FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

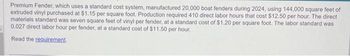

Transcribed Image Text:Premium Fender, which uses a standard cost system, manufactured 20,000 boat fenders during 2024, using 144,000 square feet of

extruded vinyl purchased at $1.15 per square foot. Production required 410 direct labor hours that cost $12.50 per hour. The direct

materials standard was seven square feet of vinyl per fender, at a standard cost of $1.20 per square foot. The labor standard was

0.027 direct labor hour per fender, at a standard cost of $11.50 per hour.

Read the requirement.

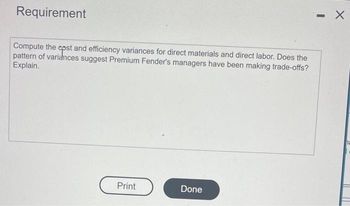

Transcribed Image Text:Requirement

Compute the

opsta

and efficiency variances for direct materials and direct labor. Does the

pattern of variances suggest Premium Fender's managers have been making trade-offs?

Explain.

Print

Done

I

X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Modern Lighting Inc. manufactures lighting fixtures, using lean manufacturing methods. Style Omega has a materials cost per unit of $140. The budgeted conversion cost for the year is $180,600 for 2,150 production hours. A unit of Style Omega requires 15 minutes of cell production time. The following transactions took place during June: 1. Materials were acquired to assemble 850 Style Omega units for June. 2. Conversion costs were applied to 850 Style Omega units of production. 3. 835 units of Style Omega were completed in June. 4. 820 units of Style Omega were sold in June for $191 per unit. Required: a. Determine the budgeted cell conversion cost per hour. b. Determine the budgeted cell conversion cost per unit. c. Journalize the summary transactions (1)-(4) for June. Refer to the Chart of Accounts for exact wording of account titles. CHART OF ACCOUNTS Modern Lighting Inc. General Ledger ASSETS 110 Cash 120 Accounts Receivable…arrow_forwardTikTok Electronics manufactures an aluminium fibre tripod model “TRI-X” which sells for $1,600. The production cost computed per unit under traditional costing for each model in 2019 was as follows: Traditional Costing TRIX Direct Materials $700 Direct Labour ($20/hour) $120 Manufacturing overhead ($38 per DLH) $228 Total per unit cost $1, 048 In 2019, TikTok Electronics manufactured 26,000 units of TRI-X. Under traditional costing, the gross profit on TRI-X was $552 ($1,600-$1,048). Management is considering phasing out TRI- X as it has continuously failed to reach the gross profit target of $600. Before finalizing its decision, management asks TikTok Electronics management accountant to prepare ananalysis using activity-based costing (ABC). The management accountant accumulates the following information about overhead for the year ended December 31, 2019. Activity Cost Pools Cost Drivers…arrow_forwardGreat Fender, which uses a standard cost system, manufactured 20,000 boat fenders during 2024, using 142,000 square feet of extruded vinyl purchased at $1.20 per square foot. Production required 440 direct labor hours that cost $14.50 per hour. The direct materials standard was seven square feet of vinyl per fender, at a standard cost of $1.25 per square foot. The labor standard was 0.027 direct labor hour per fender, at a standard cost of $13.50 per hour. Read the requirement. Begin with the cost variances. Select the required formulas, compute the cost variances for direct materials and direct labor, and identify whether each variance is favorable (F) or unfavorable (U). (Abbreviations used: AC = actual cost; AQ= actual quantity, FOH = fixed overhead; SC standard cost; SQ = standard quantity.) Direct materials cost variance Direct labor cost variance Formula Variance Requirement Compute the cost and efficiency, variances for direct materials and direct labor Does the pattern of…arrow_forward

- Old Camp Company manufactures awnings for its own line of tents. The company currently is operating at capacity and received an offer from one of its suppliers to make the 11,000 awnings it needs for $20 each. Old Camp’s costs for making the awning are $7 in direct materials and $6 in direct labor. Variable manufacturing overhead is 75 percent of direct labor. If Old Camp accepts the offer, $37,000 of fixed manufacturing overhead currently being charged to the awnings will have to be absorbed by other product lines. Required: Complete the incremental analysis for the decision to make or buy the awnings in the table provided below. Should Old Camp continue to manufacture the awnings, or should it purchase the awnings from the supplier? Assuming the capacity released by purchasing the awnings allowed Old Camp to record a profit of $35,000, should Old Camp continue to manufacture or purchase the awnings?arrow_forwardOld Camp Company manufactures awnings for its own line of tents. The company is currently operating at capacity and has received an offer from one of its suppliers to make the 10,000 awnings it needs for $18 each. Old Camp’s costs to make the awning are $7 in direct materials and $5 in direct labor. Variable manufacturing overhead is 80 percent of direct labor. If Old Camp accepts the offer, $32,000 of fixed manufacturing overhead currently being charged to the awnings will have to be absorbed by other product lines.Required:1. Complete the incremental analysis for the decision to make or buy the awnings in the table provided below. Make Buy Net Income Increase (Decrease) Direct Materials Direct Labor Variable OH Fixed OH Purchase Price Total 2. Should Old Camp continue to manufacture the awnings or should they purchase the awnings from the supplier?3. Assuming that the capacity released by purchasing the awnings…arrow_forwardro Fender, which uses a standard cost system, manufactured 20,000 boat fenders during 2016, using 146,000 square feet of extruded vinyl purchased at $1.05 per square foot. Production required 410 direct labor hours that cost $15.00 per hour. The direct materials standard was seven square feet of vinyl per fender, at a standard cost of $1.10 per square foot. The labor standard was 0.026 direct labor hour per fender, at a standard cost of $14.00 per hour. Compute the cost and efficiency variances for direct materials and direct labor. Does the pattern of variances suggest Pro Fender's managers have been making trade-offs? Explain.arrow_forward

