FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Prepare a schedule of cost of goods manufactured for the year ended December 31, 2021, clearly showing total manufacturing cost & total

Transcribed Image Text:Part 1

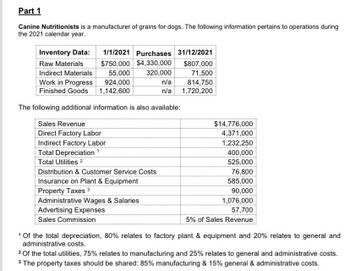

Canine Nutritionists is a manufacturer of grains for dogs. The following information pertains to operations during

the 2021 calendar year.

Inventory Data:

Raw Materials

Indirect Materials

1/1/2021 Purchases 31/12/2021

$750,000 $4,330,000

55,000 320,000

924,000

1,142,600

Work in Progress

Finished Goods

The following additional information is also available:

Sales Revenue

Direct Factory Labor

Indirect Factory Labor

Total Depreciation ¹

Total Utilities 2

Distribution & Customer Service Costs

Insurance on Plant & Equipment

Property Taxes 3

Administrative Wages & Salaries

Advertising Expenses

Sales Commission

n/a

n/a

$807,000

71,500

814,750

1,720,200

$14,776,000

4,371,000

1,232,250

400,000

525,000

76,800

585,000

90,000

1,076,000

57,700

5% of Sales Revenue

1 Of the total depreciation, 80% relates to factory plant & equipment and 20% relates to general and

administrative costs.

2 Of the total utilities, 75% relates to manufacturing and 25% relates to general and administrative costs.

3 The property taxes should be shared: 85% manufacturing & 15% general & administrative costs.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Good Night manufactures comforters. The estimated inventories on January 1 for finished goods, work in process, and materials were $51,000, $28,000, and $33,000, respectively. The desired inventories on December 31 for finished goods, work in process, and materials were $48,000, $35,000, and $29,000, respectively. Direct material purchases were $555,000. Direct labor was $252,000 for the year. Factory overhead was $176,000. Prepare a cost of goods sold budget for Good Night, Inc. Good Night, Inc.Cost of Goods Sold BudgetFor the Year Ending December 31arrow_forwardPlease provide help about this Questionarrow_forwardI. Cost Behavior and Estimation (HP 6) The owners of Mormont Co., Jorah and Lyanna, are expecting sales for August, 2019 to be 250,000 units. Information about Mormont's Sales and costs over the past three months, are as follows: Units Sold Sales Cost of Goods Sold Wage & Salary Expense Admin Expense May O 200,000 300,000 $3,450,000 $5,175,000 $1,575,000 $2,312,500 $950,000 $975,000 $1,300,000 $1,600,000 June July 500,000 $8,625,000 $3,787,500 $1,925,000 $2,500,000 Required: Based on the information provided, provide a projected income statement, using the contribution margin format. 5arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education