FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

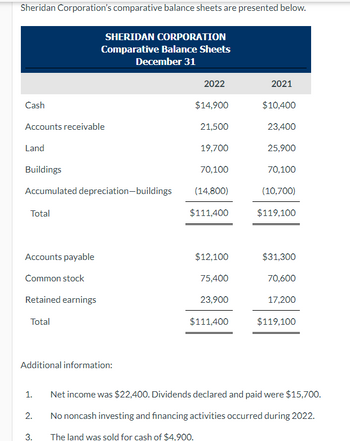

Transcribed Image Text:Sheridan Corporation's comparative balance sheets are presented below.

Cash

Accounts receivable

Land

Buildings

Accumulated depreciation-buildings

Total

Accounts payable

Common stock

Retained earnings

Total

SHERIDAN CORPORATION

Comparative Balance Sheets

December 31

Additional information:

1.

2.

3.

2022

$14,900

21,500

19,700

70,100

(14,800)

$111,400

$12,100

75,400

23,900

$111,400

2021

$10,400

23,400

25,900

70,100

(10,700)

$119,100

$31,300

70,600

17,200

$119,100

Net income was $22,400. Dividends declared and paid were $15,700.

No noncash investing and financing activities occurred during 2022.

The land was sold for cash of $4.900.

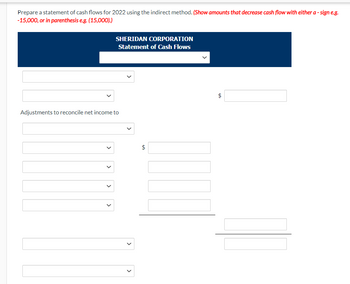

Transcribed Image Text:Prepare a statement of cash flows for 2022 using the indirect method. (Show amounts that decrease cash flow with either a - sign e.g.

-15,000, or in parenthesis e.g. (15,000).)

SHERIDAN CORPORATION

Statement of Cash Flows

Adjustments to reconcile net income to

$

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Nonearrow_forwardThe following table is from the Home Depot Website. Which number should be used for EBIT in order to calculating the component of Operating Cashflows (OCF), for Q1 of 2022 (in millions). THE HOME DEPOT, INC. CONDENSED CONSOLIDATED STATEMENTS OF EARNINGS in millions, except per share data Net sales Cost of sales Gross profit Operating expenses: Selling, general and administrative Depreciation and amortization Total operating expenses Operating income Interest and other (income) expense: Interest income and other, net Interest expense Interest and other, net Earnings before provision for income taxes Provision for income taxes Net earnings O 5560 5929 O4145 O 5781 (Unaudited) $ Three Months Ended May 1, 2022 38,908 $ 25.763 13.145 6,610 606 7,216 5,929 (3) 372 369 5,560 1.329 $ 4,231 May 2, 2021 37,500 24,758 12.742 6,374 587 6.961 5,781 (6) 339 333 5,448 1,303 4,145 4arrow_forwardThe comparative unclassified statement of financial position for Sheridan Ltd. follows: Assets Cash Term deposits (maturing in 60 days) Accounts receivable Inventory Estimated inventory returns Long-term investments Equipment Accumulated depreciation Total assets Liabilities and Shareholders' Equity Accounts payable Refund liability Bank loan payable (non-current) Common shares Retained earnings Total liabilities and shareholders' equity $599,000 Additional information pertaining to 2024: 1. 2. 3. 5. 6. 7. 8. 9. Sheridan Ltd. Statement of Financial Position December 31 10. 11. 2024 $50,400 4,600 Interest expense was $14,000. Income tax expense was $30,000. 90,000 178,000 6,000 79,000 270,000 (79,000) $599,000 $22,000 10,000 165,000 201,000 201,000 2023 $24,100 900 78,500 185,000 No equipment was sold during the year. $6,500 of the bank loan was repaid during the year. Common shares were issued for $21,000. 3,000 100,000 174,000 (30,000) $535,500 $45,000 3,000 171,500 180,000 136,000…arrow_forward

- Please use the image below to calculate the cash flow from assets, cash flow to creditors, and cash flow to stockholders for 2022. Please show all calculations.arrow_forwardFrom the attached image, which deferred revenue do we need to consider for calculations? I can see two of them one is current and the other one is net of the current portion.arrow_forwardplease answer. thanksarrow_forward

- As part of your analysis, you are required to investigate Insignia Corporation Limited’s cash flows. Required: Using the financial statement provided: Prepare Insignia’s Cash Flow Statement for 2020.arrow_forwardCompute free cash flow for 2022. Please show your work, also everything needed is included in the problem.arrow_forwardBased on the following transactions, answer the follosssasdswing questions.Calculate the revenues, expenses, and net income that would be reported on the cash basis. (Enter loss amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Revenues Expenses Net Income / (Loss) i. Inventory costing $79, 800 was purchased on account. ii. Inventory costing $68, 400 was sold for $114,000. Eighty percent of the sales were for cash. iii. Cash collected from credit customers (those who bought on account) totalled $22, 800. iv. A lease was signed at the beginning of the year, requiring monthly payments of $1,100. The rent for the first month was paid when the lease was signed. After that, the $1,100 rent was paid on the last day of each month, to cover the following month. v. Supplies costing $ 6,300 were purchased for cash. At the end of the year, $600 of the supplies were still unused. vi. Wages of $42, 800 were paid during the year. Also, wages of $600…arrow_forward

- Compute KLT's net cash provided by operating activities-indirect method. Complete the partial Statement of Cash Flows. (Use a minus sign or parentheses for amounts that result in a decrease in cash.) KLT Equipment, Inc. Statement of Cash Flows (Partial) Year Ended December 31, 2024 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by Operating Activities: Net Cash Provided by (Used for) Operating Activitiesarrow_forwardSuperior Exercise Equipment, Inc. reported the following financial statements for 2024: (Click the icon to view the income statement.) (Click the icon to view the comparative balance sheet.) i (Click the icon to view additional information.) Complete the statement one section at a time, beginning with the cash flows from operating activities. Superior Exercise Equipment, Inc. Statement of Cash Flows Year Ended December 31, 2024 Cash Flows from Operating Activities: Net Income Adjustments to Reconcile Net Income to Net Cash Provided by (Used for) Operating Activities: Net Cash Provided by (Used for) Operating Activities s example Get more help. Data table Net Sales Revenue Cost of Goods Sold Gross Profit Operating Expenses: Net Income G Superior Exercise Equipment, Inc. Income Statement Year Ended December 31, 2024 Depreciation Expense Other Operating Expenses Total Operating Expenses Print Prepare the company's statement of cash flows-indirect method for the year ended December 31,…arrow_forwardPlease help.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education