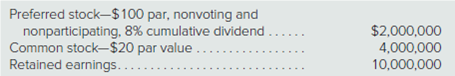

Smith, Inc., has the following

Haried Company purchases all of Smith’s common stock on January 1, 2018, for $14,040,000. The

During 2018, Smith reports earning $450,000 in net income and declares $360,000 in cash dividends. Haried applies the equity method to this investment.

a. What is the noncontrolling interest’s share of consolidated net income for this period?

b. What is the balance in the Investment in Smith account as of December 31, 2018?

c. What consolidation entries are needed for 2018?

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 7 images

- Kindly explain properlyarrow_forwardMatthew, Inc., owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee's operations and decision making. On January 1, 2021, the balance in the Investment in Lindman account is $406,000. Amortization of excess fair value associated with the 30% ownership is $13,800 per year. In 2021, Lindman earns an income of $298,000 and declares cash dividends of $74,500. Previously, in 2020, Lindman had sold inventory costing $38, 400 to Matthew for $ 48,000. Matthew consumed all but 25 percent of this merchandise during 2020 and used the rest during 2021. Lindman sold additional inventory costing $45, 600 to Matthew for $60,000 in 2021. Matthew did not consume 40 percent of these 2021 purchases from Lindman until 2022. What amount of equity method income would Matthew recognize in 2021 from its ownership interest in Lindman? What is the equity method balance in the Investment in Lindman account at the end of 2021?arrow_forwardNovak Inc. acquired 20% of the outstanding common stock of Theresa Kulikowski Inc. on December 31, 2020. The purchase price was $1,214,400 for 52,800 shares. Kulikowski Inc. declared and paid an $0.80 per share cash dividend on June 30 and on December 31, 2021. Kulikowski reported net income of $768,000 for 2021. The fair value of Kulikowski’s stock was $26 per share at December 31, 2021. Assume that the security is a trading security. Prepare the journal entries for Novak Inc. for 2020 and 2021, assuming that Novak can exercise significant influence over Kulikowski. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31, 2020June 30, 2021Dec. 31, 2021…arrow_forward

- On January 1, 2024, Nana Company paid $100,000 for 6,300 shares of Papa Company common stock. The ownership in Papa Company is 10%. Nana Company does not have significant influence over Papa Company. Papa reported net Income of $51,000 for the year ended December 31, 2024. The fair value of the Papa stock on that date was $50 per share. What amount will be reported in the balance sheet of Nana Company for the Investment in Papa at December 31, 2024? Multiple Choice O O $270,000 $315,000 $255,000 $240,000arrow_forwardMatthew, Incorporated, owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee's operations and decision making. On January 1, 2024, the balance in the Investment in Lindman account is $365,000. Amortization associated with this acquisition is $12,600 per year. In 2024, Lindman earns an income of $132,000 and declares cash dividends of $33,000. Previously, in 2023, Lindman had sold inventory costing $33,600 to Matthew for $56,000. Matthew consumed all but 20 percent of this merchandise during 2023 and used the rest during 2024. Lindman sold additional inventory costing $44,800 to Matthew for $80,000 in 2024. Matthew did not consume 40 percent of these 2024 purchases from Lindman until 2025. Required: a. What amount of equity method income would Matthew recognize in 2024 from its ownership interest in Lindman? b. What is the equity method balance in the Investment in Lindman account at the end of 2024? a. Equity income b.…arrow_forwardMatthew, Inc., owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee’s operations and decision making. On January 1, 2021, the balance in the Investment in Lindman account is $341,000. Amortization of excess fair value associated with the 30% ownership is $17,400 per year. In 2021, Lindman earns an income of $159,000 and declares cash dividends of $53,000. Previously, in 2020, Lindman had sold inventory costing $47,200 to Matthew for $59,000. Matthew consumed all but 25 percent of this merchandise during 2020 and used the rest during 2021. Lindman sold additional inventory costing $60,800 to Matthew for $80,000 in 2021. Matthew did not consume 40 percent of these 2021 purchases from Lindman until 2022. What amount of equity method income would Matthew recognize in 2021 from its ownership interest in Lindman? What is the equity method balance in the Investment in Lindman account at the end of 2021?arrow_forward

