FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

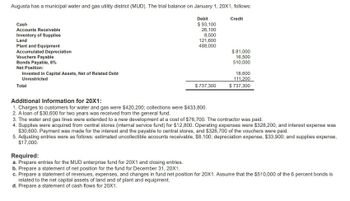

Transcribed Image Text:Augusta has a municipal water and gas utility district (MUD). The trial balance on January 1, 20X1, follows:

Cash

Accounts Receivable

Inventory of Supplies

Land

Plant and Equipment

Accumulated Depreciation

Vouchers Payable

Bonds Payable, 6%

Net Position:

Invested in Capital Assets, Net of Related Debt

Unrestricted

Total

Additional Information for 20X1:

Debit

$ 93,100

26,100

8,500

Credit

121,600

488,000

$ 81,000

16,500

510,000

18,600

111,200

$737,300

$737,300

1. Charges to customers for water and gas were $420,200; collections were $433,800.

2. A loan of $30,600 for two years was received from the general fund.

3. The water and gas lines were extended to a new development at a cost of $76,700. The contractor was paid.

4. Supplies were acquired from central stores (internal service fund) for $12,800. Operating expenses were $328,200, and interest expense was

$30,600. Payment was made for the interest and the payable to central stores, and $326,700 of the vouchers were paid.

5. Adjusting entries were as follows: estimated uncollectible accounts receivable, $8,100; depreciation expense, $33,900; and supplies expense,

$17,000.

Required:

a. Prepare entries for the MUD enterprise fund for 20X1 and closing entries.

b. Prepare a statement of net position for the fund for December 31, 20X1.

c. Prepare a statement of revenues, expenses, and changes in fund net position for 20X1. Assume that the $510,000 of the 6 percent bonds is

related to the net capital assets of land and of plant and equipment.

d. Prepare a statement of cash flows for 20X1.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 7 images

Knowledge Booster

Similar questions

- The Edwards Lake Community Hospital balance sheet as of December 31, 2019, follows. EDWARDS LAKE COMMUNITY HOSPITAL Balance Sheet As of December 31, 2019 Assets Current assets: Cash and Cash Equivalents $ 485,400 Accounts and notes receivable (net of uncollectible accounts of $17,500) 28,200 Inventory 98,200 Total current assets 611,800 Assets limited as to use: Cash $ 18,840 Investments 237,720 Total assets limited as to use 256,560 Property, plant, and equipment: Land 218,600 Buildings (net of accumulated depreciation of $1,624,700) 2,901,500 Equipment (net of accumulated depreciation of $1,026,200) 1,862,200 Total property, plant, and equipment 4,982,300 Total assets $ 5,850,660…arrow_forwardThe amount of Gross Loans is The following are real Iife data extracted from the Housing Bank financial statements. Use them to answer the questions. Additional Information: Accumulated Provislons for Loan Losses (end balance) 250; Number of Outstanding Shares 315,000,000 (315 MIllon) and share price JD9 (Balance Sheet (in Milion (Assets (JD Cash and Balances at Central Banks Balances at Banks and Financial institutions Deposits at Banks and Financial institutions Total Cash and Due trom Depository institutions Trading Investments Available for Sale Investments Held to Maturity Investments, Net Total Securitles 1,478 743 53 2,221 581 745 1,327 Investments in Affilates 2,369 Loans (or Credit Facilities), Net 93 Fixed Assets, Net 6. Doferred income Tax Assets Other Assets Total Asseta (Uabilitles (JD Customers Deposits Banks & Financial Institutions Deposits 71 6,090 4,430 284 Total Deposits Cash Margins 4,714 290arrow_forwardThis is the financial position of Hospital AMIH, Inc. regarding the repayment of its debts. These are the most relevant data of its financial statements: Total revenues $ 245,000 Total expenses $ 145,000 Depreciation $ 10,000 Changes in receivable accounts +$ 50,000 Changes in inventory ($ 20,000) Changes in accounts payable ($ 25,000) Total current liabilities $ 30,000 Total long-term debt $ 45,000 cash flow (total margin + depreciation expense) + interest expense/principal payment + interest expense Calculate the operating cash flow.arrow_forward

- help please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardCity A has the following financial data. What is the Net Asset Ratio? Cash: $ 4,650; Cash Equivalents: $12,350; Market Securities: $3,462; Receivables: $ 12,409; Current Liabilities: $45,690; Net Assets: $139,450; Total Assets: $2,458,360; Total Revenues: $1,367,809; Total Expenditures: $1,450,098; Population: 1,670.arrow_forwardAs loan analyst for Waterway Bank, you have been presented the following information. Toulouse Co. Lautrec Co. Assets Cash $114,000 $328,000 Receivables 230,000 296,000 Inventories 582,000 493,000 Total current assets 926,000 1,117,000 Other assets 493,000 607,000 Total assets $1,419,000 $1,724,000 Liabilities and Stockholders' Equity Current liabilities $314,000 $340,000 Long-term liabilities 385,000 493,000 Capital stock and retained earnings 720,000 891,000 Total liabilities and stockholders' equity $1,419,000 $1,724,000 Annual sales $911,000 $1,440,000 Rate of gross profit on sales 30 % 40 % Each of these companies has requested a loan of $50,000 for 6 months with no collateral offered. Because your bank has reached its quota for loans of this type, only one of these requests is to be granted. Compute the various ratios for each company. (Round answer to 2 decimal places, e.g. 2.25.) Toulouse Co. Lautrec Co. Current ratio :1 :1 Acid-test ratio :1 :1 Accounts receivable turnover…arrow_forward

- Cash receipts totaled $875,000 for property taxes and $292,500 from other revenue. Note: Enter debits before credits. Transaction General Journal Debit Credit 04 .arrow_forwardConsider the following balance sheet for Northern Highland Credit Union (NHCU) before answering parts (i) through (v). Assets ($ million) $ Liabilities ($ million) $ Cash 30 Overnight interbank borrowing (7.00%) 160 T-notes 2 month (7.05%) 60 2-year CD (5%) 20 T-notes 3 months (7.25%) 80 7 year fixed rate Subordinated debt (8.55%) 150 T-notes two-year (7.50%) 60 Equity 25 T-notes 10-year (8.96%) 100 Corporate bonds (>5 years to maturity) 25 Total assets 355 Total liabilities and Equity 355 What is the repricing (funding) gap over the 0-to-6 months maturity bucket?arrow_forwardAssume that on January 1, First Union Co. purchases for cash a $400,000 of Medford City 5% bond at 100 plus accrued interest of $4,500 as an investment on January 1. What accounts would be debited for the $4,500 in the journal entry to record the investment? DATE DESCRIPTION PREF DEBIT CREDIT Jan. 1 (?) $400,000 (?) 4,500 (?) 404,500 Investment in Medford City Bonds Interest receivable Cash Interest revenue O000arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education