FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

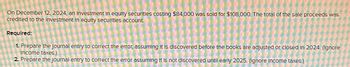

Transcribed Image Text:On December 12, 2024, an Investment in equity securities costing $84,000 was sold for $108,000. The total of the sale proceeds was

credited to the Investment in equity securities account

Required:

1. Prepare the Journal entry to correct the error, assuming it is discovered before the books are adjusted or closed in 2024. (Ignore

Income taxes.)

2. Prepare the journal entry to correct the error assuming It is not discovered until early 2025. (Ignore income taxes.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hi! I'm trying to practice my practice problems for Accounting but I seem to always get stuck on preparing journal entries. How do I know which journal entry to prepare for each step?arrow_forwardBlue Inc. reports under IFRS and has adopted the policy of classifying interest received as an investing activity. During 2023, Blue lent $29,000 to a key supplier in exchange for a two-year interest-bearing promissory note. Interest revenue earned on the note and recorded on the statement of income was in the amount of $1,230 and a balance of $410 for interest receivable was reported on the statement of financial position at December 31, 2023, relating to the note. Prepare Blue's cash flows from (used by) investing activities section of the statement of cash flows. (Show amounts that decrease cash flow with either a negative sign e.g. -15,000 or in parenthesis e.g. (15,000).) Blue Inc. Statement of Cash Flows > tA tAarrow_forwardPrepare entries to record the following non-strategic investment transactions of Arrowhead Investment Corporation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations. Round your final answers to the nearest whole dollar amount.) 2023 Mar. 1 Paid $67,980 to purchase a $67,000, two-year, 7.0% bond payable of Action Corporation dated March 1. There was a $95 transaction fee included in the above - noted payment amount. Interest is paid quarterly beginning June 1. Management intends to actively trade bond purchases. Apr. 16 Bought 2,700 common shares of Brandon Motors at $27.00. There was a $95 transaction fee included in the above-noted payment amount. May 2 Paid $52,968 to purchase a five-year, 4.50%, $ 54,000 bond payable of Collingwood Corporation. There was a $95 transaction fee included in the above-noted payment amount. Interest is paid annually each April 30. June 1 Received a…arrow_forward

- Gadubhaiarrow_forward4. A company borrowed $200,000 on January 1, 2019 to pay them on January 1, 2022. On January 1, 2019, the company received an amount equal to $200,000, less interest discounted at an annual rate of 11.5%, which is the market rate. The company closes its books every December 31.a. Prepare the journal entry for the debtor on January 1, 2019.b. Prepare the journal entry on December 31, 2020 related to this debt. 5. Suppose that the company from the previous exercise number 4 received the full sum of $200,000 on January 1, 2019 and agreed to repay the loan by making three annual payments (January 1, 2020, 2021 and 2022) equal to the base at an interest rate of 11.5%.Prepare the journal entry to record the second of the three annual payments.arrow_forwardDo not give answer in imagearrow_forward

- Bramble Corporation purchases equity securities costing $ 66,200. At December 31, the fair value of the portfolio is $ 58,100.Prepare the adjusting entry to report the securities properly, assuming that the investments purchased represent less than a 5% interest in the other companies. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Account Titles and Explanation Debit Creditarrow_forwardA company buys a debt investment for $316, 000. At the end of 2023, the amortized cost of the investment is $315,000 and the fair value of the investment is $322, 000. The company intends to hold the investment until maturity and does not intend to use the fair value option. Therefore, the company must report the investment at $316,000 on its 2023 year-end balance sheet. True or Falsearrow_forwardi need the answer quicklyarrow_forward

- Gatsby, Inc. owed $500,000 on account for inventory purchased on November 1, 2020. The company's fiscal year ends on December 31. Gatsby was unable to pay the amount owed by February 1, 2021 due date because of financial difficulties experienced in early 2021. On February 1, 2021, it signed a $500,000, 10% interest- bearing note. This note was repaid with interest on September 1, 2021. How much interest should Gasby recognize on September 1, 2021 (enter your answer in whole dollars, no comma or dollar sign)?arrow_forwardthank you.arrow_forwardKevin Smith, financial officer of Benson Inc., showed the following unadjusted account balances at January 31, 2023, its year end. Other information: There was one reconciling item on the bank reconciliation: an NSF cheque for $800. A review of the Prepaid Rent account showed that the balance represents rent for two months beginning January 1, 2023. Annual depreciation on the boats is $3,780. Annual depreciation on the furniture is $3,560. Use this information to prepare the January 31, 2023 classified balance sheet. xxx F 团 + (select one) Balance Sheet (select one) Account Balance Accounts payable 24,800 Accounts receivable 5,600 Accumulated depreciation, boats, 41,820 Accumulated depreciation, furniture, 30,360 Boats 49,220 Bonds payable (due August, 2031). 24,800 Cash 12,400 Commissions earned 19,400 Consulting revenue earned 6,700 Copyright 14,300 Dividends 6,600 Furniture 46,360 Insurance expense 3,800 Land 13,300 Long-term notes payable, 25,000 Long-term investment in shares…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education