FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

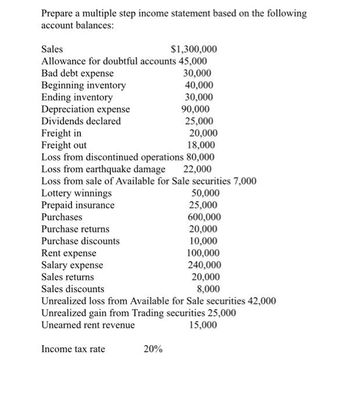

Transcribed Image Text:Prepare a multiple step income statement based on the following

account balances:

Sales

$1,300,000

Allowance for doubtful accounts 45,000

Bad debt expense

Beginning inventory

Ending inventory

Depreciation expense

Dividends declared

Freight in

Freight out

Prepaid insurance

Purchases

Purchase returns

Purchase discounts

Rent expense

Salary expense

Sales returns

Sales discounts

20,000

18,000

Loss from discontinued operations 80,000

Loss from earthquake damage 22,000

Loss from sale of Available for Sale securities 7,000

Lottery winnings

30,000

40,000

30,000

Income tax rate

90,000

20%

25,000

Unrealized loss from Available for Sale securities 42,000

Unrealized gain from Trading securities 25,000

Unearned rent revenue

15,000

50,000

25,000

600,000

20,000

10,000

100,000

240,000

20,000

8,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A manufacturer reports the data below. Accounts payable Accounts receivable Inventory Net sales $ 9,649 18,474 5,455 233,607 Cost of goods sold 138,200 (1) Compute the number of days in the cash conversion cycle. (2) Is the company more efficient at managing cash than its competitor who has a cash conversion cycle of 14 days? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the number of days in the cash conversion cycle. Note: Use 365 days in a year. Round calculations to the nearest whole day. Cash conversion cycle daysarrow_forwardshany market recorded the following events involving a recent purchase of inventory received goods for$30,000, terms 2/10, n/30 returned $600 of the shipment for credit paid $150 freight on the shipment paid the invoice within the discount period as a result of these events, the company's inventory: increased byarrow_forwardPlease show your workarrow_forward

- AB Ltd. has MCC has prepared the Income statement including the following data (all sales are on account): Sales $80,000 Cost of Goods Sold Gross Profit Expenses Net Profit $50,000 $ 25,000 $ 10,000 $15,000 The comparative balance sheet shows the following data (by definition, accounts payable relates to merchandise purchases only): End of Year Beginning of Year Accounts Receivables (net) Inventory Prepaid Expenses Accounts Payable $7,000 $3,000 $2,000 $1,140 $5,280 $2,000 $1,000 $1,500 Required 1: What is the amount of Cash received from Customers? $ Required 2: What is the amount of Cash paid for merchandise purchase? $arrow_forwardUse the following information for Transylvania Railroad: Long-term debt ratio: 0.5 • Times-interest-earned: 8.0 Current ratio: 1.5 • Quick ratio: 1.0 ⚫ Cash ratio: 0.3 • Inventory turnover: 4.9 • Receivables collection period: 73.0 days • Tax rate = 0.40 Work out the missing entries. For this problem, use the following definitions: Inventory turnover = COGS ÷ average inventory Receivables collection period = average receivables (sales + 365). Complete this question by entering your answers in the tabs below. Balance Sheet Income Statement Work out the missing entries. Note: Enter your answers in millions. Do not round intermediate calculations. Round your answers to 2 decimal places. Balance Sheet ($ in millions) December 2020 December 2019 Cash 21.00 Accounts receivable 34.10 Inventory 27.50 Total current assets 82.60 Fixed assets (net) 111.00 Total 193.60 Notes payable 31.00 20.10 Accounts payable 26.00 15.10 Total current liabilities 35.20 Long-term debt 37.90 Equity 120.50 Total…arrow_forwardNeed help with this onearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education