FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

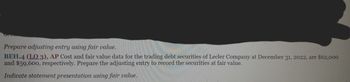

Transcribed Image Text:Prepare adjusting entry using fair value.

BEH.4 (LO 3), AP Cost and fair value data for the trading debt securities of Lecler Company at December 31, 2022, are $62,000

and $59,600, respectively. Prepare the adjusting entry to record the securities at fair value.

Indicate statement presentation using fair value.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On December 31, the cost of trading securities portfolio was $64,200, and the fair value was $67,000. The adjusting entry to record the unrealized gain or loss on trading investments would included a : Group of answer choices debit Unrealized Loss on Trading Investments debit Unrealized Gain on Trading Investments credit Unrealized Loss on Trading Investments credit Unrealized Gain on Trading Investmentsarrow_forward! Required information [The following information applies to the questions displayed below.] On December 31, Reggit Company held the following short-term investments in its portfolio of available-for-sale debt securities. Reggit had no short-term investments in its prior accounting periods. Available-for-Sale Securities Verrizano Corporation bonds Preble Corporation notes Lucerne Company bonds Prepare the December 31 adjusting entry to report these investments at fair value. General Journal Complete this question by entering your answers in the tabs below. Fair Value Adjustment Computation of fair value adjustment. Cost $ 68,000 49,000 64,000 Verrizano Corporation bonds Preble Corporation notes Lucerne Company bonds Total Fair Value Adjustment Computation - Available for Sale Portfolio Unrealized Amount Cost Fair Value $ 66,640 43,610 61,440 Fair Value $ 68,000 $ 66,640 49,000 43,610 64,000 61,440 $ 181,000 $ 171,690 Unrealized Lossarrow_forward3.The following data relates to Available for Sale Securities: Please Journalize all the entries required for this problem and then answer the question below. On December 1, 2007, a company purchased securities totaling $6,200. On December 31, 2007, the FMV of the securities was $5,300. On December 31, 2008, the FMV was $6,000. On December 31, 2009, the FMV was $3,200. Please use the blank journal paper that I have uploaded to the files section of Canvas for this class. The name of your accounts must have the correct names. Question: The unrealized loss or gains would appear on which financial statement?arrow_forward

- Year 2 and 3 for Fair Value at the end of the year are still incorrect and I do not understand why?arrow_forwardOn December 31, Reggit Company held the following short-term investments in its portfolio of available-for-sale debt securities. Reggit had no short-term investments in its prior accounting periods. Available-for-Sale Securities Verrizano Corporation bonds Preble Corporation notes Lucerne Company bonds epare the December 31 adjusting entry to report these investments at fair value. Fair Value Adjustment Computation of fair value adjustment. Complete this question by entering your answers in the tabs below. General Journal Cost $ 76,000 57,000 72,000 Verrizano Corporation bonds Preble Corporation notes Lucerne Company bonds Total Fair Value Adjustment Computation - Available for Sale Portfolio Unrealized Amount Cost $ Fair Value $ 74,480 50,730 69,120 Fair Value 76,000 $ 74,480 57,000 50,730 72,000 69,120 $ 205,000 $ 194,330 COarrow_forwardOn January 1, Valuation Allowance for Available-for-Sale Investments had a zero balance. On December 31, the cost of the available-for-sale securities was $78,400, and the fair value was $72,330. Prepare the adjusting entry to record the unrealized gain or loss on available-for-sale investments on December 31. Refer to the Chart of Accounts for exact wording of account titles.arrow_forward

- At December 31, 2025, Pharoah Company has a portfolio of equity securities valued at $136000. Its cost was $116000. If the Fair Value Adjustment has a debit balance of $7200, which of the following journal entries is required at December 31, 2025? O Unrealized Holding Gain or Loss-Income Fair Value Adjustment Fair Value Adjustment Unrealized Holding Gain or Loss-Income Fair Value Adjustment Unrealized Holding Gain or Loss-Income Unrealized Holding Gain or Loss-Income Fair Value Adjustment 12800 12800 20000 20000 12800 12800 20000 20000arrow_forwardDirections: Click the Case Link above and use the information provided in Revolutionary Designs, Inc., Part B, to answer this question: What is the impact on Revolutionary Design's adjusted debt ratio (total liabilities less subordinated debt) to adjusted tangible net worth (tangible net worth plus subordinated debt) if we assume that the owner debt will no longer be subordinated in 20Y3? Adjusted debt to adjusted tangible net worth will increase from approximately 2.7 to approximately 3.8 in 2013. Adjusted debt to adjusted tangible net worth will improve from approximately 3.5 to approximately 2.6 in 20Y3. Adjusted debt to adjusted tangible net worth will increase from approximately 3.5 to approximately 3.8 in 20Y3. Bookmark for reviewarrow_forwardPresented here are the financial statements of Sunlard Cornpany.SINI.AND COWANYConvaratWeD«rnber 31CashAccounts receivableInventccyProperty. plant. equipmentAccumu lated depreciationTotalLiabilities and Stockholders' EquityAccounts payableIncome taxes payableBonds payableCommon stockRetained earningsTotal537.400329003060059.700(29.100)"31500S2&3007.50027.9001860049.200S1315002021S20.soo20.00077.900(23500)S113000s 16.5003280014.20041300Silaoooarrow_forward

- Ee.105.arrow_forwardCarpark Services began operations in 20X1 and maintains long-term investments in available-for-sale debt securities. The year-end cost and fair values for its portfolio of debt securities follows. The year-end adjusting entry to record the unrealized gain/loss at December 31, 20X2 is: Available-for-Sale Securities Cost Fair Value December 31, 20X1 $ 305,000 $ 300,000 December 31, 20X2 $ 384,000 $ 390,000arrow_forwardAt December 31, 2024, Hull-Meyers Corporation had the following Investments that were purchased during 2024, its first year of operations: Trading Securities: Security A Security B Totals Securities Available-for-Sale: Security C Security D Totals Securities to Be Held-to-Maturity: Security E Security F Totals Trading Securities Security A Security B Securities Available-for-Sale Security C Security D Securities to be Held-to-Maturity Security E Security F Required: Complete the following table. Note: Amounts to be deducted should be indicated with a minus sign. Totals Amortized cost Reported on Balance Sheet as: No Investments were sold during 2024. All securities except Security D and Security F are considered short-term Investments. None of the fair value changes is considered permanent. Current assets Noncurrent assets $ 0 $ $ 965,000 170,000 $ 1,135,000 $ 765,000 965,000 $ 1,730,000 0 $ 555,000 680,000 $ 1,235,000 Net Income $ Fair Value $ 979,500 164, 600 $ 1,144,100 0 $ 838,500…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education