FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

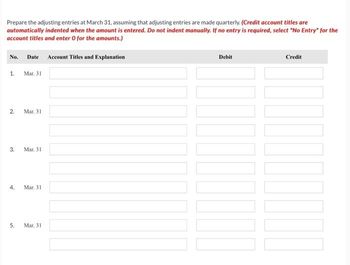

Transcribed Image Text:**Worksheet for Preparing Adjusting Entries as of March 31**

This worksheet is designed to assist in preparing adjusting entries at March 31, assuming that entries are made quarterly. Here's a detailed breakdown of the components:

### Instructions:

- Credit account titles are automatically indented when the amount is entered.

- Do not indent manually.

- If no entry is needed, select “No Entry” for the account titles and enter 0 for the amounts.

### Table Structure:

#### Columns:

1. **No.**: Sequential number for each entry (1 to 5).

2. **Date**: The date of the transaction, listed as "Mar. 31" for all entries.

3. **Account Titles and Explanation**: Space to input the name of the account and a brief explanation of the transaction.

4. **Debit**: Column to record the debit amount for the transaction.

5. **Credit**: Column to record the credit amount for the transaction.

Each row corresponds to a separate adjusting entry, allowing for up to five entries. Make sure to follow the guidelines for formatting and input precisely to maintain accuracy in financial reporting.

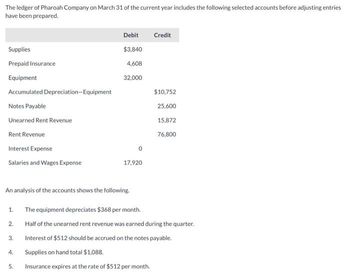

Transcribed Image Text:The ledger of Pharoah Company on March 31 of the current year includes the following selected accounts before adjusting entries have been prepared:

| Account | Debit | Credit |

|----------------------------------------|---------|---------|

| Supplies | $3,840 | |

| Prepaid Insurance | $4,608 | |

| Equipment | $32,000 | |

| Accumulated Depreciation—Equipment | | $10,752 |

| Notes Payable | | $25,600 |

| Unearned Rent Revenue | | $15,872 |

| Rent Revenue | | $76,800 |

| Interest Expense | $0 | |

| Salaries and Wages Expense | $17,920 | |

**Analysis of the Accounts:**

1. The equipment depreciates $368 per month.

2. Half of the unearned rent revenue was earned during the quarter.

3. Interest of $512 should be accrued on the notes payable.

4. Supplies on hand total $1,088.

5. Insurance expires at the rate of $512 per month.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Details of Notes Receivable and Related Entries Gen-X Ads Co. produces advertising videos. During the current fiscal year, Gen-X Ads Co. received the following notes: Interest Date Face Amount Rate Term 1. Аpr. 10 $69,000 4% 60 days 2. June 24 16,800 30 days 3. July 1 72,000 120 days 4. Oct. 31 72,000 60 days 54,000 60 days 5. Nov. 15 6. Dec. 27 108,000 30 days Required: Assume 360 days in a year. 1. Determine for each note (a) the due date and (b) the amount of interest due at maturity, identifying each note by number. (a) (ь) Note Due Date Interest Due at Maturity (1) (2) (3) (4) (5) (6) O o in o +arrow_forwardView transaction list Journal entry worksheet 2 Record the first installment payment on October 31, 2021. Assume no reversing entries were prepared. Note: Enter debits before credits. Date October 31 General Journal Debit Credit View general journal Record entry Clear entryarrow_forwardPlease don't give image formatarrow_forward

- Prepare the journal entries to record the mortgage loan and the first two installment payments. (Round answers to O decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Dec. 31, 2017 Dec. 31, 2018 Dec. 31, 2019 Debit Creditarrow_forwardnkt.1arrow_forwardDogarrow_forward

- Instructions 1 Record entry to write off the $15,000 receivable which is over 75 days outstanding 2 Calculate the desired credit balance in the Allowance for Doubtful Account using the chart above 3 Assuming prior to any adjusting entries the balance in the Allowance for Doubtful Accounts had a credit balance of $40,000, record the year ending adjusting entry for bad debts.arrow_forwardDo not give answer in image formatearrow_forwardAdjustment for Uncollectible Accounts Kirchhoff Industries has computed that the proper balance for the Allowance for Doubtful Accounts at August 31 is $79,873. Assume that the allowance for doubtful accounts for Kirchhoff Industries has a credit balance of $16,775 before adjustment on August 31. Journalize the adjusting entry for uncollectible accounts as of August 31. If an amount box does not require an entry, leave it blank. Aug. 31 - Select - - Select - - Select - - Select -arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education