FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

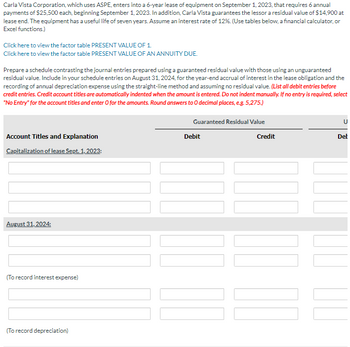

Transcribed Image Text:Carla Vista Corporation, which uses ASPE, enters into a 6-year lease of equipment on September 1, 2023, that requires 6 annual

payments of $25,500 each, beginning September 1, 2023. In addition, Carla Vista guarantees the lessor a residual value of $14,900 at

lease end. The equipment has a useful life of seven years. Assume an interest rate of 12%. (Use tables below, a financial calculator, or

Excel functions.)

Click here to view the factor table PRESENT VALUE OF 1.

Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE.

Prepare a schedule contrasting the journal entries prepared using a guaranteed residual value with those using an unguaranteed

residual value. Include in your schedule entries on August 31, 2024, for the year-end accrual of interest in the lease obligation and the

recording of annual depreciation expense using the straight-line method and assuming no residual value. (List all debit entries before

credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select

"No Entry" for the account titles and enter O for the amounts. Round answers to O decimal places, e.g. 5,275.)

Account Titles and Explanation

Capitalization of lease Sept. 1, 2023:

August 31, 2024:

(To record interest expense)

(To record depreciation)

Guaranteed Residual Value

U

Debit

Credit

Det

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On January 1, 2022, Sandhill Co. had a balance of $411,000 of goodwill on its balance sheet that resulted from the purchase of a small business in a prior year. The goodwill had an indefinite life. During 2022, the company had the following additional transactions. Jan. 2 Purchased a patent (7-year life) $307,650. July 1 Sept. 1 Acquired a 9-year franchise; expiration date July 1, 2,031, $576,000. Research and development costs $178,500.arrow_forwardSpring Garden Flowers had the following balances at December 31, 2024, before the year-end adjustments: E (Click the icon to view the balances.) The aging of accounts receivable yields the following data: E (Click the icon to view the accounts receivable aging schedule.) Requirements Journalize Spring's entry to record bad debts expense for 2024 using the aging-of-receivables method. 1. 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Requirement 1. Journalize Spring's entry to record bad debts expense for 2024 using the aging-of-receivables method. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Date Accounts Debit Credit Dec. 31 Data Table Accounts Receivable Allowance for Bad Debts 66,000 1,615 Requirement 2. Prepare a T-account to compute the ending balance of Allowance for Bad Debts. Allowance for Bad Debts Print Done Data Table Age of Accounts Receivable 0-60 Days Over 60 Days Total…arrow_forwardLaura Leasing Company signs an agreement on January 1, 2020, to lease equipment to Swifty Company. The following information relates to this agreement. 1. 2. 3. 4. 5. 6. The term of the non-cancelable lease is 3 years with no renewal option. The equipment has an estimated economic life of 5 years. The fair value of the asset at January 1, 2020, is $70,000. The asset will revert to the lessor at the end of the lease term, at which time the asset is expected to have a residual value of $7,000, none of which is guaranteed. The agreement requires equal annual rental payments of $21,827.58 to the lessor, beginning on January 1, 2020. The lessee's incremental borrowing rate is 4%. The lessor's implicit rate is 3% and is unknown to the lessee. Swifty uses the straight-line depreciation method for all equipment. Click here to view factor tables. Prepare all of the journal entries for the lessee for 2020 to record the lease agreement, the lease payments, and all expenses related to this lease.…arrow_forward

- Nonearrow_forwardSalaur Company is evaluating a lease arrangement being offered by TSP Company for use of a computer system. The lease is noncancelable, and in no case does Salaur receive title to the computers during or at the end of the lease term. The lease starts on January 1, 2017, with the first rental payment due on January 1, 2017. Additional information related to the lease is as follows. Check the below image for additional information AccountingAnalyze the lease capitalization criteria for this lease for Salaur Company. Prepare the journal entry for Salaur on January 1, 2017.AnalysisBriefly discuss the impact of the accounting for this lease for two common ratios: return on assets and debt to total assets.PrinciplesWhat element of faithful representation (completeness, neutrality, free from error) is being addressed when a company like Salaur evaluates lease capitalization criteria?arrow_forwardOn January 1, 2024, QuickStream Communications leased telephone equipment from Digium, Incorporated Digium's cash selling price for the equipment is $1,959,867. The lease agreement specifies six annual payments of $450,000 beginning December 31, 2024, and on each December 31 thereafter through 2029. The six-year lease is equal to the estimated useful life of the equipment. The contract specifies that lease payments for each year will increase by the higher of (a) the increase in the Consumer Price Index for the preceding year or (b) 2%. The CPI at the beginning of the lease is 120. Digium routinely leases equipment to other firms. The interest rate in these lease arrangements is 10%. Note: Use tables, Excel, or a financial calculator. ( FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Prepare the appropriate journal entries for QuickStream to record the lease at its beginning date of January 1, 2024 - - 1 Record the beginning of the lease for QuickStream…arrow_forward

- Assume that the business has received notification on 15 April 2020 that a debtor owing $1,850 has declared bankruptcy. On 22 August 2020 the debtor unexpectedly remits full payment for the previously written-off account. Prepare the general journal entry to re-establish this debt and record payment under each of the following methods: (i) The direct write-off method (ii) The allowance methodarrow_forward990.arrow_forwardI need help on the arrows where I am pointing at.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education