Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

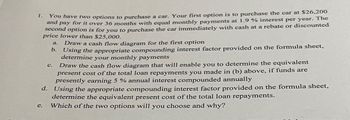

Transcribed Image Text:1.

You have two options to purchase a car. Your first option is to purchase the car at $26.200

and pay for it over 36 months with equal monthly payments at 1.9 % interest per year. The

second option is for you to purchase the car immediately with cash at a rebate or discounted

price lower than $25,000.

C.

a. Draw a cash flow diagram for the first option

b. Using the appropriate compounding interest factor provided on the formula sheet,

determine your monthly payments

Draw the cash flow diagram that will enable you to determine the equivalent

present cost of the total loan repayments you made in (b) above, if funds are

presently earning 5 % annual interest compounded annually

d. Using the appropriate compounding interest factor provided on the formula sheet,

determine the equivalent present cost of the total loan repayments.

e.

Which of the two options will you choose and why?

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Please advise on these time value of money practice problems. How would you solve these using a financial calculator? What values would you enter for N, I/YR, PV, PMT, and FV ? a) Calculate the PV when you plan to receive $5,000 in 5 years with a 10% discount rate. b) Calculate the FV of a $10,000 deposit today for 10 years @ 5%. c) What is the PV of receiving $2,500 for each of the next 5 years with a 10% discount rate?arrow_forwardAn investment will generate $12,000 a year for 30 years. If you can earn 12 percent on your funds and the investment costs $100,000, calculate the present value of investment. Use Appendix D to answer the question. Round your answer to the nearest dollar.$ Should you buy it?-Select-YesNoItem 2 Calculate the present value of investment, if you could earn only 9 percent. Use Appendix D to answer the question. Round your answer to the nearest dollar.$ Should you buy it in this case?arrow_forwardYou have an opportunity to make an investment that will pay $ 300 at the end of the first year, $ 100 at the end of the second year, $ 200 at the end of the third year, $ 400 at the end of the fourth year, and $500 at the end of the fifth year. a. Find the present value if the interest rate is 9 percent. (Hint: You can simply bring each cash flow back to the present and then add them up. Another way to work this problem is to either use the =NPV function in Excel or to use your CF key on a financial calculator —but you'll want to check your calculator's manual before you use this key. Keep in mind that with the =NPV function in Excel, there is no initial outlay. That is, all this function does is bring all the future cash flows back to the present. With a financial calculator, you should keep in mind that CF0 is the initial outlay or cash flow at time 0, and, because there is no cash flow at time 0, CF0 =0.) b. What would happen to the…arrow_forward

- Provide step by step manula solution, formula, and diagram. An investor have a projected surplus income of P1000 per year which he plans to place in a bank which offers an interest of 18% per annum for time deposit over 5 years. Compute how much shall the investor collect at the end of 13 yearsarrow_forwardGive me right solution according to the question options also given A person deposits $150 per month into a savings account for 2 years. if $75 is withdrawn in months 5,7 and 8 (in addition to the deposits), construct the cash flow diagram to determine how much will be in the account after 2 years at i=8% per year, compound quarterly. Assume there is no interperiod interest. A. $ 2,045 B. $3609 C. $3090 D. $4050arrow_forwardYou’re considering purchasing an apartment for $200,000. You believe that you can earn an initial rental income of $12,000 per year on it and that the rental income will grow at 3% per year. You also believe that you can sell the apartment for $225,000 after 5 years. The IRR calculation is shown below:arrow_forward

- If you could solve option 5 with the formulas please Option 5: Half the required money is taken out of an investment account that pays monthly interest at a 3% annual rate. The rest of the money is borrowed from a bank at a 4% annual interest rate, should payback within 3 years in equal monthly payments. Find the future value of the money taken from the investment account at the end of the shop development and periodic payments to the bank. Calculate Cumulative interest and principal payments.arrow_forwardAn investment promises to pay $7,000 at the end of each year for the next six years and $3,000 at the end of each year for years 7 through 10. Use Table II and Table IV or a financial calculator to answer the questions. Round your answers to the nearest cent. If you require a 15 percent rate of return on an investment of this sort, what is the maximum amount you would pay for this investment?$ Assuming that the payments are received at the beginning of each year, what is the maximum amount you would pay for this investment, given a 15 percent required rate of return?$arrow_forwardAssume that at the beginning of the year, you purchase an investment for $6,300 that pays $130 annual income. Also assume the investment's value has increased to $6,900 by the end of the year. a. What is the rate of return for this investment? Note: Input the amount as a positive value. Enter your answer as a percent rounded to 2 decimal places. Rate of return % b. Is the rate of return a positive or a negative number? Positive Negativearrow_forward

- Compute the monthly payment and the total amount spent for a vehicle that costs $24,000 if you finance the entire purchase over 5 years at an annual rate of 8 25 percent. Calculate the payment if you finance the car for only four years. Finally, calculate the payment for three years. What do you notice about the payment under the different time assumptions? Note: Round intermediate computations to at least five (5) decimal places Click on the table icon to view the MILPF table The monthly payment, PMT, on the 5-year auto loan is $ (Round to the nearest cent.) The total amount spent if you financed $24,000 for 5 years at 8 25 percent per year is $ (Round to the nearest cent.) The monthly payment, PMT, on the 4-year auto loan is $ (Round to the nearest cent.) Finally, the monthly payment, PMT, on the 3-year auto loan is $ (Round to the nearest cent.) What do you notice about the payment under the different time assumptions? (Select the best choice below.) OA. As the number of payments…arrow_forwardAssume you won the lottery and that you have two options for receiving the prize money. You can receive $300,000 today or receive payments of $2,700 a month for 20 years. If you can make a nominal 8% return, which option should you take and why? (Hint: To compare investments involving cash flows, you always compare the present value of the future cash flows to identify the most attractive option.) Multiple Choice The $2,700 per month. It is better to have payments spread out than receive a lump sum. The lump sum today. The present value of the lump sum is greater than the payments. The $2,700 per month. The present value of the payments is greater than the lump sum. The lump sum today. It has greater earnings potential. 27arrow_forwardQuantitative Problem: You need $14,000 to purchase a used car. Your wealthy uncle is willing to lend you the money as an amortized loan. He would like you to make annual payments for 4 years, with the first payment to be made one year from today. He requires a 9% annual return. a. What will be your annual loan payments? Do not round intermediate calculations. Round your answer to the nearest cent. b. How much of your first payment will be applied to interest and to principal repayment? Do not round intermediate calculations. Round your answers to the nearest cent. Interest: $ Principal repayment: $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education