Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

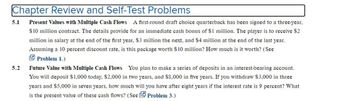

Transcribed Image Text:Chapter Review and Self-Test Problems

Present Values with Multiple Cash Flows A first-round draft choice quarterback has been signed to a three-year,

$10 million contract. The details provide for an immediate cash bonus of $1 million. The player is to receive $2

million in salary at the end of the first year, $3 million the next, and $4 million at the end of the last year.

Assuming a 10 percent discount rate, is this package worth $10 million? How much is it worth? (See

Problem 1.)

5.1

5.2

Future Value with Multiple Cash Flows You plan to make a series of deposits in an interest-bearing account.

You will deposit $1,000 today, $2,000 in two years, and $8,000 in five years. If you withdraw $3,000 in three

years and $5,000 in seven years, how much will you have after eight years if the interest rate is 9 percent? What

is the present value of these cash flows? (See Problem 3.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Weat Subject: acountingarrow_forwardEmerald Enterprises is developing a new product at the cost of $ 50,000. The new product is expected to increase the cash flow for the next five years as follows: $ 10000, $ 15000, $ 15000, $ 20000 and $ 20000. If the discounting rate is 12%, what is the discounted payback period? (Note: Roundup the fractional values; that is if the payback period is 6.23 years, enter 7 years as payback period) 4 years 5 years 3 years 2 yearsarrow_forwardSubject:arrow_forward

- A football is evaluating three contract options given to him. Each option offers a bonus and a series of payments over the life of the contract. The rate of return is 7.25% compounded anually to evaluate the options. Which contract should be chosen? Show your calculations. Year Cash flow Ever Football Club Heal Football Club Airy Football Club 0 bonus $3,500,000 $3,500,000 $3,500,000 1 Annual Salary $700,000 $850,000 $775,000 2 Annual Salary $750,000 $800,000 $775,000 3 Annual Salary $800,000 $750,000 $775,000 4 Annual Salary $850,000 $700,000 $775,000arrow_forwardRafael corporation expects receive RM20,000 per year for 10 years and RM35, 000 per year for the next 10 years. What is the present value of this cash flow given 12% discount rate?arrow_forwardJS er st un gs Sunland, Inc. management is considering purchasing a new machine at a cost of $4,370,000. They expect this equipment to produce cash flows of $791,390, $796,950, $866,730, $1,116,300, $1,212,360, and $1,300,900 over the next six years. If the appropriate discount rate is 15 percent, what is the NPV of this investment? (Enter negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) The NPV is tA $arrow_forward

- A borrower bought a house for $300,000; he can obtain an 80% loan with a 20-year fully amortizing, 7% interest rate and monthly payment. Alternatively, he could get a 30-year fully amortizing 90% loan at 9% What is the incremental cost of borrowing the additional fund?arrow_forwardA company manager is faced with an investment proposal of Rp. 100,000,000, - with a period of 4 years and cash inflows every year as follows: Year 1 Rp. 40,000,000 Year 2 Rp. 30,000,000 Year 3 Rp. 30,000,000 Year 4 Rp. 20,000,000 Requested: a. With an interest rate of 12%, with the NPV and PI method, assist the manager in making decisions. Whether the project is accepted or rejected. b. If it is known that the second interest rate is 20% and the cost of capital offered is 17%, calculate the IRR, and make a decision whether to accept or reject the project.arrow_forwardImagine that you won $100 million in the lottery and were offered the choice between two payment plans: Plan A: Receive $61 million in a lump sum today Plan B: Receive an initial payment of $1.5 million today and annual payments that increase by 5% annually over the next 29 years (30 payments total) a. Determine the net present value of each plan without discounting. Which plan is the better option? b. Assuming an interest rate of 4%, determine the future value of each plan at the end of the 29 years with discounting. Which plan is the better option?arrow_forward

- A sponsor puts $10m of equity into a project. Over a 20 year timespan, the project returns $28m in distributions to equity. An NPV calculation at a 10% p.a. discount rate shows an NPV of -$2m. What is the most likely IRR? O 0% O 8% O O 10% O 12% O 14%arrow_forwardA Masters of Accountancy degree at Central University costs $12,000 for an additional fifth year of education beyond the bachelor’s degree. Assume that all tuition is paid at the beginning of the year. A student considering this investment must evaluate the present value of cash flows from possessing a graduate degree versus holding only an undergraduate degree. Assume that the average student with an undergraduate degree is expected to earn an annual salary of $50,000 per year (assumed to be paid at the end of the year) for 10 years. Assume that the average student with a graduate Masters of Accountancy degree is expected to earn an annual salary of $66,000 per year (assumed to be paid at the end of the year) for 9 years after graduation. Assume a minimum rate of return of 10%. (1) Determine the net present value of cash flows from an undergraduate degree. Use the present value table provided below. (2) Determine the net present value of cash flows from a Masters of Accountancy…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education