FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

On January 1, 2022, the ledger of Sandhill Co. contained these liability accounts.

| Accounts Payable | $44,600 | |

| Sales Taxes Payable | 8,700 | |

| Unearned Service Revenue | 21,100 |

During January, the following selected transactions occurred.

| Jan. 1 | Borrowed $18,000 in cash from Apex Bank on a 4-month, 5%, $18,000 note. | |

| 5 | Sold merchandise for cash totaling $6,360, which includes 6% sales taxes. | |

| 12 | Performed services for customers who had made advance payments of $13,600. (Credit Service Revenue.) | |

| 14 | Paid state treasurer’s department for sales taxes collected in December 2021, $8,700. | |

| 20 | Sold 710 units of a new product on credit at $54 per unit, plus 5% sales tax. |

During January, the company’s employees earned wages of $60,000. Withholdings related to these wages were $4,590 for Social Security (FICA), $5,200 for federal income tax, and $1,560 for state income tax. The company owed no money related to these earnings for federal or state

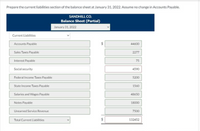

Transcribed Image Text:Prepare the current liabilities section of the balance sheet at January 31, 2022. Assume no change in Accounts Payable.

SANDHILL CO.

Balance Sheet (Partial)

January 31, 2022

Current Liabilities

Accounts Payable

44600

Sales Taxes Payable

2277

Interest Payable

75

Social security

4590

Federal Income Taxes Payable

5200

State Income Taxes Payable

1560

Salaries and Wages Payable

48650

Notes Payable

18000

Unearned Service Revenue

7500

Total Current Liabilities

132452

%24

%24

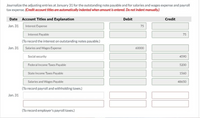

Transcribed Image Text:Journalize the adjusting entries at January 31 for the outstanding note payable and for salaries and wages expense and payrll

tax expense. (Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Date Account Titles and Explanation

Debit

Credit

Jan. 31

Interest Expense

75

Interest Payable

75

(To record the interest on outstanding notes payable.)

Jan. 31

Salaries and Wages Expense

60000

Social security

4590

Federal Income Taxes Payable

5200

State Income Taxes Payable

1560

Salaries and Wages Payable

48650

(To record payroll and withholding taxes.)

Jan. 31

(To record employer's payroll taxes.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. 1 Purchased merchandise on account from Kirkwood Co., $225,000, terms n/30. 31 Issued a 30-day, 8% note for $225,000 to Kirkwood Co., on account. Apr. 30 Paid Kirkwood Co. the amount owed on the note of March 31. Jun. 1 Borrowed $600,000 from Triple Creek Bank, issuing a 45-day, 6% note. Jul. 1 Purchased tools by issuing a $50,000, 60-day note to Poulin Co., which discounted the note at the rate of 6%. 16 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 7% note for $600,000. (Journalize both the debit and credit to the notes payable account.) Aug. 15 Paid Triple Creek Bank the amount due on the note of July 16. 30 Paid Poulin Co. the amount due on the note of July 1. Dec. 1 Purchased equipment from Greenwood Co. for $280,000, paying $80,000 cash and issuing a series of ten 9% notes for…arrow_forward1. Prepare general journal entries for the following transactions for the current year: April 25 Sold $3,500 of merchandise to Phillip Corporation receiving a 9%, 60-day, $3,500 note receivable (the merchandise cost $2,000) June 24 The note of Phillip Corporation was dishonored. Date Description Post Ref Debit Creditarrow_forwardOn Dec. 31, 2021, Boss Company had a credit balance of $50,000 in its records pertaining to allowance for uncollectible accounts. Analysis of its accounts receivable on the same date revealed the following: Age Amount % collectible 0-30 days $5,000,000 95 31-60 days 600,000 85 61-90 days 450,000 70 Over 90 days 100,000 50 Total $6,150,000 The company has written off $20, 000 of accounts receivable during 2021. How much is the allowance for uncollectible accounts to be reported on Dec. 31, 2021?arrow_forward

- Journal Entries for Accounts and Notes ReceivablePittsburgh, Inc., began business on January 1. Certain transactions for the year follow: Jun.8 Received a $33,000, 60 day, eight percent note on account from J. Albert. Aug.7 Received payment from J. Albert on her note (principal plus interest). Sep.1 Received an $39,000, 120 day, nine percent note from R.T. Matthews Company on account. Dec.16 Received a $31,800, 45 day, ten percent note from D. Leroy on account. Dec.30 R.T. Matthews Company failed to pay its note. Dec.31 Wrote off R.T. Matthews account as uncollectible. Pittsburgh, Inc. uses the allowance method of providing for credit losses. Dec.31 Recorded expected credit losses for the year by an adjusting entry. Accounts written off during this first year have created a debit balance in the Allowance for Doubtful Accounts of $48,200. An analysis of aged receivables indicates that the desired balance of the allowance account should be $43,000.…arrow_forwardThe following items were selected from among the transactions completed by Sherwood Co. during the current year: Mar. 1 Purchased merchandise on account from Kirkwood Co., $175,000, terms n/30. 31 Issued a 30-day, 6% note for $175,000 to Kirkwood Co., on account. Apr. 30 Paid Kirkwood Co. the amount owed on the note of March 31. Jun. 1 Borrowed $400,000 from Triple Creek Bank, issuing a 45-day, 5% note. Jul. 1 Purchased tools by issuing a $45,000, 60-day note to Poulin Co., which discounted the note at the rate of 7%. 16 Paid Triple Creek Bank the interest due on the note of June 1 and renewed the loan by issuing a new 30-day, 6% note for $400,000. (Journalize both the debit and credit to the notes payable account.) Aug. 15 Paid Triple Creek Bank the amount due on the note of July 16. 30 Paid Poulin Co. the amount due on the note of July 1. Dec. 1 Purchased equipment from Greenwood Co. for $260,000, paying $40,000 cash and issuing a series of ten 9% notes for…arrow_forward. Determine the due date of the note. September 21 b. Determine the maturity value of the note. Assume 360 days in a year. Linstrum Company received a 60-day, 9% note for $56,000, dated July 23, from a customer on account. CHART OF ACCOUNTS Linstrum Company General Ledger ASSETS 110 Cash 111 Petty Cash 120 Accounts Receivable 129 Allowance for Doubtful Accounts 132 Notes Receivable 141 Merchandise Inventory 145 Office Supplies 146 Store Supplies 151 Prepaid Insurance 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 194 Accumulated Depreciation-Office Equipment LIABILITIES 210 Accounts Payable 211 Salaries Payable 213 Sales Tax Payable 214 Interest Payable 215 Notes Payable EQUITY 310 Owner, Capital 311 Owner, Drawing 312 Income Summary REVENUE 410 Sales 610 Interest Revenue EXPENSES 510 Cost of Merchandise Sold…arrow_forward

