FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

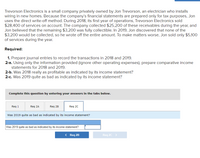

Transcribed Image Text:Trevorson Electronics is a small company privately owned by Jon Trevorson, an electrician who installs

wiring in new homes. Because the company's financial statements are prepared only for tax purposes, Jon

uses the direct write-off method. During 2018, its first year of operations, Trevorson Electronics sold

$28,400 of services on account. The company collected $25,200 of these receivables during the year, and

Jon believed that the remaining $3,200 was fully collectible. In 2019, Jon discovered that none of the

$3,200 would be collected, so he wrote off the entire amount. To make matters worse, Jon sold only $5,100

of services during the year.

Required:

1. Prepare journal entries to record the transactions in 2018 and 2019.

2-a. Using only the information provided (ignore other operating expenses), prepare comparative income

statements for 2018 and 2019.

2-b. Was 2018 really as profitable as indicated by its income statement?

2-c. Was 2019 quite as bad as indicated by its income statement?

Complete this question by entering your answers in the tabs below.

Reg 1

Reg 2A

Reg 2B

Reg 20

Was 2019 quite as bad as indicated by its income statement?

Was 2019 quite as bad as indicated by its income statement?

< Req 2B

Req 20 >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Which of the following is true regarding the incomestatement?a. The income statement is sometimes called the statement of operations.b. The income statement reports revenues, expenses, andliabilities.c. The income statement only reports revenue for whichcash was received at the point of sale.d. The income statement reports the financial position ofa business at a particular point in time.arrow_forwardPlease do not give solution in image format ?arrow_forwardThe following is information for Monty Corp. for the year ended December 31, 2023: Sales revenue Unrealized gain on FV-OCI equity investments Interest income Cost of goods sold Selling expenses Administrative expenses Dividend revenue $1,130,000 38,000 5,000 678,000 56,500 44,000 23,000 Loss on inventory due to decline in net realizable value Loss on disposal of equipment Depreciation expense related to buildings omitted by mistake in 2022 Retained earnings at December 31, 2022 Loss from expropriation of land Dividends declared $71,000 25,000 55,000 930,000 61,000 45,000 The effective tax rate is 20% on all items. Monty prepares financial statements in accordance with IFRS. The FV-OCI equity investments trade on the stock exchange. Gains/losses on FV-OCI investments are not recycled through net income.arrow_forward

- Do not give image formatarrow_forwardWhat information is found on the balance sheet? A) Results of recurring operations for the period. B) Reasons why assets are greater at the end of the year compared to the beginning of the year. C) The financial position of a company as of the balance sheet date. D) The profitability of a company during the period.arrow_forwardQ025: Which accounting concept requires that financial statements reflect the assumption that the business will continue operating indefinitely? A) Economic Entity Assumption B) Going Concern Assumption C) Monetary Unit Assumption D) Periodicity Assumptionarrow_forward

- Accountingarrow_forwardpls answer the following questionarrow_forward1. What is the adjusted net income for 2017? 2. What is the net effect of the errors in the 2018 net income? 3. What is the net effect of the errors in the retained earnings at the end of 2017? 4. What is the net effect of the errors in the retained earnings at the end of 2018?arrow_forward

- Need help please. Thank youarrow_forwardAnalyze the interrelationships among the four financial statements and enter the missing information. If an amount is zero, enter "0" how do I find the capital as of April 1,2019, the net income for April, the increase in owner's equity and his capital of ad April 30, 2019?arrow_forwardI need help with this review. I dont know how to start it.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education