Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

do not give solution in image

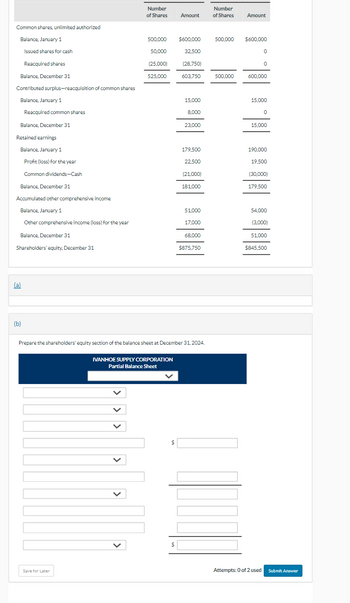

Transcribed Image Text:Common shares, unlimited authorized

Balance, January 1

Reacquired shares

Balance, December 31

Contributed surplus-reacquisition of common shares

Balance, January 1

Reacquired common shares

Balance, December 31

Retained earnings

Balance, January 1

Profit (loss) for the year

Common dividends-Cash

Balance, December 31

Accumulated other comprehensive income

Balance, January 1

Other comprehensive income (loss) for the year

Balance, December 31

Shareholders' equity, December 31

(a)

Issued shares for cash

(b)

Save for Later

Number

of Shares

>

500,000

>

50,000

(25,000)

525.000

IVANHOE SUPPLY CORPORATION

Partial Balance Sheet

$

Amount

$

$600,000

32,500

(28,750)

603,750

15,000

8,000

23,000

Prepare the shareholders' equity section of the balance sheet at December 31, 2024.

179,500

22,500

(21,000)

181,000

51,000

17,000

68,000

$875,750

Number

of Shares

Amount

500,000 $600,000

500,000

0

0

600,000

15,000

0

15,000

190,000

19,500

(30,000)

179,500

54,000

(3,000)

Attempts: 0 of 2 used

51.000

$845,500

Submit Answer

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Similar questions

- Valaarrow_forwardplease help me to solve this questionarrow_forwardVertical Analysis of Balance Sheet Balance sheet data for a company for the years ended December 31, 20Y2 and 20Y1, are shown below. 20Y2 20Υ1 Current assets $ 752,000 $ 602,000 Property, plant, and equipment 6,248,000 5,397,000 Intangible assets 1,000,000 1,001,000 Current liabilities 504,000 427,000 Long-term liabilities 1,504,000 1,197,000 Common stock 1,248,000 1,253,000 Retained earnings 4,744,000 4,123,000 | Prepare a comparative balance sheet for 20Y2 and 20Y1, stating each asset as a percent of total assets and each liability and stockholders' equity item as a percent of the total liabilities and stockholders' equity. Round your answers to one decimal place. Comparative Balance Sheet December 31, 20Y2 and 20Y1 20Y2 Amount 20Y2 Percent 20Y1 Amount 20Y1 Percent Assets Current assets $752,000 % $602,000 % Property, plant, and equipment 6,248,000 5,397,000 Intangible assets 1,000,000 1,001,000arrow_forward

- The following are 10 technical accounting terms introduced or emphasized in Chapters 11 and 12:P/e ratio Treasury stock Discontinued operationsStock dividend Extraordinary item Prior period adjustmentBasic earnings per share Additional paid-in capital Diluted earnings per shareComprehensive incomeEach of the following statements may (or may not) describe one of these technical terms. Foreach statement, indicate the term described, or answer “None” if the statement does not correctlydescribe any of the terms.a. A gain or loss that is unusual in nature and not expected to recur in the foreseeable future.b. The asset represented by shares of capital stock that have not yet been issued.c. A distribution of additional shares of stock that reduces retained earnings but causes no changein total stockholders’ equity.d. The amount received when stock is sold in excess of par value.e. An adjustment to the beginning balance of retained earnings to correct an error previouslymade in the…arrow_forwardHahaharrow_forwardCategory Accounts payable Accounts receivable Accruals Additional paid in capital Cash Common Stock COGS Current portion long-term debt Depreciation expense Interest expense Inventories Long-term debt Net fixed assets Notes payable Operating expenses (excl. depr.) Retained earnings Sales Taxes Prior Year Current Year ??? ??? 320,715 397,400 40,500 33,750 500,000 541,650 17,500 47,500 94,000 105,000 328,500 431,876.00 33,750 35,000 54,000 54,402.00 40,500 42,823.00 279,000 288,000 339,660.00 398,369.00 946,535 999,000 148,500 162,000 126,000 162,881.00 306,000 342,000 639,000 847,928.00 24,750 47,224.00 What is the current year's return on assets (ROA)? Submit Answer format: Percentage Round to: 2 decimal places (Example: 9.24%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))arrow_forward

