Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

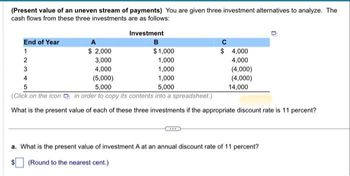

Transcribed Image Text:(Present value of an uneven stream of payments) You are given three investment alternatives to analyze. The

cash flows from these three investments are as follows:

End of Year

1

2

3

A

$ 2,000

3,000

4

5

Investment

B

$1,000

1,000

4,000

1,000

(5,000)

1,000

5,000

5,000

(Click on the icon in order to copy its contents into a spreadsheet.)

What is the present value of each of these three investments if the appropriate discount rate is 11 percent?

с

$

4,000

4,000

(4,000)

(4,000)

14,000

a. What is the present value of investment A at an annual discount rate of 11 percent?

(Round to the nearest cent.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Please solve step by step for clarity, thank you!arrow_forwardFind the present values of the following cash flow streams. The appropriate interest rate is 6%. (Hint: It is fairly easy to work this problem dealing with the individual cash flows. However, if you have a financial calculator, read the section of the manual that describes how to enter cash flows such as the ones in this problem. This will take a little time, but the investment will pay huge dividends throughout the course. Note that, when working with the calculator's cash flow register, you must enter CF0 = 0. Note also that it is quite easy to work the problem with Excel, using procedures described in the Ch04 Tool Kit.xlsx.) Do not round intermediate calculations. Round your answers to the nearest cent. Year Cash Stream A Cash Stream B 1 $100 $250 2 400 400 3 400 400 4 400 400 5 250 100 Stream A: $ Stream B: $ What is the value of each cash flow stream at a 0% interest rate? Round your answers to the nearest dollar. Stream A $ Stream B $arrow_forwardPlease help me with this problem. Thanksarrow_forward

- (Present value of annuities and complex cash flows) You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: @ End of Year 1 W 5 2 3 4 12 5 s damaged 30 6 X 7 8 3 a. What is the present value of investment A at an annual discount rate of 21 percent? $(Round to the nearest cent.) b. What is the present value of investment B at an annual discount rate of 21 percent? $(Round to the nearest cent.) c. What is the present value of investment C at an annual discount rate of 21 percent? (Round to the nearest cent.) 80 F3 E A $11,000 11,000 11,000 11,000 11,000 D C $ 4 DDD DOD F4 R Investment B F 1 $11,000 11,000 11,000 11,000 % 5 V is FS T G A 6 C $16,000 B 48,000 MacBook Air F6 Y & 7 H 44 F7 U N * CO 8 J DII FA 1 ( M 9 K MOSISO 19 O 1 0 V I 4 F10 11 P > command 4 ● FII + B = { [ I Next F12 .. ? optionarrow_forwardIf you invest $8,800, what is your rate of return if you will receive the following cash flows at the end of these years: Yr. 1 $2,000; Yr. 2 $2,100; Yr. 3 $2,200; Yr. 4 $2,300; Yr. 5 $3,700?arrow_forwardA firm has two possible investments with the following cash inflows. Each investment costs $435, and the cost of capital is seven percent. Use Appendix B and Appendix D to answer the questions. Assume that the investments are not mutually exclusive and there are no budget restrictions. Cash Inflows Year A B 1 $ 270 $ 170 2 140 170 3 100 170 Based on each investment’s net present value, which investment(s) should the firm make? Use a minus sign to enter negative values, if any. Round your answers to the nearest dollar. Investment A: $ Investment B: $ The firm should make . Based on each investment’s internal rate of return, which investment(s) should the firm make? Round your answers to the nearest whole number. Investment A: % Investment B: % The firm should make . Is this the same answer you obtained in part b? It the same answer as obtained in part b. If the cost of capital were to increase to 9 percent, which investment(s) should the firm…arrow_forward

- (Related to Checkpoint 6.6) (Present value of annuities and complex cash flows) You are given three investment alternatives to analyze. The cash flows from these three investments are as follows: Investment Alternatives End of Year 1 2 3 4 5 6 $ 780 A $ 19,000 19,000 19,000 19,000 19,000 B $19,000 19,000 19,000 19,000 19.000 C $19,000 95,000 a. What is the present value of investment A at an annual discount rate of 23 percent? $ 53265.99 (Round to the nearest cent.) b. What is the present value of investment B at an annual discount rate of 23 percent? (Round to the nearest cent.) ..arrow_forwardPlease do not give solution in image format thankuarrow_forwardDetermine the present value of the following single amounts. Note: Use tables, Excel, or a financial calculator. Round your final answers to nearest whole dollar amount. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) 1. 2 3. 4. Future Amount $ $ $ $ 32,000 26,000 37,000 52,000 i= 5% 6% 11% 10% n = 11 19 40 13 Present Valuearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education