Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

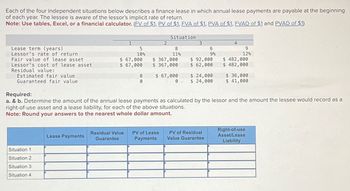

Transcribed Image Text:Each of the four independent situations below describes a finance lease in which annual lease payments are payable at the beginning

of each year. The lessee is aware of the lessor's implicit rate of return.

Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1)

Situation

1

2

3

4

Lease term (years)

Lessor's rate of return.

5

10%

8

11%

6

9

9%

12%

Fair value of lease asset

$ 67,000

$ 367,000

$ 92,000

Lessor's cost of lease asset

$ 67,000

$ 367,000

$ 62,000

$ 482,000

$ 482,000

Residual value:

Estimated fair value

Guaranteed fair value

0

$ 67,000

$ 24,000

$ 36,000

0

0

$ 24,000

$ 41,000

Required:

a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as a

right-of-use asset and a lease liability, for each of the above situations.

Note: Round your answers to the nearest whole dollar amount.

Lease Payments

Residual Value PV of Lease

Guarantee

Payments

PV of Residual

Value Guarantee

Right-of-use

Asset/Lease

Liability

Situation 1

Situation 2

Situation 3

Situation 4

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Similar questions

- Reporting Finance Lease, Guaranteed Residual-Lessee Mac Leasing Company (lessor) and Ash Corporation (lessee) signed a four-year lease on January 1 of Year 1. The underlying asset has an estimated life of six years and a fair value of $50,000, and the property reverts to Mac at the end of the lease term. Lease payments of $11,923 are payable on January 1 of each year beginning at the lease commencement and are set to yield Mac a return of 8%, which is known to Ash. The estimated residual value at the end of the lease term is $10,000 and is guaranteed by Ash Corporation. Ash expects the residual value at the end of the lease term to be $10,000. The lease contains no purchase option. Requireda. How would Ash Corporation classify the lease? Finance Lease b. What is the lease liability balance on January 1, the lease commencement date? Note: Round your answer to the nearest whole dollar. $ Estimated Residual = Guaranteed Residual, Estimated Residual < Guaranteed Residual Note: Round your…arrow_forwardsarrow_forwardDo not give answer in imagearrow_forward

- Vinubhaiarrow_forwardThe following statements relate to the impact on the financial statements for operating vs. finance leases. Indicate all statements that are correct. Select one or more: a. The right of use asset is shown at a higher amount for a finance lease. b. The lease liability is measured as the present value of future cash flows for both operating and finance leases. c. Net Income is higher at first when a lease is classified as a finance lease. d. Operating Income is lower when a lease is classified as an operating lease.arrow_forward1arrow_forward

- Each of the four independent situations below describes a finance lease in which annual lease payments are payable at the beginning of each year. The lessee is aware of the lessor's implicit rate of return. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Situation 1 2 3 4 Lease term (years) Lessor's rate of return 4 10% 7 11% 5 8 9% 12% Fair value of lease asset $ 64,000 $ 364,000 $ 89,000 Lessor's cost of lease asset $ 64,000 $ 364,000 $ 59,000 $ 479,000 $479,000 0 $ 64,000 $ 21,000 $ 33,000 0 0 $ 21,000 $ 38,000 Residual value: Estimated fair value Guaranteed fair value Required: a. & b. Determine the amount of the annual lease payments as calculated by the lessor and the amount the lessee would record as a right-of-use asset and a lease liability, for each of the above situations. Note: Round your answers to the nearest whole dollar amount. Right-of-use Lease Payments Residual Value Guarantee PV of Lease…arrow_forwardOn the balance sheet, the lease liability is measured as ________. Group of answer choices the present value of the lease payments less the present value of the guaranteed residual value (if any) the present value of the lease payments plus the future value of the guaranteed residual value (if any) the present value of the lease payments plus the present value of the guaranteed residual value if the lessee guarantees it(if any) the future value of the lease payments plus the future value of the guaranteed residual value (if any)arrow_forwardPLEASE HELP ME WITH THE ONES I GOT INCORRECT. THANK YOU.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education