FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

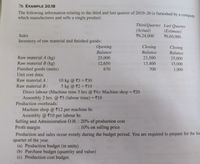

Transcribed Image Text:A EXAMPLE 20.18

The following information relating to the third and last quarter of 2019-20 is furnished by a compan

which manufactures and sells a single product:

Third Quarter Last Quarter

(Actual)

76,24,000

(Estimate)

76,60,000

Sales

Inventory of raw material and finished goods:

Орening

Balance

Closing

Balance

Closing

Balance

Raw material A (kg)

Raw materialB (kg)

Finished goods (units)

25,000

23,500

25,000

15,000

12,650

13,400

670

700

1,000

Unit cost data:

Raw material A:

10 kg @ 33 = 730

5 kg @ 2 = 10

%3D

Raw material B:

%3D

Direct labour (Machine time 5 hrs @ 4): Machine shop = 20

Assembly 2 hrs. @ 75 (labour time) = 710

Production overheads:

%3D

Machine shop @ 12 per machine hr.

Assembly @10 per labour hr.

Selling and Administration O.H. : 20% of production cost

Profit margin

: 10% on selling price

Production and sales occur evenly during the budget period. You are required to prepare for the las

quarter of the year.

(a) Production budget (in units)

(b) Purchase budget (quantity and value)

(c) Production cost budget.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 6 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 74. Subject :- Accountingarrow_forwardCollected these information from Bell Telecom Company (Egypt) producing 3 products"E" ,"F", and "G" for the year 2022:First: Sales:- Estimated sales "E" 11,000,000 EGP "F" 8,400,000 EGP "G" 7,380,000 EGP- Sales price/unit 440 EGP 420 EGP 410 EGPSecond: Production and Inventory (finished goods):- Total estimated sales units for product (E) will allocate for first quarter, second quarter,third quarter, and fourth quarter by equally.- For calculating of ending inventory of Finished Goods (F.G.) of product (E), 1/4 of salesunits of the next quarter are used except the fourth quarter 4/4 of sales units of the samequarter.- Ending inventory of Finished Goods (F.G.) for first quarter = 1250 units for product (E).- Beginning inventory of Finished Goods (F.G.) for first quarter = 2300 units for product (E).- Ending inventory of Finished Goods (F.G.) for product (F) and (G) 1/4 of sales units.- Inventory 31/12/2021 for product (F) and (G) are 1600 and 1100 units, respectivelyThird: Raw materials…arrow_forwardABC Co. is selling its products to customers A, B and C. The following information is given for the year 2018-19. Customer A Customer B Customer C Sales in Lakhs (?) 15.90 20.0 15.0 Number of deliveries (including rush deliveries) 100 40 50 Number of orders 120 50 60 1.2 Average number of hours per delivery (for verification of goods | before loading for delivery) 1 1.30 Number of rush deliveries 2 1 2 Sales commission (% to sales) 4 5 Normal delivery cost is ? 1,250 per delivery. Order processing cost is ? 1,84,000. Verification cost of goods before loading is ? 5,32,500. Rush delivery cost is 180% of normal delivery cost. Variable cost is 75 percent of sales. (i) Present a customer wise profitability statement.arrow_forward

- Make a system for recording the cost of raw materials using the complete Perpetual and Periodic method. note: excel formulas for each workarrow_forwardUramilabenarrow_forwardCollected these information from Bell Telecom Company (Egypt) producing 3 products"E" ,"F", and "G" for the year 2022:First: Sales:- Estimated sales "E" 11,000,000 EGP "F" 8,400,000 EGP "G" 7,380,000 EGP- Sales price/unit 440 EGP 420 EGP 410 EGPSecond: Production and Inventory (finished goods):- Total estimated sales units for product (E) will allocate for first quarter, second quarter,third quarter, and fourth quarter by equally.- For calculating of ending inventory of Finished Goods (F.G.) of product (E), 1/4 of salesunits of the next quarter are used except the fourth quarter 4/4 of sales units of the samequarter.- Ending inventory of Finished Goods (F.G.) for first quarter = 1250 units for product (E).- Beginning inventory of Finished Goods (F.G.) for first quarter = 2300 units for product (E).- Ending inventory of Finished Goods (F.G.) for product (F) and (G) 1/4 of sales units.- Inventory 31/12/2021 for product (F) and (G) are 1600 and 1100 units, respectivelyThird: Raw materials…arrow_forward

- Prepare a schedule of cost of goods manufactured for the year ended December 31, 2021, clearly showing total manufacturing cost & total manufacturing costs to account for and What is the unit product cost if Canine Nutritionists manufactured 18,500 bags of grains for the year?arrow_forwardAssume General Electric Company reports the following footnote in its 10-K report. December 31 (In millions) 2016 2015 Raw materials and work in process $5,527 $5,042 Finished goods 5,152 4,806 Unbilled shipments 333 402 11,012 10,250 Less revaluation to LIFO (697) (661) $10,315 $9,589 The company reports its inventories using the LIFO inventory costing method.Assume GE has a 35% income tax rate. As of the 2016 year-end, how much has GE saved in taxes by choosing LIFO over FIFO method for costing inventory?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education