Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

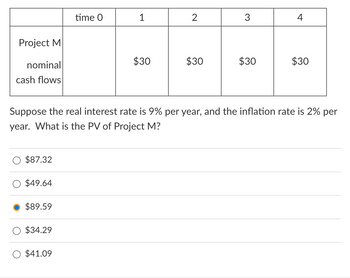

Transcribed Image Text:Project M

nominal

cash flows

$87.32

$49.64

$89.59

$34.29

time 0

$41.09

1

$30

2

$30

Suppose the real interest rate is 9% per year, and the inflation rate is 2% per

year. What is the PV of Project M?

3

$30

4

$30

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- QUESTION 6 Seaborn Co. has identified an investment project with the following cash flows. Year Cash Flow $950 1,050 1,320 1,200 1 2 3 4 If the discount rate is 10 percent, what is the present value of these cash flows? 3542.76 3578.84 3418.66 4470.00 3847.03 Click Save and Submit to save and submit. Click Save All Answers to save all answers. SEP 28 30 tv ♫ Aarrow_forwardCash Flow -$50,000 $ 7,000 $ 4,000 $9,000 $61,000 Year 1 2 3 4 What is the internal rate of return (IRR) for this investment? 17. Using the information above, wha investment using a 10% discount rate? the NPV of thisarrow_forwardConsider the following information relating to the expected cash flows from two independent projects. The cash flows are expressed in real terms, the nominal discount rate is 10% p.a. and the expected inflation rate is 4% p.a. Time 0 1 2 3 4 5 6 Project 1 -$200,000 $50,000 $50,000 $50,000 $50,000 $50,000 Project 2 -$250,000 $65,000 $65,000 $65,000 $65,000 $65,000 $65,000 a) Calculate the NPV of each of the projects b) In no more than 6 lines, explain which of the above projects you should select and why?arrow_forward

- Nonearrow_forwarded ok O t 1 ht 0 ences For the given cash flows, suppose the firm uses the NPV decision rule. Cash Flow Year 0 123 a. NPV b. NPV -$ 150,000 a. At a required return of 10 percent, what is the NPV of the project? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. At a required re urn of 20 percent, what is the NPV of the project? (A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) 66,000 73,000 57,000arrow_forward► CRC Inc. is buying new equipment that has the following cash flows: Year Cash Flow O-$17.7 What is the NPV if the interest rate is $6%? O $482.24 D -$537.78 0 -$500 O $22.44 1 $100 2 $200 3 $250arrow_forward

- is 22 percent? Future Value and Multiple Cash Flows Wells, Inc., has identified an investment project with the following cash flows. If the discount rate is 8 LO 1 3. percent, what is the future value of these cash flows in Year 4? What is the future value at an interest rate of 11 percent? At 24 percent? Year Cash Flow $ 865 1,040 1,290 1,385 1 2 3 4arrow_forward4.Find the present worth in year 0 (PT) for the cash flow diagram using an interest rate of 10% per year PT=? PA=? i=10% Actual year 8 4 2 67 series year 1 3 14 A=$4000 $2000arrow_forwardYear 0123 Cash Flow -$ 27,000 11,000 14,000 10,000 The appropriate discount rate is 16 percent. What is the IRR for this project? (Do not round intermediate calculations and enter your answer as a percent rounded to 2 decimal places, e.g., 32.16.) IRR % Should the firm accept the project? O Reject O Acceptarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education