FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Question 2 of 4

>

-/3

(To record credit sale)

2

(To record cost of goods sold)

(To record return of goods)

6.

(To record cost of goods returned)

11

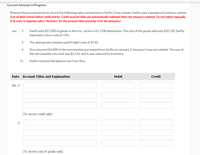

Transcribed Image Text:Current Attempt in Progress

Prepare the journal entries to record the following sales transactions in Swifty Corp's books. Świfty uses a perpetual inventory system.

(List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually.

If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Jan.

2

Świfty sold $37,000 of goods to Xtra Inc., terms n/45, FOB destination. The cost of the goods sold was $20,720. Swifty

expected a return rate of 15%.

The appropriate company paid freight costs of $740.

Xtra returned $4,900 of the merchandise purchased from Świfty on January 2, because it was not needed. The cost of

the merchandise returned was $2,744, and it was restored to inventory.

11

Świfty received the balance due from Xtra.

Date Account Titles and Explanation

Debit

Credit

Jan. 2

(To record credit sale)

2

(To record cost of goods sold)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Haynes Jewelers uses a perpetual inventory system and had the following purchase transactions. Journalize all necessary transactions. Explanations are not required. View the transactions. Journalize all necessary transactions in the order they are presented in the transaction list. (Record debits first, then credits. Exclude explanations from journal entries. Round all numbers to the nearest whole dollar.) Jun. 20: Purchased inventory of $5,900 on account from Luca Diamonds, a jewelry importer. Terms were 1/15, n/45, FOB shipping point. Date Jun. 20 Accounts Debit Credit Transactions Purchased inventory of $5,900 on account from Luca Diamonds, a jewelry importer. Terms were 1/15, n/45, FOB shipping point. Paid freight charges, $200. Returned $700 of inventory to Luca Diamonds. Jun. 20 Jun. 20 Jul. 4 Jul. 14 Jul. 16 Jul. 18 Jul. 24 Paid Jia Diamonds, less allowance and discount. Paid Luca Diamonds, less return. Purchased inventory of $4,100 on account from Jia Diamonds, a jewelry…arrow_forwardRamos Hair Styling is a wholesaler of hair supplies. Ramos Hair Styling uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $30,957). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $280). c. Sold merchandise (costing $6,460) to a customer on account with terms n/60. d. Collected half of the balance owed by the customer in (c). e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. f. Anticipate further returns of merchandise (costing $200) after year-end from sales made during the year. $ 55,040 310 13,600 6,800 172 320 PA6-3 (Algo) Part 1 Required: 1. Compute Net Sales and Gross Profit for Ramos Hair Styling. Net Sales Gross Profit Sarrow_forwardLevine Company uses the perpetual inventory system. April 8 Sold merchandise for $8,700 (that had cost $6,429) and accepted the customer's Suntrust Bank Card. Suntrust charges a 4% fee. April 12 Sold merchandise for $8,000 (that had cost $5,184) and accepted the customer's Continental Card. Continental charges a 2.5% fee. Prepare journal entries to record the above credit card transactions of Levine Company. (Round your answers to the nearest whole dollar amount.)arrow_forward

- Whispering Company 'sells one product. Presented below is information for January for Whispering Company. Jan. 1 4 11 13 20 27 Inventory 111 90 159 130 149 85 Sale Purchase Sale Purchase Sale Whispering uses the FIFO cost flow assumption. All purchases and sales are on account. Assume Whispering uses a perpetual system. Prepare all necessary journal entries. (If no entry is required, select "No entry" for the account titles and enter O for the amounts, Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) units at $5 each units at $8 each units at $6 each units at $9 each units at $7 each units at $11 each Date Account Titles and Explanation (To record the sale) (To record the cost of inventory) (To record the sale) Debit Creditarrow_forwardTravis Company purchased merchandise on account from a supplier for $14,000, terms 2/10, net 30. Travis Company paid for the merchandise within the discount period. Under a perpetual inventory system, journalize these transactions. If an amount box does not require an entry, leave it blank. a. b.arrow_forwardPrepare the necessary journal entries on the books of Kelly Carpet Company to record the following transactions, assuming a perpetual inventory system: Kelly purchased $45,000 of merchandise on account, terms 2/10,n/30. Returned $3,000 of damaged merchandise for credit. Paid for the merchandise purchased within 10 days. (a) (b) (c) (Credit account titles are automatically indented when the amount is entered. Do not indent manually.) Account Titles and Explanation No. (a) (b) (c) Inventory Accounts Payable Accounts Payable Inventory Accounts Payable Cash Purchase Discounts Debit 45,000 3,000 42,000 Credit 45,000 3,000 41,160 840arrow_forward

- Nonearrow_forwardRamos Hair Styling is a wholesaler of hair supplies. Ramos Hair Styling uses a perpetual inventory system. The following transactions (summarized) have been selected for analysis: a. Sold merchandise for cash (cost of merchandise $30,957). b. Received merchandise returned by customers as unsatisfactory (but in perfect condition) for cash refund (original cost of merchandise $280). c. Sold merchandise (costing $6,460) to a customer on account with terms n/60. d. Collected half of the balance owed by the customer in (c). e. Granted a partial allowance relating to credit sales the customer in (c) had not yet paid. f. Anticipate further returns of merchandise (costing $200) after year-end from sales made during the year. $ 55,040 310 13,600 6,800 172 320 PA6-3 (Algo) Part 2 2. Compute the gross profit percentage. (Round your answer to 1 decimal place.) Gross Profit Percentage %arrow_forwardTravis Company purchased merchandise on account from a supplier for $12,300, terms 2/10, net 30. Travis Company paid for the merchandise within the discount period. Under a perpetual inventory system, record the journal entries required for the above transactions. If an amount box does not require an entry, leave it blank. a. b.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education