FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

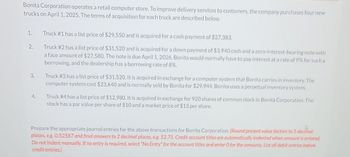

Transcribed Image Text:Bonita Corporation operates a retail computer store. To improve delivery services to customers, the company purchases four new

trucks on April 1, 2025. The terms of acquisition for each truck are described below.

1.

2.

3.

4.

Truck #1 has a list price of $29,550 and is acquired for a cash payment of $27,383.

Truck #2 has a list price of $31,520 and is acquired for a down payment of $3,940 cash and a zero-interest-bearing note with

a face amount of $27,580. The note is due April 1, 2026. Bonita would normally have to pay interest at a rate of 9% for such a

borrowing, and the dealership has a borrowing rate of 8%.

Truck #3 has a list price of $31,520. It is acquired in exchange for a computer system that Bonita carries in inventory. The

computer system cost $23,640 and is normally sold by Bonita for $29,944. Bonita uses a perpetual inventory system.

Truck #4 has a list price of $12,980. It is acquired in exchange for 920 shares of common stock in Bonita Corporation. The

stock has a par value per share of $10 and a market price of $13 per share.

Prepare the appropriate journal entries for the above transactions for Bonita Corporation. (Round present value factors to 5 decimal

places, e.g. 0.52587 and final answers to 2 decimal places, eg. 52.75. Credit account titles are automatically indented when amount is entered.

Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before

credit entries.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- On June 1, 2020 Comfort Creamery Corp. purchased 9,000 wooden barrels on account for $900,000 (purchase price of $100/barrel). The terms of the purchase were 2/10, n/30. Comfort Creamery Corp. accounts for such purchases using the net method. Required: 1. Prepare the journal entry to record the purchase of 9,000 wooden barrels. 2. Comfort Creamery Corp. paid for the barrels on June 17, 2020. Prepare the journal entry to record the payment for the 9,000 wooden barrels.arrow_forwardBefore you begin this assignment, review the Tying It All Together feature in the chapter iHeartMedia , Inc. in their annual report for the year ending December 31, 2015, state that the plant assets reported on its balance sheet includes the following: Depreciation is computed using the straight-line method. Requirements 1. Suppose iHeartMedia, Inc. purchases a new advertising structure for $100,000 on August 1. The residual value of the structure is $4,000 and the useful life is 10 years. How would iHeartMedia record the depreciation expense on December 31 in the first year of use? What about the second year of use? 2. What would be the book value of the structure at the end of the first year? What would be the book value of the structure at the end of the second year? 3. What would be the impact on iHeartMedia, Inc. financial statements if they failed to record the adjusting entry related to the structure?arrow_forwardConcord Corporation operates a retail computer store. To improve delivery services to customers, the company purchases four new trucks on April 1, 2020. The terms of acquisition for each truck are described below. 1. 2. 3. 4. Truck #1 has a list price of $40,350 and is acquired for a cash payment of $37,391. Truck #2 has a list price of $43,040 and is acquired for a down payment of $5,380 cash and a zero-interest-bearing note with a face amount of $37,660. The note is due April 1, 2021. Concord would normally have to pay interest at a rate of 9% for such a borrowing, and the dealership has an incremental borrowing rate of 8%. Truck #3 has a list price of $43,040. It is acquired in exchange for a computer system that Concord carries in inventory. The computer system cost $32,280 and is normally sold by Concord for $40,888. Concord uses a perpetual inventory system. Truck #4 has a list price of $37,660. It is acquired in exchange for 900 shares of common stock in Concord Corporation. The…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education