- TikTok Electronics manufactures an aluminium fibre tripod model “TRI-X” which sells for $1,600. The production cost computed per unit under traditional costing for each model in 2019 was as follows:Traditional CostingTRIXDirect Materials$700Direct Labour ($20/hour)$120Manufacturing overhead ($38 per DLH)$228Total per unit cost$1, 048In 2019, TikTok Electronics manufactured 26,000 units of TRI-X. Under traditional costing, the gross profit on TRI-X was $552 ($1,600-$1,048). Management is considering phasing out TRI-X as it has continuously failed to reach the gross profit target of $600. Before finalizing its decision, management asks TikTok Electronics management accountant to prepare an3analysis using activity-based costing (ABC). The management accountant accumulates the following information about overhead for the year ended December 31, 2019.Activity Cost PoolsCost DriversEstimated OverheadExpected Use of Cost DriversPurchasingNumber of orders$1,200,00040,000Machine setupsNumber of…arrow_forwardWhispering Winds Company has developed the following standard costs for its product for 2022: WHISPERING WINDSCOMPANY Standard Cost Card Product A Cost Component Standard Quantity Standard Price Standard Cost Direct materials 4 pounds $3 $12 Direct labor 3 hours 8. 24 Manufacturing overhead 3 hours 4 12 $48 The company expected to produce 31,700 units of Product A in 2022 using 95,900 direct labor hours. Actual results for 2022 are as follows: 33,000 units of Product A were produced. Actual direct labor costs were $794,580 for 96,900 direct labor hours worked. Actual direct materials purchased and used during the year cost $369,875 for 134,500 pounds. Actual variable overhead incurred was $165,000 and actual fixed overhead incurred was $220,000. Compute the following variances showing all computations to support your answers. Indicate whether the variances are unfavorable. Compute the following variances showing all computations to support your answers. Indicate whether the variances…arrow_forwardSchultz Electronics manufactures two ultra high-definition television models: the Royale which sells for $ 1,480, and a new model, the Majestic, which sells for $ 1,270. The production cost computed per unit under traditional costing for each model in 2020 was as follows. Traditional Costing Royale Majestic Direct materials $ 650 $ 420 Direct labor ($20 per hour) 120 100 Manufacturing overhead ($ 42 per DLH) 252 210 Total per unit cost $ 1,022 $ 730 In 2020, Schultz manufactured 25,000 units of the Royale and 10,000 units of the Majestic. The overhead rate of $ 42 per direct labor hour was determined by dividing total estimated manufacturing overhead of $ 8,476,500 by the total direct labor hours (200,000) for the two models.Under traditional costing, the gross profit on the models was Royale $ 458 ($ 1,480 – $ 1,022) and Majestic $ 540 ($ 1,270 – $ 730). Because of this difference, management is considering phasing out the Royale…arrow_forward

- Leeds Corp. produces product BR500. Shamokin expects to sell 10,000 units of BR500 and to have an ending finished inventory of 2,000 units. Currently, it has a beginning finished inventory of 800 units. Each unit of BR500 requires two labor operations, one labor hour of assembling and two labor hours of polishing. The direct labor rate for assembling is $10 per assembling hour and the direct labor rate for polishing is $12.50 per polishing hour. The expected number of hours of direct labor for BR500 for this period are O 8,800 hours of assembling; 17,600 hours of polishing O 11,200 hours of assembling: 22,400 hours of polishing 17,600 hours of assembling: 8,800 hours of polishing O 22,400 hours of assembling: 11,200 hours of polishingarrow_forwardTikTokElectronics manufactures an aluminium fibre tripod model“TRI-X” which sells for $1,600.The production cost computed per unit under traditional costing for each model in 2019was as follows: Traditional Costing TRIX Direct Materials $700 Direct Labour($20/hour) $120 Manufacturing overhead($38 per DLH) $228 Total per unit cost $1,048 In 2019, TikTokElectronics manufactured 26,000units of TRI-X. Under traditional costing, the gross profit on TRI-X was $552 ($1,600-$1,048). Management is considering phasing out TRI-X as it has continuously failed to reach the gross profit target of $600. Before finalizing its decision, management asks TikTokElectronics management accountant to prepare an analysis using activity-based costing (ABC). The management accountant accumulates the following information…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education