- Matthew, Inc., owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee's operations and decision making. On January 1, 2021, the balance in the Investment in Lindman account is $422,000. Amortization of excess fair value associated with the 30% ownership is $15,000 per year. In 2021, Lindman earns an income of $138,000 and declares cash dividends of $46,000. Previously, in 2020, Lindman had sold inventory costing $35,000 to Matthew for $50,000. Matthew consumed all but 25 percent of this merchandise during 2020 and used the rest during 2021. Lindman sold additional inventory costing $42,900 to Matthew for $65,000 in 2021. Matthew did not consume 40 percent of these 2021 purchases from Lindman until 2022. a. What amount of equity method income would Matthew recognize in 2021 from its ownership interest in Lindman? b. What is the equity method balance in the Investment in Lindman account at the end of 2021? a. b. Equity…arrow_forwardMatthew, Inc. owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee's operations and decision making. On January 1, 2018, the balance in the Investment in Lindman account is $422,000. Amortization associated with this acquisition is $15.000 per year. In 2018, Lindman earns an income of $138,000 and declares cash dividends of $46,000. Previously, in 2017, Lindman had sold inventory costing $35,000 to Matthew for $50,000. Matthew consumed allI but 25 percent of this merchandise during 2017 and used the rest during 2018. Lindman sold additional inventory costing $42,900 to Matthew for $65,000 in 2018. Matthew did not consume 40 percent of these 2018 purchases from Lindman until 2019. a. What amount of equity method income would Matthew recognize in 2018 from its ownership interest in Lindman? b. What is the equity method balance in the Investment in Lindman account at the end of 2018? a. Equity income b. Investment in…arrow_forwardAn investor company purchased 121,000 of the 250,000 outstanding shares of the investee company's common stock for $79,000 on January 1, 2021. During 2021, the investee company declared and paid dividends of $55,000 and reported earnings for the year of $355,000. If the investor company uses the equity method of accounting for its investment in the investee company, its Equity Investment in the investee company account at December 31, 2021 should be $____________. (Do not round your answer for any part of the computation.)arrow_forward

- Matthew, Inc., owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee's operations and decision making. On January 1, 2021, the balance in the Investment in Lindman account is $365,000. Amortization of excess fair value associated with the 30% ownership is $12,600 per year. In 2021, Lindman earns an income of $132,000 and declares cash dividends of $33,000. Previously, in 2020, Lindman had sold inventory costing $33,600 to Matthew for $56,000. Matthew consumed all but 20 percent of this merchandise during 2020 and used the rest during 2021. Lindman sold additional inventory costing $44,800 to Matthew for $80,000 in 2021. Matthew did not consume 40 percent of these 2021 purchases from Lindman until 2022. a. What amount of equity method income would Matthew recognize in 2021 from its ownership interest in Lindman? b. What is the equity method balance in the Investment in Lindman account at the end of 2021? a. b. Equity…arrow_forwardOn July 1, 2020, Selig Company purchased for cash 30% of the outstanding common stock of Spoor Corporation. Both Selig and Spoor have a December 31 year-end. Spoor Corporation, whose common stock is actively traded on the NASDAQ exchange, paid a cash dividend on November 15, 2020, to Selig Company and its other stockholders. It also reported its total net income for the year of $920,000 to Selig Company. Instructions Prepare a one-page memorandum of instructions on how Selig Company should report the above facts in its December 31, 2020, balance sheet and its 2020 income statement. In your memo, identify and describe the method of valuation you recommend. Provide rationale where you can. Address your memo to the chief accountant at Selig Company.arrow_forwardMatthew, Inc. owns 30 percent of the outstanding stock of Lindman Company and has the ability to significantly influence the investee’s operations and decision making. On January 1, 2018, the balance in the Investment in Lindman account is $365,000. Amortization associated with this acquisition is $12,600 per year. In 2018, Lindman earns an income of $132,000 and declares cash dividends of $33,000. Previously, in 2017, Lindman had sold inventory costing $33,600 to Matthew for $56,000. Matthew consumed all but 20 percent of this merchandise during 2017 and used the rest during 2018. Lindman sold additional inventory costing $44,800 to Matthew for $80,000 in 2018. Matthew did not consume 40 percent of these 2018 purchases from Lindman until 2019. What amount of equity method income would Matthew recognize in 2018 from its ownership interest in Lindman? What is the equity method balance in the Investment in Lindman account at the end of 2018?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education