- which of the below ratios can I use the attached file to calculate? return on total assets return on common stockholder's equity dividend payout ratio price-earnings ratioarrow_forwardCommon-size financial statements recast each statement item as: Multiple Choice a percentage using industry averages for the "base number." a percentage using a base year number for each line item. a percentage of some "base number" on the financial statement in question. a percentage of the "bottom line."arrow_forward1. It represents the cumulative balance of periodic earnings, dividend distributions, prior period adjustments and other capital adjustments. a. Income summaryb. net incomec.dividends d. accumulated profits 2. The date on which liability for dividends must be recorded a. Date of recordb.Date of issuance c.Date of payment d. Declaration date 3. The amount attributable to every share of ordinary share capital outstanding during the period. a. Par value b. Stated value c. Carrying value d. Bookvalue 4. The date which determines who gets the dividend a. Date of payment b. Date of declaration c. Date of record d. Date of issuance 5. How is the treasury share account presented in the Statement of Financial Position? a. deducted from accumulated profitsb. deducted from shareholders’ equityc. part of reservesd. current assetarrow_forward

- RATIO ANALY SIS OF COMPARATI VE FIN ANCIAL STATE MENT S Refer to the financial statements in Problem 24-8A. REQUIRED Calculate the following ratios and amounts for 20-1 and 20-2 (round all calculations to two decimal places): (a) Return on assets (Total assets on January 1, 20-1, were 175,750.) (b) Return on common stockholders equity (Total common stockholders equity on January 1, 20-1, was 106,944.) (c) Earnings per share of common stock (The average numbers of shares outstanding were 8,400 shares in 20-1 and 9,200 in 20-2.) (d) Book value per share of common stock (e) Quick ratio (f) Current ratio (g) Working capital (h) Receivables turnover and average collection period (Net receivables on January 1, 20-1, were 39,800.) (i) Merchandise inventory turnover and average number of days to sell inventory (Merchandise inventory on January 1, 20-1, was 48,970.) (j) Debt-to-equity ratio (k) Asset turnover (Assets on January 1, 20-1, were 175,750.) (l) Times interest earned ratio (m) Profit margin ratio (n) Assets-to-equity ratio (o) Price-earnings ratio (The market price of the common stock was 100.00 and 85.00 on December 31, 20-2 and 20-1, respectively.)arrow_forward16 At year end, other comprehensive income is closed out to Select one: a.share capital. b.retained earnings. c.net income. d.accumulated other comprehensive income.arrow_forwardRequired information. [The following information applies to the questions displayed below.] Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Current Year. $ 25,603 74,949 91,435 8,163 233,807 $ 433,957 1 Year Ago $ 108,055 79,952 162,500 83,450 $ 433,957 $ 30,826 52,374 69,901 7,699 213,301 $374,101 Liabilities and Equity Accounts payable $63,223 Long-term notes payable. Common stock, $10 par value 88,625 163,500 Retained earnings 58,753 Total liabilities and equity $ 374,101 For both the current year and one year ago, compute the following ratios: 2 Years Ago $32,110 42,398 44,716 3,533 192,143 $314,900 $ 41,567 68,201 163,500 41,632 $314,900 1. Express the balance sheets in common-size percents. 2. Assuming annual sales have not changed in the last three years, Is the change in accounts receivable as a percentage of total assets favorable or unfavorable? 3.…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning