FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

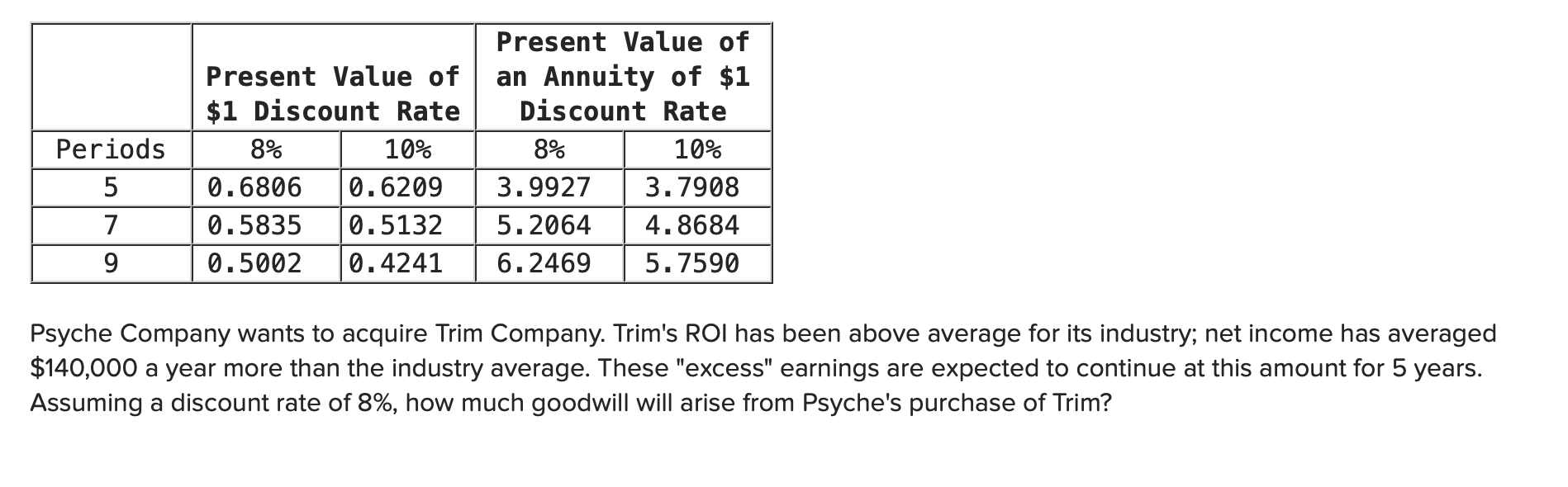

Transcribed Image Text:Present Value of

an Annuity of $1

Discount Rate

Present Value of

$1 Discount Rate

Periods

8%

10%

8%

10%

0.6806

0.6209

3.9927

3.7908

0.5835

0.5132

5.2064

4.8684

0.5002

0.4241

6.2469

5.7590

Psyche Company wants to acquire Trim Company. Trim's ROI has been above average for its industry; net income has averaged

$140,000 a year more than the industry average. These "excess" earnings are expected to continue at this amount for 5 years.

Assuming a discount rate of 8%, how much goodwill will arise from Psyche's purchase of Trim?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- 3. Answer the following questions based on the information below Current credit policy(n/a) Proposed credit policy (net 30) Price (RO) 15 17 Variable cost per unit (RO) 8. 12 Quantity 200,000 300,000 Monthly rate 1.25% a. What is the incremental cash flows from switching credit policies? b. What is the cost of switching? c. What is your recommendation? d. We assume that the variable cost and the price per unit remain stable as in the current policy, calculate and interpret the break-even sales increase. e. What is the break-even probability of default if we assume one time scale? Interpret.arrow_forwardNet Present Value Versus Internal Rate of Return for discount factors use Exhibit 128-1 and Exhibit 128-2. Skiba Company is thinking about two different modifications to its cument manufacturing process. The after-tax cash flows associated with the two investments follow Year D 1 2 Project I $(100,000) Project 1 Project II 134,560 Skiba's cost of capital is 10%. Required: 1. Compute the NPV and the IRR for each investment. Round present value calculations and your final NPV answers to the nearest dollar. Round IRR answers to the nearest whole percent. Project II $(100,000) 63,857 63,857 NPV IRRarrow_forwardFind the Net Present Value (NPV) for Oman Computer company if the initial investment is 15000 OMR and the cash Inflows are as follows: Year 1 =2509 OMR; Year 2 =5590 OMR; Year 3=7500 OMR and Year 4=9200 OMR. Use discount rate as 2.02%. Select one: O a. None of the options O b. 8936.11 OMR O c. 8574.51 OMR O d. 8234441 OMR O e. 8386.11 OMRarrow_forward

- Find the overall percentage change in the price of a good if it rises by 5% in a year but is then reduced by 30% in a sale. Select one: а. 25% b. 26.5% C. 35% d. 73.5% е. Cannot be determinedarrow_forwardr = discount rate C = net cash flow (the profit) at time t (The initial cost of ac- quiring a customer would be a negative net cash flow at time 0.) How much are you worth to a given company if you continue to purchase its brand for the rest of your life? Many marketers are grappling with that question, but it's not easy to determine how much a customer is worth to a company over his or her lifetime. Calculating customer lifetime value can be very com- plicated. Intuitively, however, it can be a fairly simple net pres- ent value calculation, which incorporates the concept of the time value of money. To determine a basic customer lifetime value, each stream of profit (C, the net cash flow after costs are subtracted) is discounted back to its present value (PV) and then summed. The basic equation for calculating net present value (NPV) is: NPV can be calculated easily on most financial calculators or by using one of the calculators available on the Internet, such as the one found at…arrow_forwardHow do I solve the expected return percent and know if i should buy or sell it?arrow_forward

- Find the Net Present Value (NPV) for Oman Computer company if the initial investment is 15000 OMR and the cash Inflows are as follows: Year 1 =2509 OMR; Year 2 =5590 OMR; Year 3=7500 OMR and Year 4=9200 OMR. Use discount rate as 2.02%. Select one: O a. None of the options O b. 8936.11 OMR O c. 8574.51 OMR O d. 82344.41 OMR O e. 8386.11 OMRarrow_forward6 Suppose Blooper's financials are as follows: See SPREADSHEET 9.1 Inputs Initial Investment Salvage value Initial revenue Initial expenses Inflation rate Discount rate ok Acct receivable as % of sales Investment as % of expenses Tax rate 150 Spreadsheet Name Investment 20 Salvage 150 Initial revenue 100 Initial expenses 5.0% 1.1% 1/4 15.0% 21.0% Inflation Discount rate AR Inv_pct Tax rate Calculate Blooper's working capital in each year of its project. Year Working Capital 0 1 23 4 5 6 COarrow_forwardA company is planning to expand its business is costing OMR 24509. The following cash inflows are expected. Calculate Profitability index given the rate of discounting to be 3.008% Years Machine A 10107 13300 12500 14500 Select one: Oa a. none of the options Ob. 22153.099 Oc. 1.904 Od. 1.916 Oe. 0.525 Previous page Next pagearrow_forward

- Based on the above information, calculate the sustainable growth rate for Kayla's Heavy Equipment.arrow_forwardA company is planning to expand its business is costing OMR 24271. The following cash inflows are expected. Calculate Profitability index given the rate of discounting to be 3.008% Years Machine A 1 11055 2 13300 3 12500 4 14500 Select one: a. none of the options b. 0.510 c. 23311.416 d. 1.960 e. 1.974arrow_forwardhello, I need help pleasearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education