FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

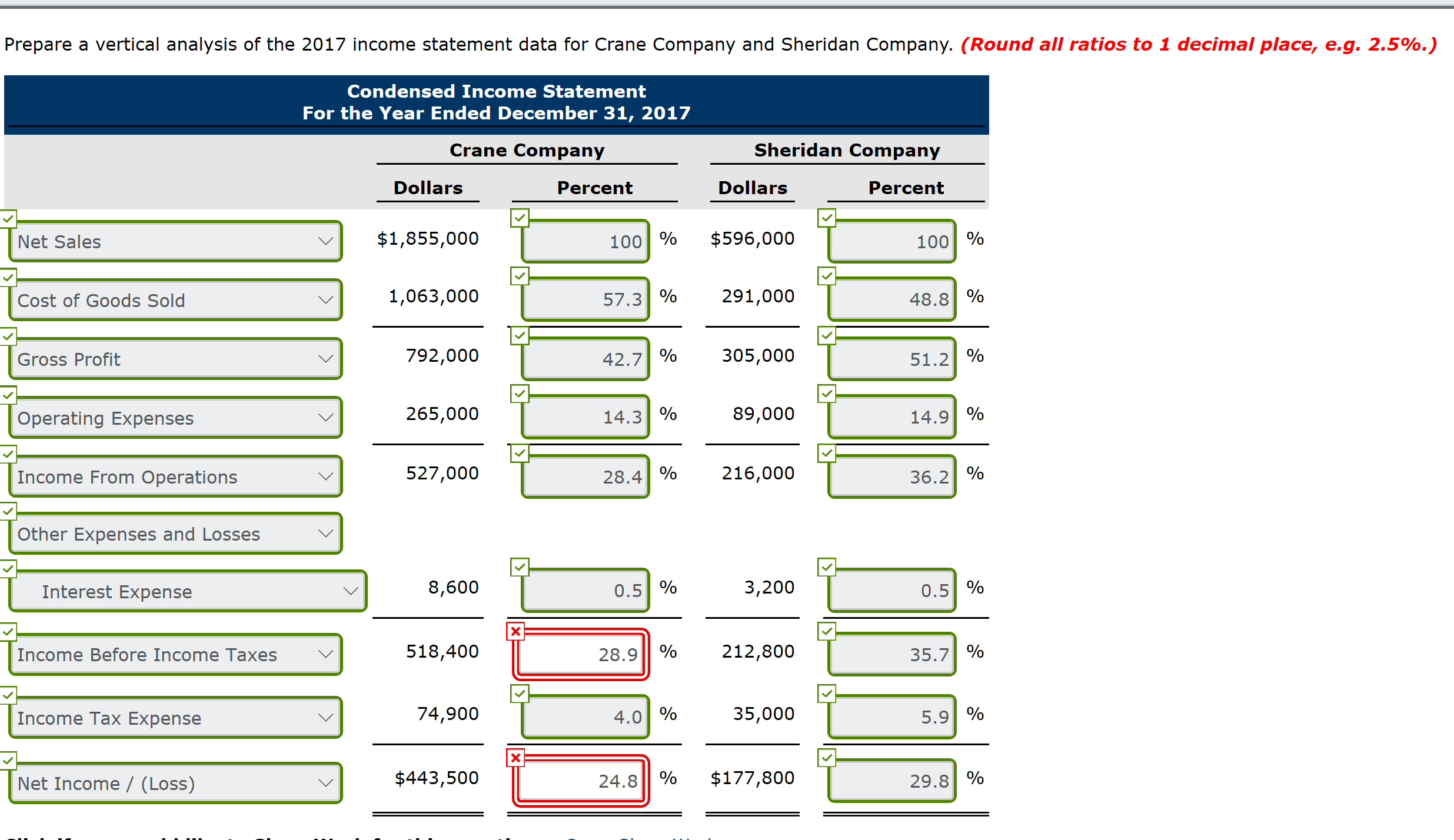

I need help with the two I got wrong which are highlighted in red.

Transcribed Image Text:Prepare a vertical analysis of the 2017 income statement data for Crane Company and Sheridan Company. (Round all ratios to 1 decimal place, e.g. 2.5%.)

Condensed Income Statement

For the Year Ended December 31, 2017

Sheridan Company

Crane Company

Dollars

Dollars

Percent

Percent

$1,855,000

$596,000

Net Sales

100 %

100 %

1,063,000

291,000

57.3 %

48.8 %

Cost of Goods Sold

792,000

305,000

Gross Profit

42.7 %

51.2 %

265,000

89,000

14.3 %

14.9 %

Operating Expenses

527,000

216,000

Income From Operations

28.4%

36.2 %

Other Expenses and Losses

8,600

3,200

Interest Expense

0.5 %

0.5 %

X

518,400

212,800

28.9%

35.7 %

Income Before Income Taxes

74,900

35,000

Income Tax Expense

4.0 %

5.9 %

X

$443,500

$177,800

24.8 %

29.8 %

Net Income / (Loss)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 3arrow_forwardIm having an issue with this problem. Thank you!arrow_forwardRegarding accountant's liability, the courts have held accountants liable for their financial statements to which of the following: (multiple answers possible. However marking all will result in an incorrect score.) a. client b. bankers of the client c. future investors in the business of the client d. creditors of the client e. third party vendors that might supply clientarrow_forward

- What did you guys get for the last two blank spots. The other question didn't give me a full answer for it.arrow_forwardwhat exactly is a cookie jar reserve? Does using a cookie jar reserve follow GAAP? Does using a cookie jar reserve appear to be an ethical practice? Support your opinion. Your post should be more than a single sentence.arrow_forwardPlease fill out the missing Colin and show the calaculations and formulaarrow_forward

- The main selling point(s) of managed care is (are) what? ☐ 1) Reduce the cost of care. 2) Raise or maintain the quality of care 3) Help employer select healthier employees in the insurance pool. ○ 4) A & B ☐ 5) B & C ○ 6) A & Carrow_forwardHow did COVID-19 chnage medical supplies where they're needed during emergencies. How can that be changed now?arrow_forwardIt says they answers are wrong from your example.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education