FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

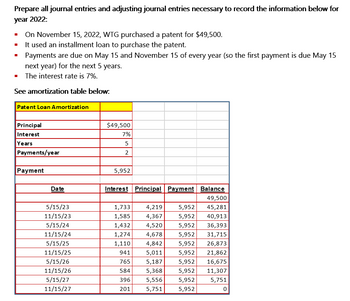

Transcribed Image Text:Prepare all journal entries and adjusting journal entries necessary to record the information below for

year 2022:

On November 15, 2022, WTG purchased a patent for $49,500.

It used an installment loan to purchase the patent.

Payments are due on May 15 and November 15 of every year (so the first payment is due May 15

next year) for the next 5 years.

The interest rate is 7%.

See amortization table below:

■

Patent Loan Amortization

Principal

Interest

Years

Payments/year

Payment

Date

5/15/23

11/15/23

5/15/24

11/15/24

5/15/25

11/15/25

5/15/26

11/15/26

5/15/27

11/15/27

$49,500

7%

5

2

5,952

Interest Principal Payment Balance

49,500

5,952

45,281

5,952 40,913

5,952

36,393

5,952

5,952

5,952

5,952

5,952

5,952

5,952

1,733

4,219

1,585 4,367

4,520

4,678

4,842

941

5,011

765

5,187

584

5,368

396 5,556

201 5,751

1,432

1,274

1,110

31,715

26,873

21,862

16,675

11,307

5,751

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Prepare journal entries to record the following transactions entered into by the Ivanhoe Company. Omit cost of goods sold entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) 2024 June Nov. 1 1 Received a $10,800, 9%, 1-year note from Luke Bryan as full payment on his account. Sold merchandise on account to Ace, Inc., for $17,000, terms 2/10, n/30. Nov. 5 Ace, Inc., returned merchandise worth $1,500. Received payment in full from Ace, Inc. Accrued interest on Bryan's note. Nov. 9 Dec. 31 2025 June 1 Luke Bryan honored his promissory note by sending the face amount plus interest.arrow_forwardWhat would be a classified balance sheet as of December 31, 2021 for this problem?arrow_forward3. Prepare the journal entries to record the two expenditures during 2019. (If no entry is required for a transaction/event, select " journal entry required" in the first account field.) View transaction listarrow_forward

- Please read through the questions parts 2 and 3 is asking for journal entry. The rest are fill ins.arrow_forwardPut the following steps in the accounting cycle in the correct order (1-9). Journalize transactions and events Three Journalize and post the adjusting journal entires Three Analyze transactions and events from source documents One Prepare the post-closing trial balance Nine Post the journal entires to the general ledger Choose. + Prepare the unadjusted trial balance Choose. Prepare the adjusted trial balance Choose. +arrow_forwardNeed a worksheet in excel form add interest expense - of 167.00 please.arrow_forward

- What is a 'bonus share'? Give the journal entries required at the date of a bonus issuearrow_forwardregarding to the question and answer stated above what should be my datesarrow_forwardView History Bookmarks Window Help A education.wiley.com 1 ך WP NWP Assessment Player UI Application DAXMED WALI FURINL Question 26 of 42 View Policies Current Attempt in Progress Which of the following is in accordance with generally accepted accounting principles? Accrual-basis accounting Cash-basis accounting Both accrual-basis and cash-basis accounting Neither accrual-basis nor cash-basis accounting Save for Later OO O Oarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education