FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

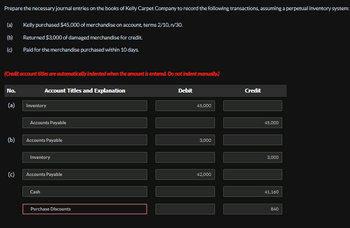

Transcribed Image Text:Prepare the necessary journal entries on the books of Kelly Carpet Company to record the following transactions, assuming a perpetual inventory system:

Kelly purchased $45,000 of merchandise on account, terms 2/10,n/30.

Returned $3,000 of damaged merchandise for credit.

Paid for the merchandise purchased within 10 days.

(a)

(b)

(c)

(Credit account titles are automatically indented when the amount is entered. Do not indent manually.)

Account Titles and Explanation

No.

(a)

(b)

(c)

Inventory

Accounts Payable

Accounts Payable

Inventory

Accounts Payable

Cash

Purchase Discounts

Debit

45,000

3,000

42,000

Credit

45,000

3,000

41,160

840

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you prepare an unadjusted trial balance based on this info and journal entries: Palisade Creek Co. is a merchandising business that uses the perpetual inventory system. The account balances for Palisade Creek Co. as of May 1, 2019 (unless otherwise indicated), are as follows: 110 Cash $83,600 112 Accounts Receivable 233,900 115 Merchandise Inventory 624,400 116 Estimated Returns Inventory 28,000 117 Prepaid Insurance 16,800 118 Store Supplies 11,400 123 Store Equipment 569,500 124 Accumulated Depreciation—Store Equipment 56,700 210 Accounts Payable 96,600 211 Customer Refunds Payable 50,000 212 Salaries Payable — 310 Lynn Tolley, Capital, June 1, 2018 685,300 311 Lynn Tolley, Drawing 135,000 410 Sales 5,069,000 510 Cost of Merchandise Sold 2,823,000 520 Sales Salaries Expense 664,800 521 Advertising Expense 281,000 522 Depreciation Expense — 523 Store Supplies Expense — 529 Miscellaneous Selling Expense 12,600 530 Office Salaries Expense…arrow_forwardStar Company uses a purchases journal to record all purchases on account, including merchandise purchases. The company purchases merchandise and office supplies on a frequent basis. On November 12, Star Company purchased merchandise on account from Moon Company for $6,500, terms 2/10, n/30. How would this transaction be recorded in the purchases journal of Star Company?arrow_forward9arrow_forward

- A company uses a perpetual system to record inventory transactions. The company purchases inventory on account on February 9, 2021, for $50,000 and then sells this inventory on account on March 7, 2021, for $70,000. Record the transactions for the purchase and sale of the inventory. (If no entry is required for a particular transaction/event select "No Journal Entry Required" in the first account field.)arrow_forwardAt year-end, the perpetual inventory records of Marigold Company showed merchandise inventory of $100,600. The company determined, however, that its actual inventory on hand was $96,900.Record the necessary adjusting entry. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation Debit Credit eTextbook and Mediaarrow_forwardPurchase-Related Transactions The Stationery Company purchased merchandise on account from a supplier for $17,400, terms 1/10, n/30. The Stationery Company returned merchandise with an invoice amount of $2,300 and received full credit. a. If The Stationery Company pays the invoice within the discount period, what is the amount of cash required for the payment? b. Under a perpetual inventory system, what account is credited by The Stationery Company to record the return?arrow_forward

- Nonearrow_forwardJournalize the following transactions using the allowance method of accounting for uncollectible receivables. Apr. 1 Sold merchandise on account to Jim Dobbs, $7,770. The cost of the merchandise is $3,885. If an amount box does not require an entry, leave it blank. Apr. 1 fill in the blank 95f337068076f92_2 fill in the blank 95f337068076f92_3 fill in the blank 95f337068076f92_5 fill in the blank 95f337068076f92_6 Apr. 1 fill in the blank 95f337068076f92_8 fill in the blank 95f337068076f92_9 fill in the blank 95f337068076f92_11 fill in the blank 95f337068076f92_12 June 10 Received payment for one-third of the receivable from Jim Dobbs and wrote off the remainder. If an amount box does not require an entry, leave it blank. June 10 fill in the blank becc7c06d02c06d_2 fill in the blank becc7c06d02c06d_3 fill in the blank becc7c06d02c06d_5 fill in the blank becc7c06d02c06d_6 fill in the blank becc7c06d02c06d_8 fill in the blank…arrow_forwardOn January 10, 2022, Cullumber Co. sold merchandise on account to Robertsen Co. for $16,600, n/30, On February 9, Robertsen Co. gave Cullumber Co.a 11% promissory note in settlement of this account. Prepare the journal entry to record the sale and the settlement of the account receivable. (Omit cost of goods sold entries.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Account Titles and Explanation) Date Jan 10 4 Feb. 9 # Debit Credit 1000arrow_forward

- On December 22, Travis Company purchased merchandise on account from a supplier for $7,500, terms 2/10, net 30. Travis Company paid for the merchandise within the discount period on December 31. Required: Under a perpetual inventory system, record the journal entries required for the above transactions. Refer to the Chart of Accounts for exact wording of account titles. Chart of Accounts CHART OF ACCOUNTS Travis Company General Ledger ASSETS 110 Cash 120 Accounts Receivable 125 Notes Receivable 130 Merchandise Inventory 131 Estimated Returns Inventory 140 Supplies 142 Prepaid Insurance 180 Land 190 Equipment 191 Accumulated Depreciation LIABILITIES 210 Accounts Payable 216 Salaries Payable 221 Sales Tax Payable 222 Customers Refunds Payable 231 Unearned Rent 241 Notes Payable EQUITY 310 Common Stock 311 Retained Earnings 312 Dividends 313 Income Summary REVENUE…arrow_forwardLamplight Plus sells lamps to consumers. The company contracts with a supplier who provides them with lamp fixtures. There is an agreement that Lamplight Plus is not required to provide cash payment immediately and instead will provide payment within thirty days of the invoice date. You are to provide the journal entries for the following transactions assuming a perpetual inventory system. Cash Accounts Payable Purchases Accounts Receivable Merchandise Inventory Sales PLEASE NOTE: You must enter the account names exactly as written above and all whole dollar amounts will be with "$" and commas as needed (i.e. $12,345). Lamplight purchases thirty light fixtures for $20 each on August 1, invoice date August 1, with no discount terms DR CR Lamplight returns ten light fixtures, receiving a credit amount for the full purchase price on August 3: DR CR Lamplight purchases an additional fifteen light fixtures for $15 each on August 19, invoice…arrow_forwardDengararrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education