- During the year ended December 31, 2021, Kelly's Camera Shop had sales revenue of $120,000, of which $60,000 was on credit. At the start of 2021, Accounts Receivable showed a $12,000 debit balance and the Allowance for Doubtful Accounts showed a $500 credit balance. Collections of accounts receivable during 2021 amounted to $58,000. Data during 2021 follow: a. On December 10, a customer balance of $1,000 from a prior year was determined to be uncollectible, so it was written off. b. On December 31, a decision was made to continue the accounting policy of basing estimated bad debt losses on 2 percent of credit sales for the year. Required: 1. Give the required journal entries for the two events in December. 2-a. Show how the amounts related to Bad Debt Expense would be reported on the income statement. 2-b. Show how the amounts related to Accounts Receivable would be reported on the balance sheet. 3. On the basis of the data available, does the 2 percent rate appear to be reasonable?arrow_forwardRecord these transactions in general journal ledger: Dec 1: Purchased equipment costing $15,608 by taking out a 4-month installment note with First Bank. Dec 4: Accepted a sales return from Eastern for an item having an original gross sales price of $6,000. The original sale to Eastern occurred in November with terms 2/15, n/30. Dec 5: Specifically wrote off the receivable balance owed by Baker as uncollectible. Dec 7: Returned defective inventory with a gross cost of $4,000 back to Hunt Corp. Dec 14: Wilson returned an item originally purchased on Dec 12 with a gross sales price of $7,000. Dec 14: Returned inventory with a gross cost of $2,000 back to Nelson Industries. Dec 18: Bought office supplies on account for $9,000 from Staples Inc. (open a new Accounts Payable in the subsidiary ledger--Vendor # 210-30). Invoice # is OM1218. Staples Inc.’s terms are n/30 Dec 19: Received the December utilities bill for the amount of $15,000. The bill will be paid in January of next year.…arrow_forwardHaresharrow_forward

- Recording Note Transactions The following information is extracted from Tara Corporation’s accounting records: May 1 Received a $6,000, 12%, 90-day note from V. Leigh, a customer. May 6 Received a $9,000, 10%, 120-day note from C. Gable, a customer. May 11 Sold the Leigh and Gable notes with recourse at the bank at 13%. In addition, borrowed $10,000 from the bank for 90 days at 12%. The bank remits the face value less the interest. The estimated recourse liability for Leigh and Gable is $84 and $110, respectively. July 31 The July bank statement indicated that the Leigh note had been paid. Aug. 10 Repaid the $10,000 borrowed on May 11. Sept. 4 Received notice that Gable had defaulted on the May 6 note. The bank charged a fee of $10. Paid the amount due on the Gable note to the bank. Informed Gable to pay Tara the entire amount due plus 11% interest on the total of the face amount of the note, the accrued interest, and the fee from the maturity date until Gable remits the amount owed.…arrow_forwardThe year-end financial statements of Prize Inc. include the accounts receivable footnote:Total accounts and other receivables at December 31 consisted of the following: (in millions) Year 2 Year 1 Total accounts and other receivables $444.4 $476.6 Allowance for doubtful accounts (6.0) (8.4) Total accounts and other receivables, net $438.4 $468.2 The balance sheet reports total assets of $2,984.1 million at December 31, Year 2.The common-size amount for gross accounts and other receivables are: Select one: a. $444.4 million b. None of these are correct. c. 14.7% d. 14.9% e. $438.4 millionarrow_forwardMonty Corp. has the following transactions related to notes receivable during the last 2 months of the year. The company does not make entries to accrue interest except at December 31. Nov. 1 Dec. 11 16 31 Loaned $77,000 cash to C. Bohr on a 12-month, 12% note. Sold goods to K. R. Pine, Inc., receiving a $3,300, 90-day, 6% note. Received a $12,000, 180-day, 7% note to settle an open account from A. Murdock. Accrued interest revenue on all notes receivable. Journalize the transactions for Monty Corp. (Omit cost of goods sold entries.) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Use 360 days for calculation. Round intermediate calculations to 5 decimal places, e.g. 15.25127 and final answers to 0 decimal places, e.g. 5,275.) Date Account Titles and Explanation Debit creditarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education