FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

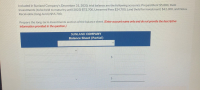

Transcribed Image Text:Prepare the long-term investments section of the balance sheet. (Enter account name only and do not provide the descriptive

information provided in the question.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Specify the section of a classified balance sheet in which each of the following accounts would be found.Please tell me foll;owing the instructions above what part of the Balance Sheet and Section would these be found in1) Investment in XYZ2)Fund to Retire Bondsarrow_forwardFor each account listed, identify the category in which it would appear on a classified balance sheet. Use the following categories: Current Assets; Long-term Investments; Property, Plant, and Equipment; Intangible Assets; Current Liabilities; Long-term Liabilities; and Owner's Equity. If the item does not belong on the classified balance sheet, put an X. Account a. Land (used n operations) b. Accumulated Depreciation-Equipment c. Reed, Capital d. Service Revenue e. Investment in Starbucks Corporation (to be held long-term) Accounts Receivable g. Equipment h. Buildings i. Notes Payable (due in 10 years) j. Unearned Revenue Cash 1. Accounts Payable m. Prepaid Rent n. Reed, Withdrawals o. Land (held for investment purposes) p. Depreciation Expense Category Current Assets Long-term Investments Property, Plant, and Equipment Intangible Assets Current Liabilities Long-term Liabilities Owner's Equity X Warrow_forwardDo the following: (1) Assign a formula to (1) Tot. current assets, (2) Net fixed assets, (3) Total assets (2) Do the same to other cells if they are calculated. This can vary depending on YOUR financial statements FIN CF and Toves Last Namo vlex (sheet name:arrow_forward

- review the picture below and correct any lines that involve formulas and add any lines that arent highlighted that need formulas by adding forumlas where they are neededarrow_forwardWhich of the following is essentially unsecured? A• Certificate deposits B• Treasury bills C• Commercial papers D• Repurchase agreementarrow_forwardLO1 - Describe the specific elements of the balance sheet (assets, liabilities, and owners’ equity), and prepare a balance sheet with assets and liabilities properly classified into current and noncurrent categories. A balance sheet contains the following classifications: (a) Current assets (b) Investments (c) Property, plant, and equipment (d) Intangible assets (e) Other noncurrent assets (f) Current liabilities (g) Long-term debt (h) Other noncurrent liabilities (i) Capital stock (j) Additional paid-in capital (k) Retained earnings Indicate by letter how each of the following accounts would be classified. Place a minus sign (-) for all accounts representing offset or contra balances. Discount on Bonds Payable Stock of Subsidiary Corporation 3.12% Bonds Payable (due in six months) U.S. Treasury Bills Income Taxes Payable Sales Taxes Payable Estimated Claims under Warranties for Service and Replacements Par Value of Stock Issued and Outstanding Unearned Rent Revenue (six months…arrow_forward

- From the dropdown box beside each numbered balance sheet item, select the option of its balance sheet classification. If the item should not appear on the balance sheet, choose the option "No item required" from the selection choices.arrow_forwardw.com/takeAssignment/takeAssignmentMain.do?invoker= &takeAssign On the balance sheet, liabilities are generally classified as O legal or nonlegal. O probable or estimated. current or long-term. material or immaterial.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education