Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

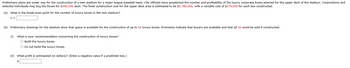

Transcribed Image Text:Preliminary plans are under way for the construction of a new stadium for a major league baseball team. City officials have questioned the number and profitability of the luxury corporate boxes planned for the upper deck of the stadium. Corporations and

selected individuals may buy the boxes for $340,000 each. The fixed construction cost for the upper deck area is estimated to be $5,780,000, with a variable cost of $170,000 for each box constructed.

(a) What is the break-even point for the number of luxury boxes in the new stadium?

(b) Preliminary drawings for the stadium show that space is available for the construction of up to 52 luxury boxes. Promoters indicate that buyers are available and that all 52 could be sold if constructed.

(i) What is your recommendation concerning the construction of luxury boxes?

O Build the luxury boxes.

O Do not build the luxury boxes.

(ii) What profit is anticipated (in dollars)? (Enter a negative value if a predicted loss.)

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Temporary Housing Services Incorporated (THSI) is considering a project that involves setting up a temporary housing facility in an area recently damaged by a hurricane. THSI will lease space in this facility to various agencies and groups providing relief services to the area. THSI estimates that this project will initially cost $4 million to set up and will generate $20 million in revenues during its first and only year in operation (paid in one year). Operating expenses are expected to total $8 million during this year and depreciation expense will be another $2 million. THSI will require no working capital for this investment. THSI's tax-rate is 20% Assume that THSI's cost of capital for this project is 15%. The net present value (NPV) of this temporary housing project is closest to:arrow_forwardRefer to Picture, Please answer Part A and Barrow_forwardThe city of Bloomington is deciding if they are going to be able to justify an additional street light. The cost of the light to install is $14,000. City officials believe it will reduce the death rate at that intersection from 1.0% to 0.6%. Our guideline for valuing human life is $8M per person. What is the net of this cost benefit proposal? A. 32,000 B. 18,000 C. (18,000) D. (32,000)arrow_forward

- Temporary Housing Services Incorporated (THSI) is considering a project that involves setting up a temporary housing facility in an area recently damaged by a hurricane. THSI will lease space in this facility to various agencies and groups providing relief services to the area. THSI estimates that this project will initially cost $4.87 million to setup and will generate $20 million in revenues during its first and only year in operation (paid in one year). Operating expenses are expected to total $12 million during this year and depreciation expense will be another $3 million. THSI will require no working capital for this investment. THSI's marginal tax rate is 35%. Assume that THSI's cost of capital is 14.6% p.a. Compute the NPV of the temporary housing facility to the nearest dollararrow_forwardThe city of Columbia is considering extending the runways of its municipal airport so that commercial jets can use the facility. The land necessary for the runway extension is currently a farmland that can be purchased for $350,000. Construction costs for the runway extension are projected to be $600,000, and the additional annual maintenance costs for the extension are estimated to be $22,500. If the runways are extended, a small terminal will be constructed at a cost of $250,000. The annual operating and maintenance costs for the terminal are estimated at $75,000. Finally, the projected increase in flights will require the addition of two air traffic controllers at an annual cost of $100,000. Annual benefits of the runway extension have been estimated as follows (shown): Apply the B–C ratio method with a study period of 20 years and a MARR of 10% per year to determine whether the runways at Columbia Municipal Airport should be extended.arrow_forwardPlease see image for question.arrow_forward

- Can some one please help me to answer each question correctly? please and thank you.arrow_forwardAn electric utility is considering a new power plant in northern Arizona. Power from the plant would be sold in the Phoenix area, where it is badly needed. Because the firm has received a permit, the plant would be legal; but it would cause some air pollution. The company could spend an additional $40 million at Year 0 to mitigate the environmental problem, but it would not be required to do so. The plant without mitigation would require an initial outlay of $240.20 million, and the expected cash inflows would be $80 million per year for 5 years. If the firm does Invest in mitigation, the annual inflows would be $84.06 million. Unemployment in the area where the plant would be built is high, and the plant would provide about 350 good jobs. The risk adjusted WACC is 19%. a. Calculate the NPV and IRR with mitigation. Enter your answer for NPV in millions. For example, an answer of $10,550,000 should be entered as 10.55. Negative values, if any, should be indicated by a minus sign. Do not…arrow_forwardgreat lakes clinic has been asked to provide exclusive healthcare services for next year's world exposition. although flattered by the request, the clinic's managers want to conduct a financial analysis of the project. there will be an up front cost of $160,000 to get the clinic in operation. then, a net cash inflow of $1 million is expected from operations in each of the two years of the exposition. however, the clinic has to py the organizers of the exposition a fee for the marketing value of the opportunity. this fee, which must be paid at th end of the second year, is $2 million.a. what are the cash flows associated with the project?b. what is the project's IRR?c. assuming a project cost of capital of 10 percent, what is the project's NPV?arrow_forward

- [The following information applies to the questions displayed below.] Washington County's Board of Representatives is considering the construction of a longer runway at the county airport. Currently, the airport can handle only private aircraft and small commuter jets. A new, long runway would enable the airport to handle the midsize jets used on many domestic flights. Data pertinent to the board's decision appear below. Cost of acquiring additional land for runway Cost of runway construction Cost of extending perimeter fence Cost of runway lights Annual cost of maintaining new runway Annual incremental revenue from landing fees In addition to the preceding data, two other facts are relevant to the decision. First, a longer runway will require a new snowplow, which will cost $105,000. The old snowplow could be sold now for $10,500. The new, larger plow will cost $6,000 more in annual operating costs. Second, the County Board of Representatives believes that the proposed long runway,…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardWashington County’s Board of Representatives is considering the construction of a longer runway at the county airport. Currently, the airport can handle only private aircraft and small commuter jets. A new, long runway would enable the airport to handle the midsize jets used on many domestic flights. Data pertinent to the board’s decision appear below. Cost of acquiring additional land for runway $ 70,000 Cost of runway construction 200,000 Cost of extending perimeter fence 29,840 Cost of runway lights 39,600 Annual cost of maintaining new runway 28,000 Annual incremental revenue from landing fees 40,000 In addition to the preceding data, two other facts are relevant to the decision. First, a longer runway will require a new snowplow, which will cost $100,000. The old snowplow could be sold now for $10,000. The new, larger plow will cost $12,000 more in annual operating costs. Second, the County Board of Representatives believes that the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education