FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

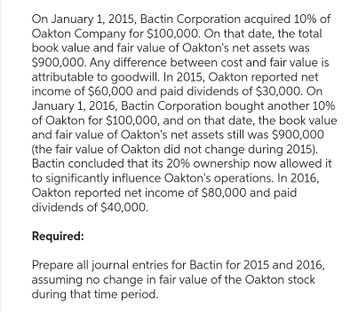

Transcribed Image Text:On January 1, 2015, Bactin Corporation acquired 10% of

Oakton Company for $100,000. On that date, the total

book value and fair value of Oakton's net assets was

$900,000. Any difference between cost and fair value is

attributable to goodwill. In 2015, Oakton reported net

income of $60,000 and paid dividends of $30,000. On

January 1, 2016, Bactin Corporation bought another 10%

of Oakton for $100,000, and on that date, the book value

and fair value of Oakton's net assets still was $900,000

(the fair value of Oakton did not change during 2015).

Bactin concluded that its 20% ownership now allowed it

to significantly influence Oakton's operations. In 2016,

Oakton reported net income of $80,000 and paid

dividends of $40,000.

Required:

Prepare all journal entries for Bactin for 2015 and 2016,

assuming no change in fair value of the Oakton stock

during that time period.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Based on the fair value of the awards, what was Target’s primary form of sharebased compensation for the year ended January 30, 2016?arrow_forward3.The following data relates to Available for Sale Securities: Please Journalize all the entries required for this problem and then answer the question below. On December 1, 2007, a company purchased securities totaling $6,200. On December 31, 2007, the FMV of the securities was $5,300. On December 31, 2008, the FMV was $6,000. On December 31, 2009, the FMV was $3,200. Please use the blank journal paper that I have uploaded to the files section of Canvas for this class. The name of your accounts must have the correct names. Question: The unrealized loss or gains would appear on which financial statement?arrow_forwardCompany X purchased trading securities in February. Company Y purchased available-for-sale securities in February as well, and it plans to sell them before December. Company Z purchased available-for-sale securities and is planning to hold onto them for at least two years. What is implied here? 1. Company X and Company Y will report their securities under current assets on the balance sheet, while Company Z will report their securities immediately below current assets in the investments section. 2. Company X will report their securities under current assets on the balance sheet, while Company Y and Company Z will report their securities immediately under current assets in the investments section. 3. Company X and Company Y will report their securities under current assets, while Company Z will report their securities under current liabilities. 4. Company X, Y, and Z will all report their securities under current assets on the balance sheet.arrow_forward

- On December 31, Reggit Company held the following short-term investments in its portfolio of available-for-sale debt securities. Reggit had no short-term investments in its prior accounting periods. Available-for-Sale Securities Verrizano Corporation bonds Preble Corporation notes Lucerne Company bonds epare the December 31 adjusting entry to report these investments at fair value. Fair Value Adjustment Computation of fair value adjustment. Complete this question by entering your answers in the tabs below. General Journal Cost $ 76,000 57,000 72,000 Verrizano Corporation bonds Preble Corporation notes Lucerne Company bonds Total Fair Value Adjustment Computation - Available for Sale Portfolio Unrealized Amount Cost $ Fair Value $ 74,480 50,730 69,120 Fair Value 76,000 $ 74,480 57,000 50,730 72,000 69,120 $ 205,000 $ 194,330 COarrow_forwardThe following selected circumstances relate to pending lawsuits for Erismus, Incorporated Erismus’s fiscal year ends on December 31. Financial statements are issued in March 2025. Erismus prepares its financial statements according to U.S. GAAP. Required: Indicate the amount Erismus would record as an asset, a liability or if no accrual would be necessary in the following circumstances. Erismus is defending against a lawsuit. Erismus's management believes the company has a slightly worse than 50/50 chance of eventually prevailing in court, and that if it loses, the judgment will be $1,430,000. Erismus is defending against a lawsuit. Erismus's management believes it is probable that the company will lose in court. If it loses, management believes that damages could fall anywhere in the range of $2,830,000 to $5,660,000, with any damage in that range equally likely. Erismus is defending against a lawsuit. Erismus's management believes it is probable that the company will lose in court.…arrow_forwardOn January 1, Valuation Allowance for Available-for-Sale Investments had a zero balance. On December 31, the cost of the available-for-sale securities was $78,400, and the fair value was $72,330. Prepare the adjusting entry to record the unrealized gain or loss on available-for-sale investments on December 31. Refer to the Chart of Accounts for exact wording of account titles.arrow_forward

- At December 31, 2025, Pharoah Company has a portfolio of equity securities valued at $136000. Its cost was $116000. If the Fair Value Adjustment has a debit balance of $7200, which of the following journal entries is required at December 31, 2025? O Unrealized Holding Gain or Loss-Income Fair Value Adjustment Fair Value Adjustment Unrealized Holding Gain or Loss-Income Fair Value Adjustment Unrealized Holding Gain or Loss-Income Unrealized Holding Gain or Loss-Income Fair Value Adjustment 12800 12800 20000 20000 12800 12800 20000 20000arrow_forwardOn December 12, 2024, an Investment in equity securities costing $84,000 was sold for $108,000. The total of the sale proceeds was credited to the Investment in equity securities account Required: 1. Prepare the Journal entry to correct the error, assuming it is discovered before the books are adjusted or closed in 2024. (Ignore Income taxes.) 2. Prepare the journal entry to correct the error assuming It is not discovered until early 2025. (Ignore income taxes.)arrow_forwardAt December 31, 2024, Hull-Meyers Corporation had the following Investments that were purchased during 2024, its first year of operations: Trading Securities: Security A Security B Totals Securities Available-for-Sale: Security C Security D Totals Securities to Be Held-to-Maturity: Security E Security F Totals Trading Securities Security A Security B Securities Available-for-Sale Security C Security D Securities to be Held-to-Maturity Security E Security F Required: Complete the following table. Note: Amounts to be deducted should be indicated with a minus sign. Totals Amortized cost Reported on Balance Sheet as: No Investments were sold during 2024. All securities except Security D and Security F are considered short-term Investments. None of the fair value changes is considered permanent. Current assets Noncurrent assets $ 0 $ $ 965,000 170,000 $ 1,135,000 $ 765,000 965,000 $ 1,730,000 0 $ 555,000 680,000 $ 1,235,000 Net Income $ Fair Value $ 979,500 164, 600 $ 1,144,100 0 $ 838,500…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education