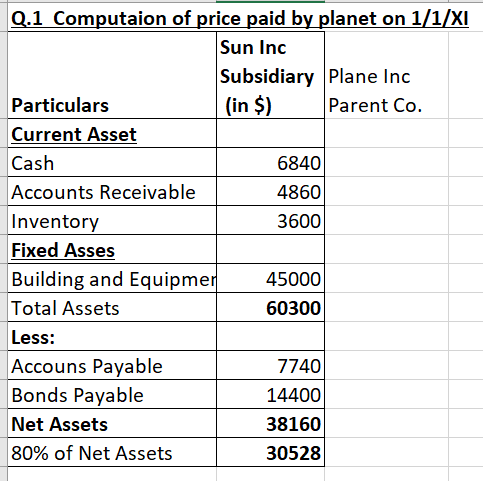

Presented below are the adjusted trial balances for Sun, Inc. and Planet Corporation as of 12/31/X1. (Remember that adjusted trial balances are prepared before closing.) Credit balances are in parentheses. This problem ignores income taxes. Sun Planet Sales Revenue (23,220) (47,432) Income from Sun ----- ? Cost of Goods Sold 4,500 33,880 Wage Expense 2,160 5,500 Depreciation Expense 1,440 2,640 Cash 6,840 59,400 Accounts Receivable (net) 4,860 44,000 Inventory 3,600 31,460 Buildings and Equipment (net) 45,000 193,600 Investment in Sun ------ ? Accounts Payable (7,740) (44,000) Bonds Payable (14,400) (110,000) Common Stock (5,400) (66,000) APIC (16,200) (107,380) Retained Earnings, 1/1/X1 (1,800) (16,300) Dividends Declared 360 2,200 On 1/1/X1, Planet Corporation purchased 80% of the common stock of Sun, Inc. at book value (book value and fair value of Sun’s net assets are the same). During 20X1, Sun borrowed $2,640 from Planet and has not repaid it as of the end of 20X1. Note: this problem is not asking you to prepare any journal entries. Required: 1. What price did Planet pay on 1/1/X1 for 80% of Sun’s stock? 2. What is Sun’s separate Net Income for 20X1? 3. What is the balance in Planet’s Income from Sun account on 12/31/X1? 4. What is Planet’s separate Net Income for 20X1? 5. What is the balance in Planet’s Investment in Sun account on 12/31/X1? 6. What is the book value of the net assets of Sun on 12/31/X1? 7. Prepare a Consolidated Income Statement for the year ending 12/31/X1. 8. Does Consolidated Net Income equal Planet’s Net Income + Sun’s Net Income? Why or why not? 9. Does Controlling Interest Net Income equal Planet’s Net Income? Why or why not? 10. Prepare a Statement of Consolidated Retained Earnings for the year ending 12/31/X1. 11. Prepare a Consolidated Balance Sheet as of 12/31/X1

Bad Debts

At the end of the accounting period, a financial statement is prepared by every company, then at that time while preparing the financial statement, the company determines among its total receivable amount how much portion of receivables is collected by the company during that accounting period.

Accounts Receivable

The word “account receivable” means the payment is yet to be made for the work that is already done. Generally, each and every business sells its goods and services either in cash or in credit. So, when the goods are sold on credit account receivable arise which means the company is going to get the payment from its customer to whom the goods are sold on credit. Usually, the credit period may be for a very short period of time and in some rare cases it takes a year.

Presented below are the adjusted

Sun Planet

Sales Revenue (23,220) (47,432) Income from Sun ----- ? Cost of Goods Sold 4,500 33,880 Wage Expense 2,160 5,500 Depreciation Expense 1,440 2,640 Cash 6,840 59,400

On 1/1/X1, Planet Corporation purchased 80% of the common stock of Sun, Inc. at book value (book value and fair value of Sun’s net assets are the same). During 20X1, Sun borrowed $2,640 from Planet and has not repaid it as of the end of 20X1. Note: this problem is not asking you to prepare any

Required: 1. What price did Planet pay on 1/1/X1 for 80% of Sun’s stock? 2. What is Sun’s separate Net Income for 20X1? 3. What is the balance in Planet’s Income from Sun account on 12/31/X1? 4. What is Planet’s separate Net Income for 20X1? 5. What is the balance in Planet’s Investment in Sun account on 12/31/X1? 6. What is the book value of the net assets of Sun on 12/31/X1? 7. Prepare a Consolidated Income Statement for the year ending 12/31/X1. 8. Does Consolidated Net Income equal Planet’s Net Income + Sun’s Net Income? Why or why not? 9. Does Controlling Interest Net Income equal Planet’s Net Income? Why or why not? 10. Prepare a Statement of Consolidated Retained Earnings for the year ending 12/31/X1. 11. Prepare a Consolidated Balance Sheet as of 12/31/X1.

Given: Book Value and Fair Value are same.

Trending now

This is a popular solution!

Step by step

Solved in 3 steps with 3 images