.] On August 1, 2022, Colombo Company's treasurer signed a note promising to pay $122,400 on December 31, 2022. The proceeds of the note were $116,400. c. 1. Record the journal entry to show the effects of signing the note and the receipt of the cash proceeds on August 1, 2022. 2. Record the journal entry to show the effects of recording interest expense for the month of September. 3. Record the journal entry to show the effects of repaying the note on December 31, 2022. Complete this question by entering your answers in the tabs below. Required C1 Required C2 Required C3 Record the journal entry to show the effects of signing the note and the receipt of the cash proceeds on August 1, 2022. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet < 1arrow_forward

- Physicians’ Hospital has the following balances on December 31, 2024, before any adjustment: Accounts Receivable = $50,000; Allowance for Uncollectible Accounts = $1,000 (credit). On December 31, 2024, Physicians’ estimates uncollectible accounts to be 20% of accounts receivable. Required: 1. Record the adjusting entry for uncollectible accounts on December 31, 2024.2. Determine the amount at which bad debt expense is reported in the income statement and the allowance for uncollectible accounts is reported in the balance sheet.3. Calculate net accounts receivable reported in the balance sheet.arrow_forwardKelly Jones and Tami Crawford borrowed $10,500 on a 7-month, 8% note from Gem State Bank to open their business, Oriole’s Coffee House. The money was borrowed on June 1, 2022, and the note matures January 1, 2023. Prepare the entry to accrue the interest on June 3 Date Account Titles and Explanation Debit Credit June 30arrow_forwardThe accounting records and bank statement of Orison Supply Store provide the following information at the end of April. The closing 'Cash' account balance was $28,560, and the bank statement shows a closing balance of $32,000. On reviewing the bank statement it is found an account customer has deposited $2,000 into the bank account for a March sale and the monthly insurance premium of $4,500 was automatically charged to the account. Interest of $5,10 was paid by the bank and a bank fee of $50 was charged to the account. A payment of $1,500 to a supplier has been recorded twice in the accounts. After the ,calculation of the "ending reconciled cash balance", what is the balance of the 'cash' account?arrow_forward

- A customer opens a certificate of deposit of $909,642. The current CD-rate is 9% and the CD duration is 162 days. What is the amount due to the customer at expiration of the CD? Round your answer to the nearest two decimals if needed. Do not type the $ symbol.arrow_forwardMarin University sells 6,500 season basketball tickets at $55 each for the entire 13-game home schedule. (a) Give the entry to record the sale of the season tickets. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit Accounts Receivable 357,500 Cash 357,500arrow_forwardOn Dec. 31, 2021, Boss Company had a credit balance of $50,000 in its records pertaining to allowance for uncollectible accounts. Analysis of its accounts receivable on the same date revealed the following: Age Amount % collectible 0-30 days $5,000,000 95 31-60 days 600,000 85 61-90 days 450,000 70 Over 90 days 100,000 50 Total $6,150,000 The company has written off $20, 000 of accounts receivable during 2021. How much is the allowance for uncollectible accounts to be reported on Dec. 31, 2021?arrow_forward

- On March 1, Terrell & Associates provides legal services to Whole Grain Bakery regarding some recent food poisoning complaints. Legal services total $9,900. In payment for the services, Whole Grain Bakery signs a 8% note requiring the payment of the face amount and interest to Terrell & Associates on September 1. Required: For Whole Grain Bakery, record the issuance of the note payable on March 1 and the cash payment on September 1. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardDhapaarrow_forwardDO NOT GIVE SOLUTION IN IMAGEarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education