FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

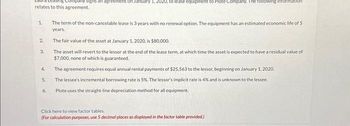

Transcribed Image Text:ompany signs an agreement on January 1, 2020, to lease equipment to Plote Company. The following information

relates to this agreement.

1.

2

3.

4.

5.

6.

The term of the non-cancelable lease is 3 years with no renewal option. The equipment has an estimated economic life of 5

years.

The fair value of the asset at January 1, 2020, is $80,000.

The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of

$7,000, none of which is guaranteed.

The agreement requires equal annual rental payments of $25,563 to the lessor, beginning on January 1, 2020.

The lessee's incremental borrowing rate is 5%. The lessor's implicit rate is 4% and is unknown to the lessee.

Plote uses the straight-line depreciation method for all equipment.

Click here to view factor tables.

(For calculation purposes, use 5 decimal places as displayed in the factor table provided.)

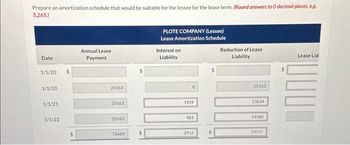

Transcribed Image Text:Prepare an amortization schedule that would be suitable for the lessee for the lease term. (Round answers to O decimal places, e.g.

5,265)

Date

1/1/20

1/1/20

1/1/21

1/1/22

$

Annual Lease

Payment

25563

25563

25563

76689

$

PLOTE COMPANY (Lessee)

Lease Amortization Schedule

Interest on

Liability

0

1929

983

2912

$

Reduction of Lease

Liability

25563

23634

24580

73777

Lease Lial

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Each of the four independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessor's implicit rate of return. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Situation 1 Lease term (years) Lessor's rate of return Fair value of lease asset $ 61,000 $361,000 $86,000 Lessor's cost of lease asset$ 61,000 $361,000 $ 56,000 Residual value: $61,000 Estimated fair value Guaranteed fair value 4 10% 3 0 0 4 7 11% 5 9% 8 12% $ 476,000 $ 476,000 $18,000 $ 30,000 0 $ 18,000 $ 35,000 Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as a right-of-use asset and a lease liability, for each of the above situations. Note: Round your answers to the nearest whole dollar amount.arrow_forwardOwefix a. compute the amount of lease receiveable for the leaseb. discusd the bethre of the leasec. prepara an amoritization table for the lessee and lessorarrow_forwardEach of the four independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessor's implicit rate of return. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Situation 1 2 3 4 Lease term (years) Lessor's rate of return. 5 10% 8 11% 6 9 9% 12% Fair value of lease asset $ 67,000 $ 367,000 $ 92,000 Lessor's cost of lease asset $ 67,000 $ 367,000 $ 62,000 $ 482,000 $ 482,000 Residual value: Estimated fair value Guaranteed fair value 0 $ 67,000 $ 24,000 $ 36,000 0 0 $ 24,000 $ 41,000 Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as a right-of-use asset and a lease liability, for each of the above situations. Note: Round your answers to the nearest whole dollar amount. Lease Payments Residual Value PV of Lease Guarantee Payments PV of…arrow_forward

- How will a 20-year lease obligation appear on the lessee's statement of financial position? a.as a long-term liability, only if an operating lease b.as a long-term liability, only if a finance lease c.as a long-term liability for any lease, operating or finance d.as a long-term asset for an operating leasearrow_forwardE1.arrow_forwardEach of the four independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessor's implicit rate of return. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Situation 1 2 3 4 Lease term (years) Lessor's rate of return 4 10% 7 11% 5 8 9% 12% Fair value of lease asset $ 56,000 $ 356,000 $ 81,000 $ 471,000 Lessor's cost of lease asset $ 56,000 $ 356,000 $ 51,000 $ 471,000 Residual value: Estimated fair value 0 $ 56,000 Guaranteed fair value 0 0 $ 13,000 $13,000 $ 51,000 $ 56,000 Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the essee would record as a right-of-use asset and a lease liability, for each of the above situations. Note: Round your answers to the nearest whole dollar amount. Answer is complete but not entirely correct. Lease Payments Residual…arrow_forward

- For which of the following conditions will the lessor classify a lease as a sales-type lease? a.The leased asset may be exchanged for a similar asset during the lease term. b.The present value of the sum of the lease payments is equal to or more than the fair value of the underlying asset. c.The lease term is less than one year. d.The lease term is half of the underlying asset’s economic life.arrow_forwardNonearrow_forwardEach of the four independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessor’s implicit rate of return. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Situation 1 2 3 4 Lease term (years) 5 8 6 9 Lessor's rate of return 10% 11% 9% 12% Fair value of lease asset $ 65,000 $ 365,000 $ 90,000 $ 480,000 Lessor's cost of lease asset $ 65,000 $ 365,000 $ 60,000 $ 480,000 Residual value: Estimated fair value 0 $ 65,000 $ 22,000 $ 34,000 Guaranteed fair value 0 0 $ 22,000 $ 39,000 Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as a right-of-use asset and a lease liability, for each of the above situations. Note: Round your answers to the nearest whole dollar amount. I have got all answers except…arrow_forward

- am. 127.arrow_forwardam. 104.arrow_forwardThree independent situations are given. Each describes a finance lease in which annual lease payments are payable at the beginning of each year. Each lease agreement contains an option that permits the lessee to acquire the leased asset at an option price that is sufficiently lower than the expected fair value that the exercise of the option appears reasonably certain. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Lease term (years) Lessor's rate of return Fair value of leased asset. Lessor's cost of leased asset. Purchase option: Exercise price Exercisable at end of year: Reasonably certain? Situation 1 Situation 2 Situation 3 1 Annual lease payments 4 10% $92,000 $ 66,000 $ 26,000 4 yes Situation 2 4 11% $ 436,000 $ 436,000 $ 66,000 4 no 3 3 9% $ 201,000 $ 161,000 yes $ 38,000 2 Determine the annual lease payments for each situation: Note: Round your intermediate and final answers to the nearest whole dollar…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education