Concept explainers

The

| Cash | $ | 8,500 | |

| Land | 4,000 | ||

| Notes Payable | 5,000 | ||

| Common Stock | 6,000 | ||

| 1,500 | |||

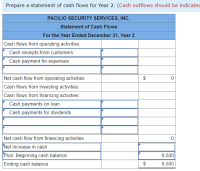

During Year 2, Pacilio Security Services experienced the following transactions:

- Acquired an additional $2,000 from the issue of common stock.

- Paid $3,000 on the debt owed to the Small Business Government Agency. The loan is interest-free.

- Performed $21,000 of security services for numerous local events during the year; $15,000 was on account and $6,000 was cash.

- On May 1, rented a small office building. Paid $2,400 for 12 months’ rent in advance.

- Purchased supplies on account for $650.

- Paid salaries expense for the year of $8,000.

- Incurred other operating expenses on account, $6,200.

- On September 1, Year 2, a customer paid $600 for services to be provided over the next six months.

- Collected $13,500 of

accounts receivable during the year. - Paid $5,800 on accounts payable.

- Paid $1,500 of advertising expenses for the year.

- Paid a cash dividend to the shareholders of $1,000.

- The market value of the land was determined to be $5,000 at December 31, Year 2.

Information for Adjustments

- There was $65 of supplies on hand at the end of the year.

- Recognized the expired rent.

- Recognized the revenue earned from Transaction 8.

- Accrued salaries were $1,200 at December 31, Year 2.

Required

a. Show the effects of the events on the financial statements using a horizontal statements model given below. In the

b. Prepare an income statement, statement of changes in

c. Indicate whether the transaction increases (+), decreases (–), or increases and decreases (+/-) for each element of the financial statements. Also, in the Cash Flow column, use the letters OA to designate operating activity, IA for investing activity, FA for financing activity. The first transaction is recorded as an example.

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 3 images

- Sophia incorporated a company last year by investing an amount of $5 Million. For the expansion of her business, she needs to acquire additional funds from external sources at least for 5 years but she does not want to dilute her ownership in the business. Sophia should acquire the funds through which of the following sources of finance? Equity shares Both B and C Trade Credit Bondsarrow_forward________ differences between book income and taxable income result in an effective tax rate that differs from the statutory tax rate. Group of answer choices Short-term Permanent Temporary Long-termarrow_forwardSpeedware Corporation A friend of yours reviewed the 20X5 Annual Report for Speedware Corporation. The following are extracts from the Report. 7. Finance Subsidiaries (continued) At December 31, 20x5, receivables of $898 included $595 of notes and accounts receivable and $303 due under non-cancelable leases, maturing as follows: Year ended December 31: 20x6 Years 2-5 Thereafter Less unearned income 18. Commitments Lease receivables ($millions) Total receivables $ 159 $ 357 190 535 15 364 61 $303 67 959 61 $ 898 At December 31, 20x5, the future minimum lease payments under finance leases and operating leases consisted of: Year ended December 31: 20x6 Years 2-5 Thereafter Total future minimum lease payments Less: imputed interest Present value of net minimum lease payments Finance leases Operating leases $ 5 14 $ 132 290 9 154 28 $576 8 $20 Rental expense on operating leases for the years ended December 31, 20x5, 20x4, and 20x3, amounted to $172, $170, and $131, respectively. Your friend…arrow_forward

- Accounts receivable in the amount of $658,000 were assigned to the Fast Finance Company by Sunland, Inc., as security for a loan of $564,000. The finance company assessed a 4% finance charge on the face amount of the loan, and the note bears interest at 8% per year.During the first month, Sunland collected $366,600 on assigned accounts. This amount was remitted to the finance company along with one month's interest on the note.Make all the entries for Sunland Inc. associated with the transfer of the accounts receivable, the loan, and the remittance to the finance company. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 5,275.) Account Titles and Explanation Debit Credit (To record the transfer of the accounts receivable.) (To record the loan amount…arrow_forwardDavos Company performed services on account for $160,000 in Year 1. Davos collected $120,000 cash from accounts receivable during Year 1, and the remaining $40,000 was collected in cash during Year 2. Required a. e. & f. Record the Year 1 transactions in T-accounts and close the Year 1 Service Revenue account to the Retained Earnings account. Record the Year 2 cash collection in the appropriate T-accounts.arrow_forwardSmiley Corporation wholesales repair products to equipment manufacturers. On April 1, Year 1, Smiley issued $25,100,000 of five-year, 5% bonds at a market (effective) interest rate of 3%, receiving cash of $27,414,835. Interest is payable semiannually on April 1 and October 1. Required: a. Journalize the entries to record the following. Refer to the Chart of Accounts for exact wording of account titles. 1. Issuance of bonds on April 1, Year 1. 2. First interest payment on October 1, Year 1, and amortization of bond premium for six months, using the straight-line method. (Round to the nearest dollar.) b. Explain why the company was able to issue the bonds for $27,414,835 rather than for the face amount of $25,100,000. Chart of Accounts CHART OF ACCOUNTS Smiley Corporation General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable 122 Allowance for Doubtful Accounts 126 Interest Receivable 127 Notes…arrow_forward

- The following summary transactions occurred during the year for Daisy. Cash received from: Collections from customers $386,000 Interest on notes receivable 9,000 Collection of notes receivable 56, 000 Sale of investments 33,000 Issuance of notes payable 106,000 Cash paid for: Purchase of inventory 166, 000 Interest on notes payable 8,000 Purchase of equipment 91,000 Salaries to employees 96,000 Payment of notes payable 28,000 Dividends to shareholders 1,000 Required: Calculate net cash flows from investing activities. (Amounts to be deducted should be indicated with a minus sign.)arrow_forwardSmiley Corporation wholesales repair products to equipment manufacturers. On April 1, Year 1, Smiley issued $24,200,000 of five-year, 11% bonds at a market (effective) interest rate of 9%, receiving cash of $26,114,936. Interest is payable semiannually on April 1 and October 1. Required: a. Journalize the entries to record the following. Refer to the Chart of Accounts for exact wording of account titles. 1. Issuance of bonds on April 1, Year 1. 2. First interest payment on October 1, Year 1, and amortization of bond premium for six months, using the straight-line method. (Round to the nearest dollar.) b. Explain why the company was able to issue the bonds for $26,114,936 rather than for the face amount of $24,200,000. Chart of Accounts CHART OF ACCOUNTS Smiley Corporation General Ledger ASSETS 110 Cash 111 Petty Cash 121 Accounts Receivable 122 Allowance for Doubtful Accounts 126 Interest Receivable 127 Notes…arrow_forwardPlease help mearrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education