Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Calculate the average collection period ratio for Urban Outfitters for both 2018 and 2019. Be sure to round your answer to 2 decimal places.

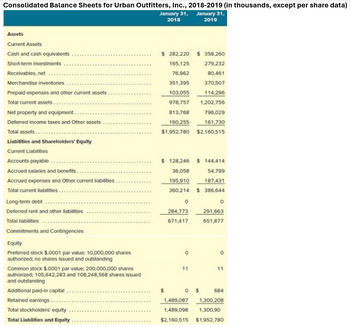

Transcribed Image Text:Consolidated Balance Sheets for Urban Outfitters, Inc., 2018-2019 (in thousands, except per share data)

January 31, January 31,

Assets

Current Assets

Cash and cash equivalents

Short-term investments

2018

2019

$ 282,220 $ 358,260

165,125

279,232

Receivables, net...

76,962

80,461

Merchandise inventories

351,395

370,507

Prepaid expenses and other current assets.

103,055

114,296

Total current assets....

978,757

1,202,756

Net property and equipment..

813,768

796,029

160,255

161,730

Deferred income taxes and Other assets

Total assets.......

Liabilities and Shareholders' Equity

Current Liabilities

Accounts payable

Accrued salaries and benefits...

Accrued expenses and Other current liabilities..

Total current liabilities...

Long-term debt

Deferred rent and other liabilities

$1,952,780 $2,160,515

$ 128,246 $144,414

36,058

195.910

360,214 $ 386,644

54,799

187,431

о

°

284,773

291,663

671,417

651,877

Total liabilities

Commitments and Contingencies

Equity

Preferred stock $.0001 par value; 10,000,000 shares

authorized; no shares issued and outstanding

Common stock $.0001 par value; 200,000,000 shares

authorized; 105,642,283 and 108,248,568 shares issued

and outstanding

Additional paid-in capital

Retained earnings...

Total stockholders' equity

Total Liabilities and Equity

$

11

11

0 $

684

1,489,087 1,300,208

1,489,098 1,300,90

$2,160,515 $1,952,780

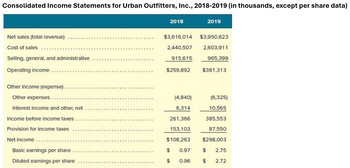

Transcribed Image Text:Consolidated Income Statements for Urban Outfitters, Inc., 2018-2019 (in thousands, except per share data)

2018

2019

Net sales (total revenue)

$3,616,014 $3,950,623

Cost of sales

2,440,507 2,603,911

Selling, general, and administrative.

915,615

965,399

Operating income

$259,892 $381,313

Other income (expense)..

Other expenses.

(4,840)

(6,325)

Interest income and other, net

Income before income taxes..

Provision for income taxes

6,314

10,565

261,366

385,553

153,103

87,550

Net income.

$108,263

$298,003

Basic earnings per share

$

0.97

$

2.75

Diluted earnings per share

$

0.96

$ 2.72

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Write a brief report about the accruals and deferrals of Amazon’s 2018 annual report.arrow_forwardThen, prepare the journal entry assuming the payment is made within 10 days (the discount period).arrow_forwardTuition of $2075 will be due when the spring term begins in 6 months. What amount should a student deposit today, at 7.51%, to have enough to pay the tuition? The student should deposit $ (Simplify your answer. Round to the nearest dollar as needed.)arrow_forward

- A person deposits $2000 every year into an account which has an interest rate of 2.5% annually. If this person made their first deposit on August 1, 2000 and plans to make their last on August 1, 2029. How much will be in the account on August 1, 2030?arrow_forwardplease answer all partarrow_forwardIn 2019, the average salary of petroleum engineers was $98,400. Predict what their salary will be in 2028 if their salary increases only by the inflation rate. Assume the inflation rate over this time period is constant at 3.8% per year. The salary of the petroleum engineers will be $ .arrow_forward

- How do you calculate quarterly hour system?arrow_forwardWhat is the guest ledger? Give an example of something included in it. Describe how you would post a check for prepayment of two nights’ room rate.arrow_forward2. Say you purchase a computer for $1300 at 7% interest and want to have it paid off in 48 months. Use the simple interest formula. a) Calculate the monthly payment necessary to pay off the principal and the interest. b) Calculate the APR. Write out the formula first to show your work.arrow_forward

- How much do you need to deposit on April 1, 2019, so that you can make a series of monthly withdrawals of $500? The first withdrawal will be made on May 1, 2025, and the last is made on May 1, 2030. The interest rate is 10% compounded monthly.arrow_forwardAssuming that the cost of medical care rises 7 percent over the next year, what would the actuarially fair premium be for the next year (2019)? Total expected expenditure in 2019 = ?arrow_forwardAn invoice dated January 25 with terms 2/10 -20 X. Find the final discount rate and the next payment date. The net payment date is 20 days after the final discount date. Assume it is not a leap year final dicount- net payment-arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education