FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

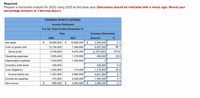

Transcribed Image Text:Required:

Prepare a horizontal analysis for 2022 using 2021 as the base year. (Decreases should be indicated with a minus sign. Round your

percentage answers to 1 decimal place.)

FEDERER SPORTS APPAREL

Income Statement

For the Years Ended December 31

Year

Increase (Decrease)

2022

2021

Amount

%

Net sales

$

18,900,000 $

15,600,000

$

3,300,000

2.1

Cost of goods sold

13,154,400

7,066,800

6,087,600

86.1

Gross profit

5,745,600

8,533,200

(2,787,600)

(32.6):

Operating expenses

1,625,400

1,216,800

408,600

33.5

Depreciation expense

1,020,600

1,020,600

Inventory write-down

226,800

226,800

0.0

Loss (litigation)

1,530,900

312,000

1,218,900

39.0

Income before tax

1,341,900

5,983,800

4,641,900

0.7

Income tax expense

472,500

2,028,000

1,555,500

0.7

Net income

$

869,400 $

3,955,800 $

3,086,400

0.7

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Solve this problem that is in the image belowarrow_forwardHorizontal analysis (trend analysis) percentages for Pharoah Company's sales, cost of goods sold, and expenses are listed here. Horizontal Analysis 2023 Sales revenue Cost of goods sold Expenses 97.5 % Net income 104.0 107.0 2022 104.8 % 97.0 97.3 2021 100.0 % 100.0 100.0 Did Pharoah's net income increase, decrease, or remain unchanged over the 3-year period?arrow_forwardCalculate the quick ratio for Los Altos, Ic., for both years, using the financial statements displayed below. Round to nearest hundredth. 2020 2019 Quick Ratio Did the company's ability to pay its current liabilities improve over the two years? No + Los Altos, Inc. Income Statement For Years Ended December 31, 2020 and 2019 (in millions) 2020 2019 Net sales $15,000 $14,250 Cost of goods sold 7,425 7,020 Gross profit 7,575 7,230 Selling and administrative expenses 3,780 3,645 Income from operations 3,795 3,585 Interest expense 405 338 Income before income taxes 3,390 3,247 Income tax expense 567 540 Net income $2 823 $2 707arrow_forward

- only typed solutionarrow_forwardPlease help me with the attached problemarrow_forwardQuick Ratio Calculate the quick ratio for Los Altos, Ic., for both years, using the financial statements displayed below. Round to nearest hundredth. 2020 2019 Quick Ratio Did the company's ability to pay its current liabilities improve over the two years? Los Altos, Inc. Income Statement For Years Ended December 31, 2020 and 2019 (in millions) 2020 2019 Net sales $13,000 $12,350 Cost of goods sold 6,600 6,240 Gross profit 6,400 6,110 Selling and administrative expenses 3,360 3,240 Income from operations 3,040 2,870 Interest expense 360 300 Income before income taxes 2,680 2,570 Income tax expense 504 480 Net income $2,176 $2,090 Los Altos, Inc. Balance Sheet December 31, 2020 and 2019 (in millions) 2020 2019 Assets Current assets Cash and cash equivalents $240 $480 Accounts receivable 1,080 960 Inventory 600 780 Other current assets 480 300 Total current assets 2,400 2,520 Property, plant, & equipment (net) 3,120 3,000 Other assets 6,840 7,080 Total assets $12,360 $12,600 Liabilities…arrow_forward

- If Ivanhoe Company had net income of $627,000 in 2021 which reflected a 20% increase in net income over 2020, what was its 2020 net income? (Round answer to O decimal places, e.g. 5,250.) Net income in 2020 $arrow_forwardSummary financial information for Gandaulf Company is as follows. Compute the amount and percentage changes in 2022 using horizontal analysis, assuming 2024 is the base year. (Enter negative amounts and percentages using either a negative sign preceding the number e.g. -45,-45% or parentheses e.g. (45), (45%). Round percentages to 2 decimal places, e.g. 1.25%.) Current Assets Dec. 31, 2022 Dec. 31, 2024 $191,100 $210,000 $ Plant Assets 1,058,600 790,000 Total assets $1,249,700 $1,000,000 $ Increase (Decrease) in 2022 Amount Percent % % %arrow_forwardManero Company included the following information in its annual report: 2019 2018 Sales $178,400 $162,500 102,500 Cost of goods sold 115,000 Operating expenses 50,000 50,000 Operating income 13,400 10,000 In a trend income statement for 2017, where 2017 is the base year, sales are expressed as: Multiple Choice 150.5% O100.0% 84,4% 92.6% 2017 $155,500 100,000 45,000 10,500arrow_forward

- The income statements for Galaxy Tennis for the years ending December 31, 2021 and 2020, are provided below.Required:1. Complete the “Amount” and “%” columns to be used in a horizontal analysis of Galaxy Tennis income statement. (Decreases should be indicated by a minus sign. Round your percentage answers to 1 decimal place.) GALAXY TENNIS Income Statements For the Years Ended December 31 Increase (Decrease) 2021 2020 Amount % Net sales $6,030,000 $6,170,000 Cost of goods sold 2,810,000 2,900,000 Gross profit 3,220,000 3,270,000 Operating expenses 1,490,000 1,374,000 Operating income 1,730,000 1,896,000 Other income (expense) 56,000 77,000 Income before tax 1,786,000 1,973,000 Income tax expense 382,000 431,000 Net income $1,404,000 $1,542,000arrow_forwardCalculate Swifty's gross profit percentage and percentage markup on cost for each fiscal year. (Round answers to 2 decimal places, eg. 52.75.) Percentage gross profit Percentage markup on cost Fiscal 2023 35.74 % 3.43 % Fiscal 2022 36.13 % 5.67 %arrow_forwardFollowing are forecasts of Illinois Tool Works Inc. sales, net operating profit after tax (NOPAT), and net operating assets (NOA) as of December 31, 2018. Note: Complete the entire question in Excel and format each answer to two decimal places. Then enter the answers into the provided spaces below with two decimal places. Reported Forecast Horizon Period $ millions 2018 2019 2020 2021 2022 Sales $14,030 $14,871 $15,763 $16,710 $17,712 NOPAT NOA Terminal Period $18,066 2,711 2,880 3,053 3,236 3,430 8,989 9,527 10,099 10,705 11,347 3,499 11,574 Answer the following requirements with the following assumptions: Assumptions Terminal period growth rate Discount rate (WACC) 2% 7.35% Common shares outstanding 328.1 million Net nonoperating obligations (NNO) $5,894 million (a) Estimate the value of a share of ITW's common stock using the residual operating income model (ROPI) model as of December 31, 2018. Forecast Horizon ($ millions) Reported 2018 Terminal 2019 2020 2021 2022 Period ROPI…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education